FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

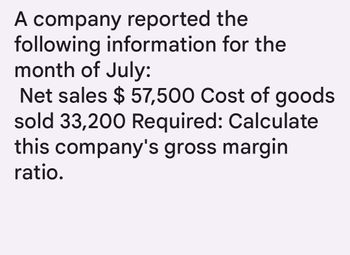

Transcribed Image Text:A company reported the

following information for the

month of July:

Net sales $ 57,500 Cost of goods

sold 33,200 Required: Calculate

this company's gross margin

ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following income statement was drawn from the records of Walton Company, a merchandising firm: WALTON COMPANY Income Statement For the Year Ended December 31, Year 1 Sales revenue (5,500 units x $168) Cost of goods sold (5,500 units * $89) Gross margin Sales commissions (5% of sales) Administrative salaries expense Advertising expense Depreciation expense Shipping and handling expenses (5,500 units x $2) Net income Req A $924,000 (489,500) 434,500 (46,200) (80,000) (31,000) Required a. Reconstruct the income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net income Walton will earn if sales increase by 10 percent. Complete this question by entering your answers in the tabs below. Less: Variable costs (44,000) (11,000) $222,300 Req B and C Reconstruct the income statement using the contribution margin format. WALTON COMPANY Income Statement For the Year Ended…arrow_forwardhe following data were provided by Mystery Incorporated for the year ended December 31: Cost of Goods Sold $ 174,000 Income Tax Expense 20,410 Merchandise Sales (gross revenue) for Cash 258,000 Merchandise Sales (gross revenue) on Credit 45,600 Office Expenses 19,900 Sales Returns and Allowances 7,590 Salaries and Wages Expense 43,800 Prepare a multistep income statement.arrow_forwardReturn on Sales RatioUsing the data below, compute Ian’s return on sales ratio for the month of January. Net Sales $12,000 Cost of goods sold 3,000 Operating expenses 7,000 Other income 500 Income tax expense 1,000 Round answer to the nearest whole percentage. Answer %arrow_forward

- The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $261,020 Selling expenses 87,190 Administrative expenses 46,100 Sales 555,370 Finished goods inventory, January 1 62,760 Finished goods inventory, January 31 57,200 For the month ended January 31, determine Bandera's (a) cost of goods sold, (b) gross profit, and (c) net income.arrow_forwardThe Income Statement columns of the August 31 (year-end) work sheet for Ralley Company are shown here. To save time and space, the expenses have been grouped together into two categories. INCOME STATEMENT ACCOUNT NAME DEBIT CREDIT Income Summary 31,100.00 31,130.00 Sales 324,360.00 Sales Returns and Allowances 13,970.00 Sales Discounts 7,620.00 Purchases 126,210.00 Purchases Returns and Allowances 1,020.00 Purchases Discounts 1,110.00 Freight In 8,460.00 Selling Expenses 61,470.00 General Expenses 51,751.00 300,581.00 357,620.00 Net Income 57,039.00 357,620.00 357,620.00 From the information given, prepare an income statement for the company. Ralley CompanyIncome StatementFor Year Ended August 31, 20-- (See images)arrow_forwardCost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured $267,820 Selling expenses 89,460 Administrative expenses 47,300 Sales 569,840 Finished goods inventory, January 1 64,390 Finished goods inventory, January 31 58,690 For the month ended January 31, determine Bandera's (a) cost of goods sold, (b) gross profit, and (c) net income. (a) Bandera Manufacturing Company Cost of Goods Sold January 31 $fill in the blank a5478ffe7014fe8_2 fill in the blank a5478ffe7014fe8_4 $fill in the blank a5478ffe7014fe8_6 fill in the blank a5478ffe7014fe8_8 $fill in the blank a5478ffe7014fe8_10 (b) Bandera Manufacturing Company Gross Profit January 31 $fill in the blank b2846803800df87_2 fill in the blank b2846803800df87_4 $fill in the blank b2846803800df87_6…arrow_forward

- The following Income statement was drawn from the records of Fanning Company, a merchandising firm: Sales revenue (7,000 units x $160) Cost of goods sold (7,000 units * $87) Gross margin Sales commissions (5% of sales) Administrative salaries expense Required For the Year Ended December 31, Year 1 Advertising expense Depreciation expense Shipping and handling expenses (7,000 units * $1) Net income FANNING COMPANY Income Statement Req A a. Reconstruct the Income statement using the contribution margin format. b. Calculate the magnitude of operating leverage. c. Use the measure of operating leverage to determine the amount of net Income Fanning will earn If sales Increase by 20 percent. Complete this question by entering your answers in the tabs below. Reg B and C FANNING COMPANY Income Statement For the Year Ended December 31, Year 1 Less: Variable costs Reconstruct the income statement using the contribution margin format. Less: Fixed costs $1,120,088 (609,000) 511,000 (56,000)…arrow_forwardSellall Department Stores reported the following amounts as of its December 31 year-end: Administrative Expenses, $2,400; Cost of Goods Sold, $22,728; Income Tax Expense, $3,000; Interest Expense, $1,600; Interest Revenue, $200; General Expenses, $2,600; Net Sales, $37,880; and Delivery (freight-out) Expense, $300. Required: 1. Calculate the gross profit percentage. 2. How has Sellall performed, relative to the 24.5 percent gross profit percentage reported for Walmart in 2019? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.)check all that apply Sellall Department Stores earned a higher gross profit percentage than Walmart. Walmart earned a higher gross profit percentage than Sellall Department Stores. Sellall includes more mark-up in the prices it charges customers than Walmart. Walmart includes more mark-up in prices it…arrow_forwardAn income statement for Sam's Bookstore for the first quarter of the year is presented below. Sam's Bookstore Income Statement For Quarter Ended March 31 Sales Cost of goods sold $910,000 565,000 Gross margin 345,000 Selling and administrative expenses Selling Administrative $ 120,000 144,000 264,000 Net operating income $ 81,000 On average, a book sells for $70. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed. The net operating income using the contribution approach for the first quarter is: Multiple Choice $81,000 $280,000 $345,000 $243,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education