Concept explainers

FIN 3004 Business Finance

Homework

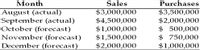

In preparation for the quarterly

∙ The firm collects 60 percent of sales for cash and 40 percent of its sales one month later.

∙ Interest income of $50,000 on marketable securities will be received in December.

∙ The firm pays cash for 40 percent of its purchases.

∙ The firm pays for 60 percent of its purchases the following month.

∙ Salaries and wages amount to 15 percent of the preceding month's sales.

∙ Sales commissions amount to 2 percent of the preceding month's sales.

∙ Lease payments of $100,000 must be made each month.

∙ A principal and interest payment on an outstanding loan is due in December of $150,000.

∙ The firm pays dividends of $50,000 at the end of the quarter.

∙ Fixed assets costing $600,000 will be purchased in December.

∙

∙ The firm has a beginning cash balance in October of $100,000 and maintains a minimum cash balance of $200,000.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

The total cash receipts have to be put in the final part?

The total cash receipts have to be put in the final part?

- QUESTION 1 Ginobili has forecast sales to be $120100 in February, $151200 in March, $162700 in April, and $174000 in May. 24% of sales are on made on credit, the rest are for cash. The sales on credit are collected 40% in the month of sale, and 60% the month following. What are the total budgeted cash receipts in April?arrow_forwardQUESTION 4 REQUIRED Use the information provided by empire Traders to prepare the following for March and April 2024: 4.1 Debtors Collection schedule 4.2 Cash Budget INFORMATION The following information was provided by Empire Traders: 1. Empire Traders expects to have a favourable bank balance of R60 000 on 28 february 2024. 2. Budgeted sales figures for 2024 are as follows: January February March April Cash Sales R320 000 R370 000 R310 000 R 250 000 Credit Sales R370 000 R390 000 R320 000 R300 000 3. Thirty percent (30%) of the cash sales is to informal traders who are entitled to a discount of 10%. Collections from debtors are usually as follows: 80% is collected in the month after sale 20% is collected two months after the sale 4. Purchases of inventory are expected to be as follows: January February March April Total Purchases R410 000 R460 000 R400 000 R380 000 5. Sixty percent (60) of then purchases is for cash to take advantage of a discount of 15%. The balance is purchased on…arrow_forwardProblem 1 As treasurer of a manufacturing company, you are preparing a cash budget for September of the next fiscal year. The information for September you have, at your disposal to complete this task is as follows: (а) Next year's sales forecast follows: July August September October $350,000 $240,000 $300,000 $360,000 (b) The sales price is $60. (c) Each month, 20% of the sales are for cash and 80% are on credit. (d) The AR collection pattern for credit sales is: 20% is received in 0-30 days 50% is received in 31-60 days 30% is received in 60-90 days (e) The cash in bank at the beginning of September is $15,400 (f) The per unit production cost data is: Direct material $20 Direct labor 1 direct labor hour per unit; $15 direct labor rate The company monthly beginning FG inventory policy is to maintain a minimum of 25% of the current month's sales. (g) (h) The AP pattern for credit purchases is: 30% is paid in 0-30 days 70% is paid in 31-60 days (i) There is a income tax payment of…arrow_forward

- 1arrow_forwardManagement Accounting Course Project – Part 1, B Group The Terranova Company is preparing information to complete its master budget for the quarter ending December 31, 2020. The company intends to make unit sales in the related months as follows: September 5,000 October 9,750 November 11,700 December 14,625 Units are to be sold for $10 each. Sales are 60% for cash and 40% on credit. Credit sales are collected in the month following the sale. *Required: 1) Prepare a sales budget for Terranova for the quarter ending December 31, 2020. Show activity by month and in total. (Hint: a quarter = 3 months.) 2) Complete a schedule of expected cash collections for the quarter ending December 31, 2020. Show activity by month and in total.arrow_forward3.3 Tutorial Questions 3.3.1 Cash Budget 1. A firm reported actual sales of RM65,000 in the month of June and RM70,000 in July. The sales forecasts indicate that sales are expected to be RM85,000, RM92,000 and RM95,750 for the months of August, September and October, respectively. Sales are 60% cash and 40% credit and credit sales are collected evenly over the following 2 month. No other cash receipts were received. What are the firm's expected cash receipts for the month August, September and October? . compile a cash disbursementarrow_forward

- Cash Budget The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: September October November Sales $120,000 $145,000 $192,000 Manufacturing costs 50,000 62,000 69,000 Selling and administrative expenses 42,000 44,000 73,000 Capital expenditures _ _ 46,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $9,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the balance in the following…arrow_forwardeBook Cash Budget The controller of Shoe Mart Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales $148,000 $179,000 $238,000 Manufacturing costs 62,000 77,000 86,000 Selling and administrative expenses 43,000 48,000 52,000 Capital expenditures _ _ 57,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 65% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $7,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 85% are expected to be paid in the month in which they are incurred and the balance in the following month. All sales and administrative…arrow_forwardComplete g cash budget table please and thank youarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education