FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

nku.8

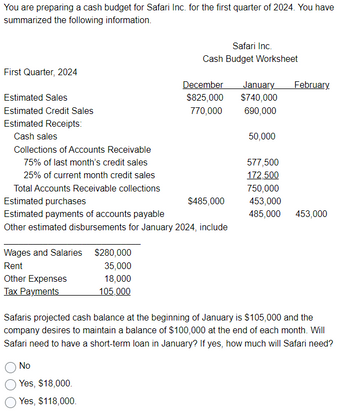

Transcribed Image Text:You are preparing a cash budget for Safari Inc. for the first quarter of 2024. You have

summarized the following information.

First Quarter, 2024

Safari Inc.

Cash Budget Worksheet

December

January February

Estimated Sales

Estimated Credit Sales

Estimated Receipts:

Cash sales

$825,000

$740,000

770,000

690,000

50,000

Collections of Accounts Receivable

75% of last month's credit sales

577,500

25% of current month credit sales

172,500

Total Accounts Receivable collections

750,000

Estimated purchases

$485,000

453,000

Estimated payments of accounts payable

485,000 453,000

Other estimated disbursements for January 2024, include

Wages and Salaries $280,000

Rent

35,000

Other Expenses

18,000

Tax Payments

105,000

Safaris projected cash balance at the beginning of January is $105,000 and the

company desires to maintain a balance of $100,000 at the end of each month. Will

Safari need to have a short-term loan in January? If yes, how much will Safari need?

No

Yes, $18,000.

Yes, $118,000.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education