FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

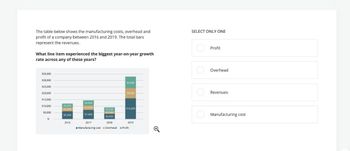

Transcribed Image Text:The table below shows the manufacturing costs, overhead and

profit of a company between 2016 and 2019. The total bars

represent the revenues.

What line item experienced the biggest year-on-year growth

rate across any of these years?

SELECT ONLY ONE

Profit

$35,000

$30,000

$9,000

$25,000

$20,000

$8,000

$15,000

$4,000

$10,000

$3,000

$3,500

$3,000

$3,000

$16,000

$5,000

$2.000

$6,000

$7,000

$4,000

2016

2017

2018

2019

Q

Manufacturing cost Overhead Profit

Overhead

Revenues

Manufacturing cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The table below shows the manufacturing costs, overhead and profit of a company between 2016 and 2019. The total bars represent the revenues. What line item experienced the biggest year-on-year growth rate across any of these years? SELECT ONLY ONE Profit Overhead $8,000 Revenues $35,000 $30,000 $9,000 $25,000 $20,000 $15,000 $4,000 $10,000 $3,000 $3,500 $3,000 $16,000 $3,000 $5,000 $2,000 $6,000 $7,000 $4,000 $- 2016 2017 2018 2019 Manufacturing cost Overhead ■Profit Manufacturing costarrow_forwardVikings Inc., is developing a pro forma income statement for the coming year. The chief financial officer estimates that sales will be $150,000,000. If gross profits are historically 36% of sales, what is the expected cost of goods sold (in dollars)? a) $36,000,000 b) $54,000,000 c) $64,000,000 d) $96,000,000 NOTE: In your Excel spreadsheet, all calculations must be includedarrow_forwardGive me correct answerarrow_forward

- Krogen Grocer’s 2016 financial statements show net income of $1,680 million, sales of $153,466 million, and average total assets of $46,350 million.How much is Krogen Grocer’s return on sales for the year? Question 22 options: A) 1.09% B) 30.20% C) 3.62% D) 6.42%arrow_forwardWhat is the sustainable growth rate for 2015? Narrow Falls Lumber 2015 Income Statement Net sales Cost of goods sold Depreciation EBIT Interest Taxable income Taxes Net income Dividends Cash Accounts receivable Inventory Net fixed assets Total assets Select one: a. 10.91% b. 14.46% c. 15.54% d. 12.63% e. 13.97% $28,200 $848,600 542,800 147,400 $158,400 12,600 $145,800 51,800 $94.000 Narrow Falls Lumber Balance Sheets as of December 31, 2014 and 2015 2015 2014 $ 32,300 $ 26,900 74,700 72,300 99,500 97,800 707,100 705,000 $913.600 $902,000 Accounts payable Notes payable Long-term debt Common stock and paid-in surplus ($1 par value) Retained earnings Total liabilities & owners' equity 2015 2014 $ 78,900 $ 79,200 40,000 354,500 50,000 295,600 170,000 175,000 319.100 253,300 $913.600 $902,000arrow_forwardSuppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forward

- need both answerarrow_forwardUsing the information provided, what is the length of the production cycle for the firm? Allied Industries, Inc. Selected Income Statement Items, 2017 Cash Sales $1,500,000 Credit Sales $7,500,000 Total Sales $9,000,000 COGS $6,000,000 Allied Industries, Inc. Selected Balance Sheet Accounts 12/31/201712/31/2016Change Accounts Receivable $270,000 $240,000 $30,000 Inventory $125,000 $100,000 $25,000 Accounts Payable $110,000 $90,000 $20,000arrow_forwardWhat is the impact on retained earnings each year?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education