Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

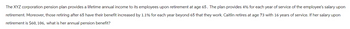

Transcribed Image Text:The XYZ corporation pension plan provides a lifetime annual income to its employees upon retirement at age 65. The plan provides 4% for each year of service of the employee's salary upon

retirement. Moreover, those retiring after 65 have their benefit increased by 1.1% for each year beyond 65 that they work. Caitlin retires at age 73 with 16 years of service. If her salary upon

retirement is $60, 106, what is her annual pension benefit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- sanjuarrow_forwardJacob is a member of his employers defined contribution pension plan. He has pensionable earnings of $110,000 and he contributes 6% of his earnings and his employers will match his 6%. What is Jacob's pension adjustment for the year? Question 5 options: $13,200 $11,000 $6,600 $19,800 Spencer has a RRSP with a balance of $600,000. Unfortunately, Spencer experienced a severe heart attack and died. Spencer was recently divorced and she had not assigned a beneficiary to her RRSP account. She also did not have a current willWhich of the following statements about her RRSP account is correct? Question 2 options: The assets in Spencer's RRSP will be fully included in her income in the year of death The assets in Spencer's RRSP will be included at a rate of 75% in her income in the year of death The assets in Spencer's RRSP will be included at a rate of 50% in her income in the year of death The assets in the RRSP will transfer to Spencer's heirs tax free.arrow_forwardAlicia has been working for JMM Corp. for 33 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2020. Before retirement, her annual salary was $588,000, $618,000, and $648,000 for 2017, 2018, and 2019. What is the maximum benefit Alicia can receive in 2020? Maximum benefit in 2020 [$] *PER MCGRAW-HILL, THE ANSWER IS NOT $370, 800*arrow_forward

- Clark Industries has a defined benefit pension plan that specifies annual, year-end retirement benefits equal to 1.2% × Service years × Final year’s salary Stanley Mills was hired by Clark at the beginning of 2002. Mills is expected to retire at the end of 2046 after 45 years of service. His retirement is expected to span 15 years. At the end of 2021, 20 years after being hired, his salary is $80,000. The company’s actuary projects Mills’s salary to be $270,000 at retirement. The actuary’s discount rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Required:1. Estimate the amount of Stanley Mills’s annual retirement payments for the 15 retirement years earned as of the end of 2021.2. Suppose Clark’s pension plan permits a lump-sum payment at retirement in lieu of annuity payments. Determine the lump-sum equivalent as the present value as of the retirement date of annuity payments during the retirement…arrow_forwardThree employees of the Horizon Distributing Company will receive annual pension payments from the company when they retire. The employees will receive their annual payments for as long as they live. Life expectancy for each employee is 15 years beyond retirement. Their names, the amount of their annual pension payments, and the date they will receive their first payment are shown below: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Employee Annual Payment Date of First Payment Tinkers $ 40,000 12/31/24 Evers 45,000 12/31/25 Chance 50,000 12/31/26 Required:1. Compute the present value of the pension obligation to these three employees as of December 31, 2021. Assume a 10% interest rate.2. The company wants to have enough cash invested at December 31, 2024, to provide for all three employees. To accumulate enough cash, they will make three equal annual contributions to…arrow_forwardPlease answer my questionarrow_forward

- Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years × final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $90,000 at the end of 2021 and the company's actuary projects her salary to be $240,000 at retirement. The actuary's discount rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Required:2. Estimate by the accumulated benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021.3. What is the company's accumulated benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.)4. If no estimates are changed in the…arrow_forwardAntonia works at First National Bank.Her employer offers her a pension retirement plan,which will be 1.75% of her average salary for the last 5 years of employment for every year worked.Antonia is planning on retiring at the end of this year after 26 years of employment.Her salaries for the last 5 years are:$91,300, $92,500, $96,750, $99,400, and $105,000. Calculate Antonia’s pensionarrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1,4% x service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $97,000 at the end of 2021 and the company's actuary projects her salary to be $315,000 at retirement. The actuary's discount rate is 7%. (EV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1 (Use appropriate factor(s) from the tables provided.) Required: 2 Estimate by the accumulated benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company's accumulated benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round yout final answer to the nearest whole dollar.) 4. If no estimates are changed in…arrow_forward

- Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% x service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $95,000 at the end of 2024 and the company's actuary projects her salary to be $305,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) At the beginning of 2025, the pension formula was amended to: 1.40% * Service years * Final year's salary The amendment was made retroactive to apply the increased benefits to prior service years. Required: 1. What is the company's prior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at…arrow_forwardKathy has an account balance in her employer’s money purchase pension plan of $1,000. The plan has a 2-6 graded vesting policy. She has been a participant for three and a half years and has worked for the company for five years. Assuming the plan permits loans, what is the maximum loan that Kathy could take from the plan? $20,000 $30,000 $40,000 $50,000arrow_forwardHow do I solve the following: An employee that has 35 years until retirement has a current salary of $30,000 per year. The employee's wages are expected to increase by 5% annually over the next 35 years. The employer has a defined benefit pension plan in which a worker’s annual pension benefit is equal to 2% of the employee's final year’s wage for each year of employment, multiplied by the number of years of employment. The employee's expected annual pension benefit is calculated as $115,836.32. The cmpany contributes to the pension plan each year for the next 35 years. Assume 10% actuarial rate of return, and 30 years of retirement life. At the employee's time of retirement, what does the accumulated amount in the employee's pension plan have to be in order to meet the employee's annual pension benefit each year in 30 years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education