Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

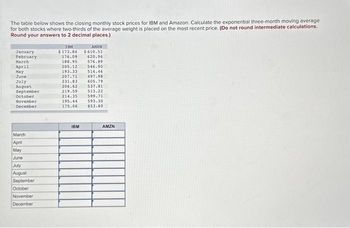

Transcribed Image Text:The table below shows the closing monthly stock prices for IBM and Amazon. Calculate the exponential three-month moving average

for both stocks where two-thirds of the average weight is placed on the most recent price. (Do not round intermediate calculations.

Round your answers to 2 decimal places.)

January

February

March

April

May

June

July

August

September

October

November

December

March

April

May

June

July

August

September

October

November

December

IBM

AMEN

$173.84 $610.51

176.09. 620.961

576.89

546.90

514.46

188.95

205.12

193.33

207.71 497.98

231.83

605.79

206.62 537.81

219.59

513.22

599.71

214.35

195.44

175.06

IBM

593.30

653.60

AMZN

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following spreadsheet contains monthly returns for Cola Co. and Gas Co. for 2013. Using these data, estimate the average monthly return and the volatility for each stock. (Click on the following icon in order to copy its contents into a spreadsheet.) Month January February March April May June July August September October November The average monthly return for Cola Co. is%. (Round to two decimal places.) Cola Co. -7.10% -2.10% -3.80% -4.10% 1.50% 1.20% -21.10% - 14.50% - 28.80% 22.90% -13.40% Gas Co. -8.10% -2.00% -2.60% -5.00% -4.70% -3.20% 6.70% -8.50% - 12.60% 16.50% -6.10%arrow_forwardhe table below shows the closing monthly stock prices for IBM and Amazon. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. (Do not round intermediate calculations. Round your answers to 2 decimal places.) IBM AMZN January $ 173.24 $ 609.06 February 175.69 619.88 March 187.69 578.30 April 203.79 546.50 May 193.81 516.54 June 207.25 499.18 July 230.50 605.49 August 207.85 538.26 September 219.11 513.48 October 214.23 598.70 November 194.99 594.17 December 174.78 652.50arrow_forwardCarnes Cosmetics Co.'s stock price is $50, and it recently paid a $1.75 dividend. This dividend is expected to grow by 19% for the next 3 years, then grow forever at a constant rate, g; and rs = 15%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Carnes Cosmetics Co.'s stock price is $37, and it recently paid a $1.25 dividend. This dividend is expected to grow by 30% for the next 3 years, then grow forever at a constant rate, g; and rs = 16%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardThe table below shows the closing monthly stock prices for IBM and Amazon. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. (Do not round intermediate calculations. Round your answers to 2 decimal places.) January February Marchi April May June July August September October November December IBM $172.04 174.89 185.17 201.13 194.77 206.33 227.84 210.31 AMZN $606.16 617.72 581.12 545.70 520.70 501.58 604.89 539.16 514.00 596.68 194.09 595.91 174.22 650.30 218.15 213.99arrow_forwardeBook Carnes Cosmetics Co.'s stock price is $39, and it recently paid a $2.00 dividend. This dividend is expected to grow by 15% for the next 3 years, then grow forever at a constant rate, g; and rs = 14%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

- The table below shows the closing monthly stock prices for Penn Company and Teller, Incorporated. Calculate the exponential three-month moving average for both stocks where two-thirds of the average weight is placed on the most recent price. Note: Input all amounts as positive values. Do not round intermediate calculations. Round your answers to 2 decimal places. Penn Teller January $ 175.04 $ 613.41 February 176.89 623.12 March 191.47 574.07 April 207.78 547.70 May 192.37 510.30 June 208.63 495.58 July 234.49 606.39 August 204.16 536.91 September 220.55 512.70 October 214.59 601.73 November 196.34 591.56 December 175.62 655.80arrow_forwardCarnes Cosmetics Co.'s stock price is $46, and it recently paid a $1.00 dividend. This dividend is expected to grow by 21% for the next 3 years, then grow forever at a constant rate, g; and rs = 14%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forwardUse the data below to construct the advance or decline line and Arms ratio for the market. Volume is in thousands of shares. Note: Input all amounts as positive values. Do not round intermediate calculations. Round your "Arms Ratio" answers to 3 decimal places. Stocks Advancing. 1,903 Monday Tuesday 2,601 Wednesday 1,699 2,204 Thursday Friday 1,901 Monday Tuesday Wednesday Thursday Friday Advancing Volume 948,321 784,531 517,757 931,460 593,799 Advance or Decline Stocks Declining 632 699 1,371 829 1,194 Cumulative Declining Volume 68,252 214,915 498,712 313,713 383,328 Arms Ratioarrow_forward

- Go to Yahoo.com’s financial website and enter Apple, Inc.’s stock symbol, AAPL. Answer the following questions concerning Apple, Inc. At what price did Apple’s stock last trade? What is the 52-week range of Apple’s stock? When was the last time Apple’s stock hit a 52-week high? What is the annual dividend of Apple’s stock? How many current broker recommendations are strong buy, buy, hold, sell, or strong sell? What is the average of the broker recommendations? What is the price-earnings ratio?arrow_forwardRalph is constructing a price-weighted index. On March 1, 2XX1, he has the following stocks in the index: Company Share price # shares outstanding Walmart $42.6 26,000 Kmart $18.76 19,000 Venture $55.11 63,000 Macy’s $39.61 45,000 What is the price-weighted index on March 1, 2XX1? (Do not round intermediate calculations. Round your answers to 3 decimal places. (e.g., 32.167))arrow_forwardCarnes Cosmetics Co.'s stock price is $45, and it recently paid a $2.00 dividend. This dividend is expected to grow by 25% for the next 3 years, then grow forever at a constant rate, g; and rs = 16%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education