FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

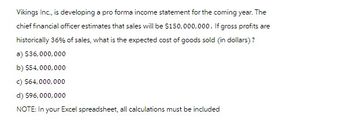

Transcribed Image Text:Vikings Inc., is developing a pro forma income statement for the coming year. The

chief financial officer estimates that sales will be $150,000,000. If gross profits are

historically 36% of sales, what is the expected cost of goods sold (in dollars)?

a) $36,000,000

b) $54,000,000

c) $64,000,000

d) $96,000,000

NOTE: In your Excel spreadsheet, all calculations must be included

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- PLEASE MAKE IT IN EXCEL AND SHOW THE FORMULAS (Take pictures) Company X, S.A.'s current sales are 12.5 million. An increase of 5% is estimated for next year, and its uncollectible accounts will go from the current 1% to 1.5%. What is the change in profit due to this customer behavior? A) 1,500 B) 3,000 C) 4,500 D) 5,000 (Choose a option)arrow_forwardAssuming costs vary with sales and a 20 percent increase in sales is projected, create the pro forma income statement. Create a pro forma Balance Sheet. All items will vary with sales. What is the plug variable in order for this to balance? Suppose no dividend is planned to be issued next year. What is the plug variable?arrow_forwardJace Furnishings has $325 million in sales. The company expects that its sales will increase 8% this year. Jace's CFO uses a simple linear regression to forecast the company's inventory level for a given level of projected sales. On the basis of recent history, the estimated relationship between inventories and sales (in millions of dollars) is as follows: Inventories = $30 + 0.105(Sales) Given the estimated sales forecast and the estimated relationship between inventories and sales, what are your forecasts of the company's year-end inventory level? Write out your answer completely. For example, 5 million should be entered as 5,000,000. Do not round intermediate calculations. Round your answer to the nearest dollar.$ What are your forecasts of the company's year-end inventory turnover ratio? Do not round intermediate calculations. Round your answer to two decimal places. xarrow_forward

- Subject - account Please help me. Thankyou.arrow_forwardPhilip Inc. expects their sales to increase by $900,000 next month. If their CMR is calculated as 48%, operating income of the next month would be expected to: Group of answer choices Increase by $432,000 Decrease by $468,000 Decrease by $432,000 Increase by $468,000arrow_forwardplease answer this with must explanation , computation , for each steps and each parts answer in text formarrow_forward

- Flingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forwardA Taste of Akerley has the following financial information. Calculate its gross profit and gross profit margin. 2016 Revenue $500,000 Cost of Sales $350,000arrow_forwardYour company has sales of $97,200 this year and cost of goods sold of $71,200. You forecast sales to increase to $113,100 next year. Using the percent of sales method, forecast next year's cost of goods sold.arrow_forward

- Data for Hermann Corporation are shown below: (See image attached) Fixed expenses are $87,000 per month and the company is selling 2,900 units per month. Required: 1-a. How much will net operating income increase (decrease) per month if the monthly advertising budget increases by $9,200 and monthly sales increase by $20,250? 1-b. Should the advertising budget be increased?arrow_forwardLast year, Jumpin' Trampolines (JT) had a quick ratio of 1.0, a current ratio of 1.8, an inventory turnover of 3.5, total current assets of $67,500, and cash and equivalents of $15,00. If the cost of goods sold equaled 70 percent of sales, what were JT's annual sales and DSO?arrow_forwardIdentify the activity ratio of a computer shop is its Cost of Goods Sold is P12 million and the Average Inventory is P24 million. Analyze and interpret your answer. Compute the return on investment of AR Grocery Store if the net profit after taxes is P10 million and its total assets is P100 million. Analyze and interpret your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education