FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

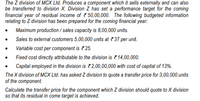

Transcribed Image Text:The Z division of MCX Ltd. Produces a component which it sells externally and can also

be transferred to division X. Division Z has set a performance target for the coming

financial year of residual income of 7 50,00,000. The following budgeted information

relating to Z division has been prepared for the coming financial year:

Maximum production / sales capacity is 8,00,000 units.

Sales to external customers 5,00,000 units at 7 37 per unit.

Variable cost per component is 7 25.

Fixed cost directly attributable to the division is ? 14,00,000.

Capital employed in the division is 2,00,00,000 with cost of capital of 13%.

The X division of MCX Ltd. has asked Z division to quote a transfer price for 3,00,000 units

of the component.

Calculate the transfer price for the component which Z division should quote to X division

so that its residual in come target is achieved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- RTI Company's master budget calls for production and sale of 18,900 units for $98,280, variable costs of $43,470, and fixed costs of $18,400. During the most recent period, the company incurred $32,900 of variable costs to produce and sell 18,400 units for $85,900. During this same period, the company earned $25,900 of operating income. Required: 1. Determine the following for RTI Company: (Do not round intermediate calculations. Round your answers to the nearest whole dollar.) a. Flexible budget operating income. b. Flexible budget variance, in terms of contribution margin. Was this variance favorable or unfavorable? c. Flexible budget variance, in terms of operating income. Was this variance favorable or unfavorable? d. Sales volume variance, in terms of contribution margin. Was this variance favorable or unfavorable? e. Sales volume variance, in terms of operating income. Was this variance favorable or unfavorable? a. Flexible budget operating income b. Flexible budget variance…arrow_forwardIllumination Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year Budgeted costs of operating the plant for 2,000 to 3,000 hours: Fixed operating costs per year Variable operating costs Budgeted long-run usage per year Flashlight Division Night Light Division Practical capacity $500,000 OA. $500,000 B. $625.000 OC. $600,000 D. $650,000 $500 per hour 2,000 hours 1,000 hours 4,000 hours Assume that practical capacity is used to calculate the allocation rates Actual usage for the year by the Flashlight Division was 1,500 hours and by the Night Light Division was 800 hours If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?arrow_forwardGHI Company manufactures two products that sell to the same market. Its budget and operating results for 2021 are as follows: Budgeted Actual Unit sales Product A 30,000 35,000 Product B 60,000 65,000 Unit contribution margin Product A P 4.00 P 3.00 Product B PI0.00 P12.00 Unit selling price Product A PI0.00 P12.00 Product B P25.00 P24.00 Industry volume was estimated to be 1,500,000 units at the time the budget was prepared. Actual industry volume for the period was 2,000,000 units. The market size contribution margin variance is Select one: a. P240,000 U O b. P240,000 F c. P160,000 F d. PI60,000 Uarrow_forward

- Nn.18. Subject :- Accountarrow_forwardBased on a predicted level of production and sales of 24,000 units, a company anticipates total contribution margin of $79,200, fixed costs of $24,000, and operating income of $55,200. Based on this information, the budgeted operating income for 21,000 units would be: Multiple Choice $55,200. $103,200. $45,300. $44,571. $79,200.arrow_forwardLadle Corporation uses the absorption costing approach to cost-plus pricing described in the text to set prices for its products. Based on budgeted sales of 81,000 units next year, the unit product cost of a particular product is $45.30. The company's selling and administrative expenses for this product are budgeted to be $1,898,000 in total for the year. The company has invested $262,000 in this product and expects a return on investment of 14%. The markup on absorption cost for this product would be: a. 14% b. 52.7% c. 51.7% d. 65.7%arrow_forward

- Canucks plc has prepared the following flexible budget for the coming year. The Budgeted level of activity is 7,500 units. SalesDirect material Direct labour Variable overheads Fixed overheads Profit £ 250,000 75,000 60,000 30,000 45,000 22,500 If the budget is flexed to a level of activity of 10,000 units, what would the total budgeted cost be? a) £265,000 b) £280,000 c) £123,750 d) £168,750arrow_forwardRequired Information [The following information applies to the questions displayed below.] The fixed budget for 21,500 units of production shows sales of $559,000; variable costs of $64,500; and fixed costs of $142,000. If the company actually produces and sells 26,500 units, calculate the flexible budget Income. Sales Variable costs Contribution margin Fixed costs Income ------Flexible Budget-..... Variable Amount Total Fixed per Unit Cost $ 689,000 689,000 ------Flexible Budget at 21,500 units $ $ 0 0 26,500 units $ $ 0 0arrow_forwardRiverbed Company expects to produce 1,272,000 units of Product XX in 2022. Monthly production is expected to range from 84,800 to 127,200 units. Budgeted variable manufacturing costs per unit are direct materials $5, direct labor $6, and overhead $8. Budgeted fixed manufacturing costs per unit for depreciation are $2 and for supervision are $1. Prepare a flexible manufacturing budget for the relevant range value using 21,200 unit increments. (List variable costs before fixed costs. Activity Level Finished Units RIVERBED COMPANY Monthly Flexible Manufacturing Budget For the Year 2022 84800 106000 127200 Variable Costs Direct Materials $ 424000 530000 636000 Direct Labor Overhead 508800 636000 763200 678400 848000 1017600 Total Variable Costs 1611200 2014000 2416800 Fixed Costs Depreciation Supervision Total Fixed Costs Total Costs +A 424000 424000 424000 424000 636000 2247200 $ 212000 636000 2650000 EA 212000 636000 3052800arrow_forward

- Accepting Business at a Special Price Power Serve Company expects to operate at 82% of productive capacity during May. The total manufacturing costs for May for the production of 31,980 batteries are budgeted as follows: Direct materials Direct labor Variable factory overhead Fixed factory overhead Total manufacturing costs The company has an opportunity to submit a bid for 3,000 batteries to be delivered by May 31 to a government agency. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during May or increase the selling or administrative expenses. $458,800 168,700 47,278 94,000 $768,778 What is the unit cost below which Power Serve Company should not go in bidding on the government contract? Round your answer to two decimal places. per unitarrow_forwardFor the year ending December 31, 2020, Cobb Company accumulates the following data for the Plastics Division which it operates as an investment center: contribution margin-$742,800 budget, $759,800 actual; controllable fixed costs-$298,400 budget, $305,300 actual. Average operating assets for the year were $2,020,000. Prepare a responsibility report for the Plastics Division beginning with contribution margin for the year ending December 31, 2020. (Round ROI to 1 decimal place, e.g. 1.5%.) COBB COMPANY Plastics Division Responsibility Report For the Year Ended December 31, 2020arrow_forwardCherokee Manufacturing Company established the following standard price and cost data: Sales price $ 12.00 per unit Variable manufacturing cost 7.20 per unit Fixed manufacturing cost 3,600 total Fixed selling and administrative cost 1,200 total Cherokee planned to produce and sell 2,000 units. Actual production and sales amounted to 2,200 units. Required Prepare the pro forma income statement in contribution format that would appear in a master budget. Prepare the pro forma income statement in contribution format that would appear in a flexible budget.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education