Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

General Accounting Question need help with this question

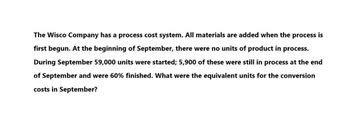

Transcribed Image Text:The Wisco Company has a process cost system. All materials are added when the process is

first begun. At the beginning of September, there were no units of product in process.

During September 59,000 units were started; 5,900 of these were still in process at the end

of September and were 60% finished. What were the equivalent units for the conversion

costs in September?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Narwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forwardThe standard cost summary for the most popular product of Phenom Products Co. is shown as follows, together with production and cost data for the period. One gallon each of liquid lead and varnish are added at the start of processing. The balance of the materials is added when the process is two-thirds complete. Labor and overhead are added evenly throughout the process. There were no units in process at the beginning of the month. Required: Calculate equivalent production for materials, labor, and overhead. (Be sure to refer to the standard cost summary to help determine the percentage of materials in ending work in process.) Calculate materials and labor variances and indicate whether they are favorable or unfavorable, using the diagram format shown in Figure 8-4. Determine the cost of materials and labor in the work in process account at the end of the month.arrow_forwardDuring March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forward

- Ardt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardThe Rolling Department of Kraus Steel Company had 200 tons in beginning work in process inventory (60% complete) on October 1. During October, 3,900 tons were completed. The ending work in process inventory on October 31 was 300 tons (25% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process?arrow_forwardDuring the month of June, the mixing department produced and transferred out 3,500 units. Ending work in process had 1,000 units, 40 percent complete with respect to conversion costs. There was no beginning work in process. The equivalent units of output for conversion costs for the month of June are: a. 3,500 b. 4,500 c. 3,900 d. 1,000arrow_forward

- Production information shows these costs and units for the smoothing department in August. All materials are added at the beginning of the period. The ending work in process is 30% complete as to conversion. What is the value of the inventory transferred to finished goods and the value of the WIP inventory at the end of the month?arrow_forwardDuring December, Krause Chemical Company had the following selected data concerning the manufacture of Xyzine, an industrial cleaner: All materials are added at the beginning of processing in this department, and conversion costs are added uniformly during the process. The beginning work in process inventory had 120 of raw materials and 180 of conversion costs incurred. Materials added during December were 540, and conversion costs of 1,484 were incurred. Krause uses the first-in, first-out (FIFO) process cost method. The equivalent units of production used to compute conversion costs for December were: a. 110 units. b. 104 units. c. 100 units. d. 92 units.arrow_forwardFordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000. Required: 1. Assuming the use of the weighted average method, prepare a schedule of equivalent units. 2. Compute the unit cost for the month.arrow_forward

- The Converting Department of Worley Company had 2,400 units in work in process at the beginning of the period, which were 35% complete. During the period, 10,800 units were completed and transferred to the Packing Department. There were 1,900 units in process at the end of the period, which were 60% complete. Direct materials are placed into the process at the beginning of production. Determine the number of equivalent units of production with respect to direct materials and conversion costs.arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forwardHeap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 80,000 units, 30 percent complete with respect to conversion costs. c. Ending work in process had 17,000 units, 25 percent complete with respect to conversion costs. d. Started in process, 95,000 units. Required: 1. Prepare a physical flow schedule. 2. Compute equivalent units using the weighted average method. 3. Compute equivalent units using the FIFO method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,