Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

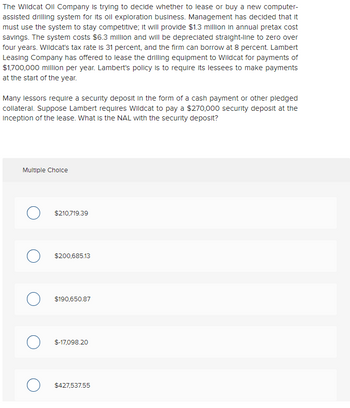

Transcribed Image Text:The Wildcat Oil Company is trying to decide whether to lease or buy a new computer-

assisted drilling system for its oil exploration business. Management has decided that it

must use the system to stay competitive; it will provide $1.3 million in annual pretax cost

savings. The system costs $6.3 million and will be depreciated straight-line to zero over

four years. Wildcat's tax rate is 31 percent, and the firm can borrow at 8 percent. Lambert

Leasing Company has offered to lease the drilling equipment to Wildcat for payments of

$1,700,000 million per year. Lambert's policy is to require its lessees to make payments

at the start of the year.

Many lessors require a security deposit in the form of a cash payment or other pledged

collateral. Suppose Lambert requires Wildcat to pay a $270,000 security deposit at the

Inception of the lease. What is the NAL with the security deposit?

Multiple Choice

$210,719.39

$200,685.13

O $190,650.87

O $-17,098.20

O $427,537.55

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Daily Enterprises is purchasing a $10.45 million machine. It will cost $64,247.00 to transport and install the machine. The machine has a depreciable life of five years using the straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.13 million per year along with incremental costs of $1.50 million per year. Daily's marginal tax rate is 34.00%. The cost of capital for the firm is 15.00%. (answer in dollars..so convert millions to dollars) The project will run for 5 years. What is the NPV of the project at the current cost of capital?arrow_forwardThe Wildcat Oil Company is trying to decide whether to lease or buy a new computer-assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $2.7 million in annual pretax cost savings. The system costs $8.6 million and will be depreciated straight-line to zero over five years. Wildcat's tax rate is 23 percent, and the firm can borrow at 7 percent. Lambert Leasing Company is willing to lease the equipment to Wildcat. Lambert's policy is to require its lessees to make payments at the start of the year. Suppose it is estimated that the equipment will have an after tax residual value of $825,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat? (Do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.).arrow_forwardASB is considering leasing a new machine. The lease calls for 9 payments of $1,403 per year with the first payment occurring immediately. The machine costs $8,683 to buy. The present value of CCA tax shield is $998. The present value of its salvage value is $496 and the present value of CCA recapture is $61. ASB firm can borrow at a rate of 10%. The corporate tax rate is 30%. What is the NPV of leasing?arrow_forward

- Genesis Corporation want to purchase a piece of machinery for $150,000 that will cost $20,000 to have it delivered and installed. Based on past information, they believe they can sell the machinery for $25,000 in 5 years. The company’s marginal tax rate is 34%. If the applicable CCA rate is 20% and the required return on this project is 15%, what is the present value of the CCA tax shield?arrow_forwardDaily Enterprises is purchasing a $10.2 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. The machine will generate incremental revenues of $3.9 million per year along with incremental costs of $1.5 million per year. If Daily's marginal tax rate is 21%, what are the incremental earnings (net income) associated with the new machine? The annual incremental earnings are $ (Round to the nearest dollar.)arrow_forward1arrow_forward

- Laurel’s Lawn Care Ltd., has a new mower line that can generate revenues of $135,000 per year. Direct production costs are $45,000, and the fixed costs of maintaining the lawn mower factory are $17,500 a year. The factory originally cost $0.90 million and is being depreciated for tax purposes over 20 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%.arrow_forwardllana Industries, Inc., needs a new lathe. It can buy a new high-speed lathe for $0.97 million. The lathe will cost $31,300 to run, will save the firm $127,700 in labour costs, and will be useful for 10 years. Suppose that for tax purposes, the lathe will be in an asset class with a CCA rate of 25%. llana has many other assets in this asset class. The lathe is expected to have a 10-year life with a salvage value of $91,000. The actual market value of the lathe at that time will also be $91,000. The discount rate is 15% and the corporate tax rate is 35%. What is the NPV of buying the new lathe? (Round your answer to the nearest cent.) NPV $arrow_forwardffarrow_forward

- Daily Enterprises is purchasing a $10.3 million machine. It will cost $54,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.3 million per year along with incremental costs of $1.3 million per year. Daily's marginal tax rate is 21%. You are forecastin incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $ (Round to the nearest dollar.)arrow_forwardThe Wildcat Oil Company is trying to decide whether to lease or buy a new computer- assisted drilling system for its oil exploration business. Management has decided that it must use the system to stay competitive; it will provide $3.5 million in annual pretax cost savings. The system costs $9.4 million and will be depreciated straight-line to zero over five years. Wildcat's tax rate is 21 percent, and the firm can borrow at 8 percent. Lambert Leasing Company is willing to lease the equipment to Wildcat. Lambert's policy is to require its lessees to make payments at the start of the year. Suppose it is estimated that the equipment will have an aftertax residual value of $1,025,000 at the end of the lease. What is the maximum lease payment acceptable to Wildcat? (Do not round intermediate calculations and enter yuor answer in dollars, not millions, rounded to 2 decimal places, e.g., 1,234,567.89.) Maximum lease paymentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education