ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

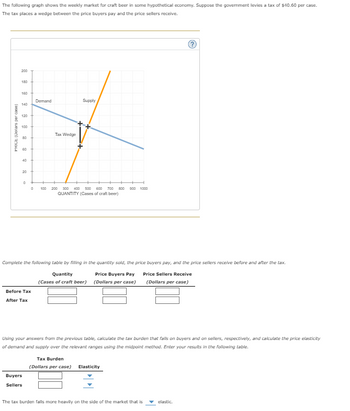

Transcribed Image Text:The following graph shows the weekly market for craft beer in some hypothetical economy. Suppose the government levies a tax of $40.60 per case.

The tax places a wedge between the price buyers pay and the price sellers receive.

PRICE (Dolars per case)

200

180

160

140

120

100

80

60

40

20

0

+

Buyers

Sellers

Demand

Before Tax

After Tax

Tax Wedge

Supply

0 100 200 300 400 500 600 700 800 900 1000

QUANTITY (Cases of craft beer)

Complete the following table by filling in the quantity sold, the price buyers pay, and the price sellers receive before and after the tax.

Quantity

Price Buyers Pay

(Cases of craft beer) (Dollars per case)

Price Sellers Receive

(Dollars per case)

Using your answers from the previous table, calculate the tax burden that falls on buyers and on sellers, respectively, and calculate the price elasticity

of demand and supply over the relevant ranges using the midpoint method. Enter your results in the following table.

Tax Burden

(Dollars per case) Elasticity

The tax burden falls more heavily on the side of the market that is

elastic.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The incidence of a tax falls more heavily on: A. Consumers than producers if demand is more inelastic than supply B. Producers than consumers of supply is more inelastic than demand C. Consumers than producers if supply is more elastic than demand D. All of the above are correctarrow_forwardWhat determines whether the buyer or seller pays the bulk of the tax?arrow_forwardSolve all this question......you will not solve all questions then I will give you down?? upvote......arrow_forward

- . A tax on umbrellas will most likely Select one: a. fall mostly on the umbrella buyers rather than the producers. b. be an effective way to tax those who don’t earn enough to pay income taxes. c. cause a large decline in the sales of umbrellas because demand is elastic. d. raise large amounts of tax revenue for the government.arrow_forwardSolve the attachmentarrow_forwardThe current market price of bananas is $1 per pound. Use a graph and words to show the effect of a ten cent tax on each pound of bananas. Insert your own numbers into your graph. Be sure to indicate the new price paid by consumers, the new price received by sellers, and the new quantity sold.arrow_forward

- Nonearrow_forwardMarked out of1.00 When the price elasticity of demand is high and the price elasticity of supply is low, the burden of a tax falls primarily or Select one. a. buyers of the product. b. both buyers and sellers of the product equally C. the tax payers. d. sellers of the product. CLEAR MY CHOICEarrow_forwardOnly typed answerarrow_forward

- Using the supply and demand data for wheat below, what would happen if the government placed a $3 per bushel tax on wheat? Bushels demanded 45 50 56 61 67 Price per bushel $6 $5 $4 LA LA LA $3 $2 Bushels supplied 77 73 68 61 57 O the producer price would fall, the consumer price would rise, and the quantity sold would increase. The producer price would fall, the consumer price would rise, and the equilibrium quantity would fall O Both the consumer price and the producer price would rise the consumer price would rise by less than $3 while the producer price would fall by more than $3 O the equilibrium consumer price would rise by $3arrow_forwardUse Exhibit to answer question a. A. b. C. c. B. d. B + C + E + F. Price e. C + F. 22 PB Po Ps I FIBI U O Size of tax per unit 'm/ F If a tax is placed on the product in this market, tax revenue paid by the sellers is the area Qo Supply Demand Quantityarrow_forwardA sales tax is imposed on good A. The supply of good A is not perfectly elastic or perfectly inelastic. Suppose that the demand for good A becomes more inelastic. (a) Will the tax burden on sellers increase or decrease? (b) Will the DWL increase or decrease?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education