FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

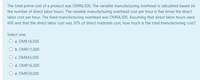

Transcribed Image Text:The total prime cost of a product was OMR6,500. The variable manufacturing overhead is calculated based on

the number of direct labor hours. The variable manufacturing overhead cost per hour is five times the direct

labor cost per hour. The fixed manufacturing overhead was OMR4,500. Assuming that direct labor hours were

600 and that the direct labor cost was 30% of direct materials cost, how much is the total manufacturing cost?

Select one:

O a. OMR18,500

O b. OMR11,000

O c. OMR43,500

O d. OMR16,500

O e. OMR39,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the selling price, variable costs, and contribution margin for one unit of each of Banner Company’s three products: A, B, and C: Product A B C Selling price $ 90.00 $ 100.00 $ 110.00 Variable costs: Direct materials 44.40 15.00 64.30 Direct labour 18.00 30.00 12.00 Variable manufacturing overhead 6.00 10.00 4.00 Total variable cost 68.40 55.00 80.30 Contribution margin $ 21.60 $ 45.00 $ 29.70 Contribution margin ratio 24 % 45 % 27 % Due to a strike in the plant of one of its competitors, demand for the company’s products far exceeds its capacity to produce. Management is trying to determine which product(s) to concentrate on next week in filling its backlog of…arrow_forwardFactory overhead costs for a given period were 1.5 times as much as the direct material costs. Prime costs totaled $16,100. Conversion costs totaled $23,190. What are the direct labor costs for the period? Multiple Choice • $2,070. $1,920. $1,945. $2,025. $1,870.arrow_forwardXYZ Company provided the following information regarding Product XY: Direct material costs OMR3 per unit of product; Direct labor costs OMR5 per direct labor hour; Predetermined overhead rate OMR10 per direct labor hour. The cost of a job for 550 units of product XY, which uses a total of 170 direct labor hours, is: Select one: O a. OMR4,200 O b. None of the answers given O c. OMR4,050 O d. OMR6,100 O e. OMR9,900arrow_forward

- Suppose that Patron Company sells a product for $24. Unit costs are as follows: Direct materials $4.98 Direct labor 2.58 Variable factory overhead 1.00 Variable selling and administrative expense 2.00 Total fixed factory overhead is $30,000 per year, and total fixed selling and administrative expense is $11,664. Required: 1. Calculate the variable cost per unit and the contribution margin per unit. 2. Calculate the contribution margin ratio and the variable cost ratio. 3. Calculate the break-even units. 4. Prepare a contribution margin income statement at the break-even number of units. Enter all amounts as positive numbers.arrow_forwardIn Marshall Company, data concerning two products are unit contribution margin-Product A $16, Product B $12; machine hours required for one unit-Product A 4, Product B 4. Compute the contribution margin per unit of limited resource for each product. (Round answers to 2 decimal places, e.g. 0.15.) Contribution margin per unit of limited resource $ Product A $ Product Barrow_forward[The following information applies to the questions displayed below.] Martinez Company's relevant range of production is 7,500 units to 12,5 its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Average Cost per Unit 6.20 3.70 $1.60 $4.00 $ 3.20arrow_forward

- Gilder Corporation makes a product with the following standard costs: Standard Quantity or Hours 7.6 grams 0.1 hours 0.1 hours Direct materials. Direct labor. Variable overhead.. Actual direct labor-hours.... Actual cost of raw materials purchases.. Actual direct labor cost.... Actual variable overhead cost. Standard Price or Rate Standard Cost Per Unit $6.00 per gram $16.00 per hour $6.00 per hour The company reported the following results concerning this product in June. Originally budgeted output.. Actual output... 5,400 units 5,500 units 39,200 grams 44,100 grams Raw materials used in production Purchases of raw materials 510 hours $260, 190 $240 U $216 U $240 F $216 F $7,803 $2,754 $45.60 $1.60 $0.60 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for June is:arrow_forwardCool Pool has these costs associated with production of 25,847 units of accessory products: direct materials, $68; direct labor, $105; variable manufacturing overhead, $48; total fixed manufacturing overhead, $780,482. What is the cost per unit under the absorption method? Round to the nearest penny, two decimal places.arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $3.20 per foot $ 6.08 Actual: 1.85 feet at $3.60 per foot $ 6.66 Direct labor: Standard: 1.00 hours at $19.00 per hour 19.00 Actual: 1.05 hours at $18.40 per hour 19.32 Variable overhead: Standard: 1.00 hours at $8.00 per hour 8.00 Actual: 1.05 hours at $7.60 per hour 7.98 Total cost per unit $ 33.08 $ 33.96 Excess of actual cost over standard cost per unit $ 0.88 The production superintendent was pleased when he saw this report and commented: “This $0.88 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that there's not much to worry about with this product." Actual production for the month was 15,500 units.…arrow_forward

- Ashvinarrow_forwardUsing the information below from Planters, Inc., what is the cost per unit under both variable and absorption costing? Production 7,000 Direct Materials $250 Direct Labor 250 Variable Manufacturing Overhead 110 Fixed Manufacturing Overhead 700,000 Variable Absorption Method Method Cost per unit $arrow_forwardKoontz Company manufactures a number of products. The standards relating to one of these products are shown below, along with actual cost data for May. Standard Cost per Unit Actual Cost per Unit Direct materials: Standard: 1.90 feet at $4.40 per foot $ 8.36 Actual: 1.85 feet at $4.80 per foot $ 8.88 Direct labor: Standard: 0.95 hours at $18.00 per hour 17.10 Actual: 1.00 hours at $17.50 per hour 17.50 Variable overhead: Standard: 0.95 hours at $6.00 per hour 5.70 Actual: 1.00 hours at $5.60 per hour 5.60 Total cost per unit $ 31.16 $ 31.98 Excess of actual cost over standard cost per unit $ 0.82 The production superintendent was pleased when he saw this report and commented: “This $0.82 excess cost is well within the 4 percent limit management has set for acceptable variances. It's obvious that…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education