Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

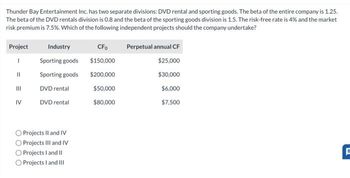

Transcribed Image Text:Thunder Bay Entertainment Inc. has two separate divisions: DVD rental and sporting goods. The beta of the entire company is 1.25.

The beta of the DVD rentals division is 0.8 and the beta of the sporting goods division is 1.5. The risk-free rate is 4% and the market

risk premium is 7.5%. Which of the following independent projects should the company undertake?

Project

1

11

|||

IV

Industry

Sporting goods

Sporting goods

DVD rental

DVD rental

Projects II and IV

Projects III and IV

O Projects I and II

O Projects I and III

CFO

$150,000

$200,000

$50,000

$80,000

Perpetual annual CF

$25,000

$30,000

$6,000

$7,500

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Raghubhaiarrow_forward2. Find All four present valuesarrow_forwardAn interior design studio is trying to choose between the following two mutually exclusive design projects: Year 0 1 2 3 Cash Flow Cash Flow (0) -$64,000 31,000 31,000 31,000 a-1 If the required return is 10 percent, what is the profitability index for both projects? (Round your answers to 3 decimal places. (e.g., 32.161)) Project I Project II -$18,000 9,700 9,700 9,700 Profitability Index a-2 If the company applies the profitability index decision rule, which project should the firm accept? O Project I O Project II Project I Project II b-1 What is the NPV for both projects? (Round your answers to 2 decimal places. (e.g., 32.16)) O Project I Project II NPV b-2lf the company applies the NPV decision rule, which project should it take?arrow_forward

- Sh2arrow_forwardIdentify two types of such a company and explain why. QUESTION TWO Total [12 marks] Finozest Solutions is considering setting up a facility to manufacture computers. The manufacturing facility will cost K15 million to build and will have the capacity to sell 50,000 computers a year. Each computer is expected to sell retail for K2,800, and the cost of making each computer is expected to be K1,400. The fixed costs amount to K150,000 per year are expected to be incurred. The business will run for five years, at which time you estimate the market value of the facility to be zero. The discount rate is estimated at 10%, and the tax rate is 40%. [5 marks] (b) Using the net present value technique for project evaluation, advise Finozest solutions on whether they should undertake this project. (a) Estimate the accounting rate of return expected from his investment. [10 marks] (c) After the release of the latest GDP projections for the country, you now estimate that at the end of 5 years, you…arrow_forwardplease provide step by step explainationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education