FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

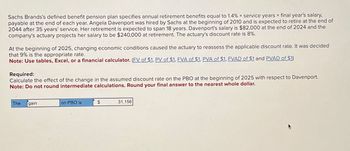

Transcribed Image Text:Sachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.4 % x service years x final year's salary,

payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of

2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $82,000 at the end of 2024 and the

company's actuary projects her salary to be $240,000 at retirement. The actuary's discount rate is 8%.

At the beginning of 2025, changing economic conditions caused the actuary to reassess the applicable discount rate. It was decided

that 9% is the appropriate rate.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1. PVA of $1, FVAD of $1 and PVAD of $1)

Required:

Calculate the effect of the change in the assumed discount rate on the PBO at the beginning of 2025 with respect to Davenport.

Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar.

The

gain

on PBO is

$

31,156

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- charrow_forwardLarkspur Corporation amended its pension plan on January 1, 2020, and granted $138,240 of prior service costs to its employees. The employees are expected to provide 1,920 service years in the future, with 330 service years in 2020.Compute prior service cost amortization for 2020. Prior service cost amortization for 2020 $enter the prior service cost amortization for 2017 in dollarsarrow_forwardStanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2024. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2024 and 2025.* A consulting firm, engaged as actuary, recommends 6% as the appropriate discount rate. The service cost is $250,000 for 2024 and $380,000 for 2025. Year-end funding is $260,000 for 2024 and $270,000 for 2025. No assumptions or estimates were revised during 2024. *We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2025. Required: Calculate each of the following amounts as of both December 31, 2024, and December 31, 2025: Note: Enter your answers in thousands (i.e., 200,000 should be entered as 200). Enter a liability as a negative amount. 1.…arrow_forward

- Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The actual return was also 10% in 2021 and 2022.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount rate. The service cost is $140,000 for 2021 and $220,000 for 2022. Year-end funding is $150,000 for 2021 and $160,000 for 2022. No assumptions or estimates were revised during 2021. * We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the estimate didn't change, that also was the actual rate in 2022. Required: Calculate each of the following amounts as of both December 31, 2021, and December 31, 2022: (Enter your answers in thousands (i.e., 200,000 should be entered as 200).) 1. Projected benefit obligation 2. Plan assets 3.…arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% x service years * final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $87,000 at the end of 2024 and the company's actuary projects her salary to be $265,000 at retirement. The actuary's discount rate is 9%. At the beginning of 2025, changing economic conditions caused the actuary to reassess the applicable discount rate. It was decided that 10% is the appropriate rate. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Calculate the effect of the change in the assumed discount rate on the PBO at the beginning of 2025 with respect to Davenport. Note: Do not round intermediate calculations. Round your final answer to…arrow_forwardBlossom Inc. has beginning-of-the-year present values for its projected benefit obligation and market-related values for its pension plan assets. Projected Benefit Obligation Plan Assets Value 2024 $1,080,000 $972,000 2025 1,350,000 1,188,000 2026 1,728,000 1,566,000 2027 2,268,000 2,160,000 The average remaining service life per employee in 2024 and 2025 is 8 years and in 2026 and 2027 is 11 years. The net gain or loss that occurred during each year is as follows: 2024, $178,200 gain; 2025, $43,200 gain; 2026, $32,400 loss; and 2027, $16,200 loss. (In working the solution, the gains and losses must be aggregated to arrive at year-end balances.) Using the corridor approach, compute the amount of net gain or loss amortized and charged to pension expense in each of the 4 years, setting up an appropriate schedule. (Round answers to O decimal places, e.g. 22,500.)arrow_forward

- In 2022, Blair Corporation paid its CEO base compensation of $700,000 and a performance bonus of $500,000; the CEO was hired in January 2020. How much of the compensation can Blair deduct?arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% x service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $95,000 at the end of 2024 and the company's actuary projects her salary to be $305,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) At the beginning of 2025, the pension formula was amended to: 1.40% * Service years * Final year's salary The amendment was made retroactive to apply the increased benefits to prior service years. Required: 1. What is the company's prior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at…arrow_forwardt A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2022, the pension formula was amended, creating a prior service cost of $220,000. The expected rate of return on assets was 8%, and the average remaining service life of the active employee group is 20 years in the current year, as well as, the previous two years. Required: Fill in the missing amounts. k Note: Enter your answers in thousands (i.e., 5,500 should be entered as 5.5). Enter credit amounts with a minus sign. ht ($ in thousands) PBO Plan Assets Prior Service Net Loss - Cost - AOCI AOCI Pension Expense Cash Net Pension (Liability)/ Asset Balance, January 1, 2024 $ (980.0) $ 720.0 $ 209.0 $ 98.0 $ (260.0) Service cost 118.0 Interest cost, 5% (49.0) Expected return on assets (57.6) Adjust for Loss on assets Amortization Prior service cost Amortization: Net…arrow_forward

- The XYZ corporation pension plan provides a lifetime annual income to its employees upon retirement at age 65. The plan provides 4% for each year of service of the employee's salary upon retirement. Moreover, those retiring after 65 have their benefit increased by 1.1% for each year beyond 65 that they work. Caitlin retires at age 73 with 16 years of service. If her salary upon retirement is $60, 106, what is her annual pension benefit?arrow_forwardB had earned income of $80,000 in 2020 and $95,000 in 2021. At the end of 2030 their pension adjustment was $3,000 and their unused trap deduction room was $1,000. What is B's maximum trap dedication in 2021arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% × service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $91,000 at the end of 2021 and the company's actuary projects her salary to be $285,000 at retirement. The actuary's discount rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company's projected benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 4. If no estimates are changed in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education