FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

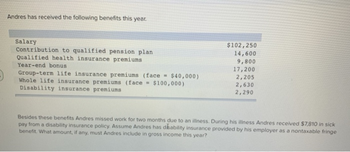

Transcribed Image Text:Andres has received the following benefits this year.

Salary

Contribution to qualified pension plan

Qualified health insurance premiums

Year-end bonus

Group-term life insurance premiums (face = $40,000)

Whole life insurance premiums (face = $100,000)

Disability insurance premiums

$102,250

14,600

9,800

17,200

2,205

2,630

2,290

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $7,810 in sick

pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe

benefit. What amount, if any, must Andres include in gross income this year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Melvin, a self-employed dentist paid $4,476 for his health insurance premiums throughout the year and is net profit was 143,216. he became eligible under his spouse's plan on August 1st. the amount of Melvin may report a self-employment health insurance deduction on his tax return is whatarrow_forwardLO.2 Valentino is a patient in a nursing home for 45 days of 2020. While in the nursing home, he incurs total costs of $13,500. Medicare pays $8,000 of the costs. Valentino receives $15,000 from his long-term care insurance policy, which pays while he is in the facility. Assume that the Federal daily excludible amount for Valentino is $380. Of the $15,000, what amount may Valentino exclude from his gross income?arrow_forward7arrow_forward

- Assignment Q. = Ken recieved $13000 in disability benefits for the year. He purchased the disability insurance policy last year. I thinks this is considered an Exclusion. If it isn't - Ans & what line on form 1040?arrow_forwardUrsula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows: (Click the icon to view the premiums attributable to Ursula.) During the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5,000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life insurance policy. Read the requirements. Requirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.) The premiums attributable to Ursula that USA Corporation can deduct is Requirement b. How much must Ursula include in income relative to the premiums paid? (Enter a "0" if none of the premiums paid should be included in income.) 0 $4,100 Ursula must report income of She must report…arrow_forwardInterview Notes Michael is 49 years old and files as single. His 2021 adjusted gross income (AGI) is $49,500, which includes gambling winningsof $1,000. Michael would like to itemize his deductions this year. Michael brings documentation for the following expenses: $8,200 Hospital and doctor bills $700 Contributions to Health Savings Account (HSA) $2,500 Long Term Care Insurance premiums before age limitation applied $3,400 State withholding (higher than Michael’s calculated state sales tax deduction) $300 Personal property taxes based on value of vehicle $400 Friend’s personal GoFundMe campaign $275 Cash contributions to the Red Cross $100 Fair market value of clothing in good condition donated to the SalvationArmy (Michael purchased clothing for $800) $7,500 Mortgage interest $820 Real estate tax $230 Mortgage Insurance Premiums (PMI) on a home he purchased in 2017. $150 Homeowners association fees $2,000 Gambling losses 11. If Michael chooses to itemize, which of the following…arrow_forward

- Ursula is employed by USA Corporation. USA Corporation provides medical and health, disability, and group term life insurance coverage for its employees. Premiums attributable to Ursula were as follows: (Click the icon to view the premiums attributable to Ursula.) During the year, Ursula suffered a heart attack and subsequently died. Before her death, Ursula collected $14,000 as a reimbursement for medical expenses and $5,000 of disability income. Upon her death, Ursula's husband collected the $40,000 face value of the life insurance policy. Read the requirements. Requirement a. What amount can USA Corporation deduct for premiums attributable to Ursula? (Enter a "0" if none of the premiums are deductible.) The premiums attributable to Ursula that USA Corporation can deduct is Data table Medical and health Disability Group term life (face amount is $40,000) S 3,600 300 200 C Xarrow_forwardMax, age 28, is insured under an individual medical expense policy that is part of a preferred provider organization (PPO) network. The policy has a calendar- year deductible of $1,000, 75/25 percent coinsurance, and an annual out-of-pocket limit of $2,000. Max recently had outpatient arthroscopic surgery on his knee, which he injured in a skiing accident. The surgery was performed in an outpatient surgical center. Max incurred the following medical expenses. (Assume that the charges shown are the charges approved by Max s insurer and that all providers are in the PPO network.) Outpatient X-rays and diagnostic tests................................................ $800 Covered charges in the surgical center ................................................ $12,000 Surgeon s fee.............................................................................. $3,000 Outpatient prescription drugs............................................................ $400 Physical…arrow_forwardElton earned $120,000 working as a recording engineer last year. The total amount of his contribution into his defined contribution pension plan was $12,000. These contributions earned income of $600 during the year. Elton also owns a personal Registered Retirement Savings Plan (RRSP). Assuming he has no unused RRSP contribution room carry-forward amounts from previous years, how much money can Elton contribute to his RRSP account this year if the money purchase limit is $24,000? O $9,000 $9,600 $8,400 $21,000arrow_forward

- In 2019, Margaret and John Murphy (both over age 65) are married taxpayers who file a joint tax return with AGI of $26,100. During the year they incurred the following expenses: Medical insurance premiums $1,300 Premiums on an insurance policy that pays $100 per day for each day Margaret is hospitalized 400 Medical care lodging (two people, one night) 65 Hospital bills 2,100 Doctor bills 850 Dentist bills 200 Prescription drugs and medicines 340 Psychiatric care 350 In addition, they drove 80 miles for medical transportation, and their insurance company reimbursed them $800 for the above expenses. On the following segment of Schedule A of Form 1040, calculate the Murphy’s medical expense deduction.arrow_forwardi need the answer quicklyarrow_forwardElodie is paid her commissions together with her bi-weekly salary of $1,000.00. This pay period her commissions are $4,300.00. Calculate her Québec Pension Plan contribution for this pay period. Your answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education