Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand rating

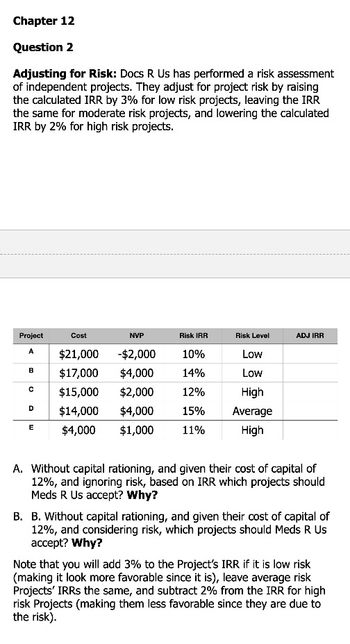

Transcribed Image Text:Chapter 12

Question 2

Adjusting for Risk: Docs R Us has performed a risk assessment

of independent projects. They adjust for project risk by raising

the calculated IRR by 3% for low risk projects, leaving the IRR

the same for moderate risk projects, and lowering the calculated

IRR by 2% for high risk projects.

Project

Cost

NVP

Risk IRR

Risk Level

ADJ IRR

A

$21,000

-$2,000

10%

Low

B

$17,000 $4,000

14%

Low

C

$15,000 $2,000

12%

High

D

$14,000

$4,000

15%

Average

E

$4,000

$1,000

11%

High

A. Without capital rationing, and given their cost of capital of

12%, and ignoring risk, based on IRR which projects should

Meds R Us accept? Why?

B. B. Without capital rationing, and given their cost of capital of

12%, and considering risk, which projects should Meds R Us

accept? Why?

Note that you will add 3% to the Project's IRR if it is low risk

(making it look more favorable since it is), leave average risk

Projects' IRRS the same, and subtract 2% from the IRR for high

risk Projects (making them less favorable since they are due to

the risk).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Define Gift card.arrow_forwardanswer all incorrectarrow_forwardWendy Marvel sold $260,000 of its inventory to Carla during 2021 for $400,000. Carla sold $300,000 of this merchandise in 2021 with the remainder to be disposed of during 2022. Assume Wendy Marvel owns 35% of Carla and has the ability to exert significant influence over Carla. What journal entry will be recorded at the end of 2021 to defer the recognition of the investor's share of the intra- entity gross profits? A) Equity in Carla B) C) D) Investment in Carla Investment in Carla Equity in Carla Equity in Carla Investment in Carla Investment in Carla Equity in Carla $35,000 $35,000 $12,250 $12,250 35,000 $35,000 $12,250 $12,250arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education