FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

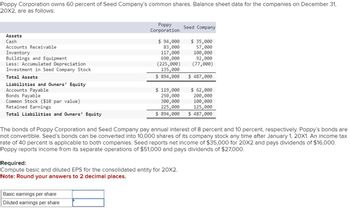

Transcribed Image Text:Poppy Corporation owns 60 percent of Seed Company's common shares. Balance sheet data for the companies on December 31,

20X2, are as follows:

Assets

Cash

Accounts Receivable

Inventory

Buildings and Equipment

Less: Accumulated Depreciation

Investment in Seed Company Stock

Total Assets

Liabilities and Owners' Equity

Accounts Payable

Bonds Payable

Common Stock ($10 par value)

Retained Earnings

Total Liabilities and Owners' Equity

Poppy

Corporation

Basic earnings per share

Diluted earnings per share

$ 94,000 $ 35,000

83,000

57,000

117,000

100,000

92,000

(77,000)

$ 487,000

690,000

(225,000)

135,000

$ 894,000

Seed Company

$ 62,000

$ 119,000

250,000

200,000

300,000

100,000

225,000

125,000

$ 894,000 $ 487,000

The bonds of Poppy Corporation and Seed Company pay annual interest of 8 percent and 10 percent, respectively. Poppy's bonds are

not convertible. Seed's bonds can be converted into 10,000 shares of its company stock any time after January 1, 20X1. An income tax

rate of 40 percent is applicable to both companies. Seed reports net income of $35,000 for 20X2 and pays dividends of $16,000.

Poppy reports income from its separate operations of $51,000 and pays dividends of $27,000.

Required:

Compute basic and diluted EPS for the consolidated entity for 20X2.

Note: Round your answers to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYZ Corporation had the following balance sheet information: Total assets: $500,000Total liabilities: $200,000Shareholders' equity: $300,000If XYZ Corporation has 50,000 shares outstanding, what is the book value per share?arrow_forwardnkt.4arrow_forwardThe following information was taken from the accounting records of BT21, Inc. for 2021:· Proceeds from issuance of preferred shares, P800,000· Bonds payable converted to ordinary shares, P200,000· Proceeds from sale of plant building, P1,000,000· Gain on sale of plant building, P100,000· Dividends paid on preference shares P50,000· Payment for purchase of machinery, P200,000· 2% bonus issue on ordinary shares, P300,000How much is the net cash flow from investing activities and cash flow from investing activities during 2021, respectively? A. P800,000; P750,000 B. P800,000; P950,000 C. P900,000; P750,000 D. P900,000; P950,000arrow_forward

- Pagle Corporation holds 80 percent of Standard Company's common shares. The companies report the following balance sheet data for December 31, 20X1: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Standard Company Stock Total Assets Liabilities and Owners' Equity Accounts Payable Taxes Payable Preferred Stock ($10 par value) Common Stock: $10 par value $5 par value Retained Earnings Total Liabilities and Owners' Equity Pagle Corporation $ 53,000 85,000 126,000 700,000 (295,000) 160,000 $ 829,000 Basic earnings per share Diluted earnings per share $ 120,000 79,000 200,000 100,000 330,000 $ 829,000 Required: Compute basic and diluted EPS for the consolidated entity for 20X1. Note: Round your answers to 2 decimal places. Standard Company $ 43,000 65,000 76,000 330,000 (130,000) $ 384,000 $ 84,000 100,000 An 8 percent annual dividend is paid on the Pagle preferred stock and a 12 percent dividend is paid on the Standard…arrow_forwardH1.arrow_forwardHansabenarrow_forward

- The following information has been taken from the Accumulated profits ledger accounts of Indian Inc. a. Total net income since incorporation P3,200,000 b. Total cash dividends paid 150,000 c. Carrying value of the company’s equipment declared as property divided 600,000 d. Proceeds from sale of donated stocks 150,500 e. Total value of stock dividends distributed 250,000 f. Gain on treasury share transaction 375,000 g. Unamortized premium on bonds payable 413,200 h. Appropriated for plant expansion 700,000 i. Loss on treasury share reissue 515,000 j. Share premium in excess of par from issued shares 215,000 k. Share issuance expense 45,000 l. Appropriated for remaining treasury shares at cost P50/share 1,000,000 Additional notes: The equipment declared as dividends had a recoverable value of P450,000 as of the date of declaration. The stock dividends distributed was based on a 10% share…arrow_forwardPlease write to text format answerarrow_forwardLuther Corporation Consolidated Income Statement Year ended December 31 (in $ millions) Total sales Cost of sales Gross profit Selling, general, and administrative expenses Research and development Depreciation and amortization Operating income Other income Earnings before interest and taxes (EBIT) Interest income (expense) Pretax income Taxes Net income Price per share Shares outstanding (millions) Stock options outstanding (millions) Stockholders' Equity Total Liabilities and Stockholders' Equity 2012 610.1 (500.2) 109.9 (40.5) (24.6) (3.6) 41.2 --- $16 10.2 126.6 2011 578.3 (481.9) 96.4 41.2 31.3 (25.1) (15.8) # 16.1 (5.5) 15.5 (5.3) 10.2 10.6 533.1 (39.0) (22.8) (3.3) 31.3 $15 8.0 0.2 502 63.6 386.7 Calculate Luther's price - earnings ratio (P/E) for the year ending December 31, 2012arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education