Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

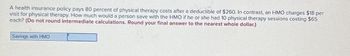

Transcribed Image Text:A health insurance policy pays 80 percent of physical therapy costs after a deductible of $260. In contrast, an HMO charges $18 per

visit for physical therapy. How much would a person save with the HMO if he or she had 10 physical therapy sessions costing $65

each? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.)

Savings with HMO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Help me with correct explanation. Not solve in excel works.arrow_forwardYou make the following monthly payments. Your total net income (net of taxes) is $4,000. Calculate your savings ratio. Rent $600 Entertainment $300 Car payment $253 $500 Credit card payment $100 $450 Utilities $200 Gasoline $185 Groceries $250 Retirement savings $150 Student loan payment $300 O 17.80%. O 16.18%. O 29.05%. O 29.48%. You spend Save for Later Health insurance Taxes Submit An:arrow_forwardPeg plans to have laser eye surgery. The total cost of $2500 will be paid with a 48-month installment loan with an APR of 4.5%. Determine Peg's total finance charge.arrow_forward

- 9. Define out of pocket maximum. a. A flat-rate fee you must pay when receiving any kind of health care service. b. The maximum amount of money your insurance will cover of a certain health care service. c. The maximum amount you will have to pay out of pocket in one year for the benefits your insurance covers. d. The maximum amount of money the insured party will pay toward prescription medications.arrow_forwardCalculate how much money a prospective homeowner would need for closing costs on a house that costs $190,000. Calculate based on a 15 percent down payment, 1.3 discount points on the loan, a 1.2 point origination fee, and $820 in other fees. The closing costs would be $. (Round to the nearest dollar.)arrow_forward3. Two different insurance agents present you two health insurance policies as follows. AIA: It covers at most 10 outpatient visits with maximum reimbursement of 80%. For specialty, the policy would not be effective until your expenses exceed $2000. Each claim receives $800 for a maximum of 10 claims. HSBC Life: For outpatient visits, a maximum 20 visits are covered with the first 5 visits are of co-insurance rate of 80% and the next 15 visits are subject to 60% co- insurance rate. For specialty, you are allow to claim at most 5 with each claim capped at $1000. Your health care services consumed are as follows: Outpatient visits of 12 with each costs $300; Specialty of 3 with each costs $2500. Which agent's policy would ! you prefer? Explain.arrow_forward

- You've been offered an investment that will double your money in 12 years. What rate of return are you being offered? * 12% 6% 4% 20% 5%arrow_forwardA family wishes to buy a $235,900 home. - If a conventional lender is willing to loan the family 87% of the price of the home, what will the loan amount be? What will be the down payment with the loan? - If the family decides to obtain an FHA loan instead, what will the minimum down payment be? (FHA loan down payments are 3.5% of the first $25,000 and 5.2% of the balance of the loan). What is the maximum FHA loan the family can obtain?arrow_forwardCalculating required down payment on home purchase. How much would you have to put down on a house costing $100,000 if the house had an appraised value of $105,000 and the lender required an 80 percent loan-to-value ratio?arrow_forward

- Goran plans to buy a used truck that costs $15,000. The dealer requires a 20% down payment. The rest of the cost is financed with a 3-year, fixed-rate amortized auto loan at 5.5% annual interest with monthly payments. Complete the parts below. Do not round any intermediate computations. Round your final answers to the nearest cent if necessary. If necessary, refer to the list of financial formulas.arrow_forwardA $15,000 personal loan charges a rate of 6%, compounded monthly and charges a $250 administration fee at the outset. What is the effective cost of the loan? 6.06% 6.10% 6.17% 6.27% The answer is 6.27% but I would like to know how to solve this problem. Thank you.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education