FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

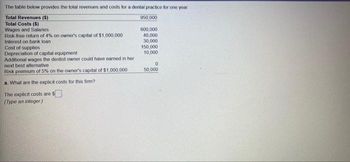

Transcribed Image Text:The table below provides the total revenues and costs for a dental practice for one year

Total Revenues ($)

Total Costs ($)

Wages and Salanes

Risk free return of 4% on owner's capital of $1,000,000

Interest on bank loan

Cost of supplies

Depreciation of capital equipment

Additional wages the dentist owner could have earned in her

next best alternative.

Risk premium of 5% on the owner's capital of $1,000,000

a. What are the explicit costs for this firm?

The explicit costs are

(Type an integer)

950,000

600,000

40,000

30,000

150,000

10,000

0

50,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the formula needed for Excel to find the monthly payment on a house that cost $189,000 in ARP of 3.1% and last for 32 yearsarrow_forwardCalculate how much money a prospective homeowner would need for closing costs on a house that costs $237 comma 500237,500. Calculate based on a 2121 percent down payment, 1.21.2 discount points on the loan, a 0.60.6 point origination fee, and $1 comma 8301,830 in other fees.arrow_forwardRefer to the data provided in Table 11.3 below to answer the following question(s). Table 11.3 Project New computer for sales staff Remodel for distribution center On-site day care center Employee fitness center Total Investment (dollars) $250,000 $200,000 $100,000 $50,000 Expected Rate of Return (percentage) 11 9 5 4 Refer to Table 11.3. If the interest rate is 2.5%, Blackstar Drone Manufacturing should O not fund any of the projects. fund all of the projects. fund all of the projects except for the employee fitness center. O fund only the employee fitness center.arrow_forward

- Rakoarrow_forwardAn engineering firm estimates that its cost for employer sponsored health insurance will be $750,000 next year and increase at 11% per year for the next 5 years. The company CFO wants to budget a uniform amount each year to cover these costs. If the firm's rate of return is 6% per year, how much should be invested each year for employer sponsored health care? Express your answer in $ to the nearest $1,000.arrow_forwardYou volunteer on a local fire department and are asked to help in the purchase of a new fire engine. You seek out a loan from a bank in which they state the annual interest on the loan would be 10%. However, the interest compounds once per quarter. What is the effective annual percentage rate (APR) if you select this loan? 10.38% 10% 15.1% 1.11%arrow_forward

- You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,360,000; rents are estimated at $174,080 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d.…arrow_forwardfill out the worksheet using the following information: Theoretical Housing Situation: Renting: Monthly Rent: $1,800 Renter’s Insurance: $200 per year Security Deposit: $2,000 After-tax Savings Rate: 5% Buying: Home Price: $250,000 Down Payment: $50,000 Loan Amount: $200,000 Loan Term: 25 years Interest Rate: 3.5% Property Taxes: 1.25% of the home price Homeowner’s Insurance: 0.4% of the home price Maintenance Costs: 1.5% of the home price Closing Costs: $5,000 After-tax Rate of Return: 4% Tax Rate: 25% Estimated Annual Appreciation: 2%arrow_forwardYou have been offered a contract to work as a consultant. The company will pay you $6215 per month. In addition, once you complete the work in 4 years, you will receive $46865. Your required return is 6.57%, what is this contract worth today? show all step and fomular. Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education