Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

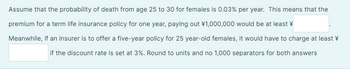

Transcribed Image Text:Assume that the probability of death from age 25 to 30 for females is 0.03% per year. This means that the

premium for a term life insurance policy for one year, paying out ¥1,000,000 would be at least

Meanwhile, if an insurer is to offer a five-year policy for 25 year-old females, it would have to charge at least

if the discount rate is set at 3%. Round to units and no 1,000 separators for both answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Equitable Insurance Company offers a fixed indexed annuity to Dane. The annuity has a cap of 10% and a floor of 3%. Dane invests $10,000 in the annuity. a, If S&P500's returns the next year is 8%, what should be the balance in Dane's account at the end of the year? 10,800 10,000 11,000 O 10,300arrow_forwardThe Nguyens are thinking of buying a home for $121,000. A potential lender advertises an 80%, thirty-year simple interest amortized loan at 8 and 1/4% interest, with an APR of 9.23%. Use the APR to approximate the fees included in the finance charge. (Round your answer to the nearest cent.)arrow_forwardIn this exercise, we consider the effects of starting early or late to save for retirement. Assume that the account considered has an APR of 7.2% compounded monthly. Against expert advice, you begin your retirement program at age 40. You plan to retire at age 60. What monthly contributions do you need to make to reach a nest egg of $137,799.63 at retirement? (round to your nearest cent)arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely.arrow_forwardA family wishes to buy a $235,900 home. - If a conventional lender is willing to loan the family 87% of the price of the home, what will the loan amount be? What will be the down payment with the loan? - If the family decides to obtain an FHA loan instead, what will the minimum down payment be? (FHA loan down payments are 3.5% of the first $25,000 and 5.2% of the balance of the loan). What is the maximum FHA loan the family can obtain?arrow_forwardLive Forever Life Insurancce Co. is selling a perpetuity contract that pays $1,400 monthly. The contract currently sells for $215,000. What is the monthly return on this investment vehicle? What is the APR? The effective annual return?arrow_forward

- Goran plans to buy a used truck that costs $15,000. The dealer requires a 20% down payment. The rest of the cost is financed with a 3-year, fixed-rate amortized auto loan at 5.5% annual interest with monthly payments. Complete the parts below. Do not round any intermediate computations. Round your final answers to the nearest cent if necessary. If necessary, refer to the list of financial formulas.arrow_forwardDecreasing the number of years of a loan decreases the amount of interest repaid over the term of the loan. Suppose a dental hygienist has the option of a 30-year loan or a 25-year loan of $395.000 at an annual interest rate of 4.75%. (a) Calculate the monthly payment (in dollars) for each loan. (Round your answers to the nearest cent.) 30-year loan $? 25-year loan $? (b) Calculate the savings in interest (in dollars) by using the 25-year loan. (Round your answer to the nearest cent.)arrow_forwardYou are trying to decide between two mobile phone carriers. Carrier A requires you to pay $195 for the phone and then monthly charges of $62 for 24 months. Carrier B wants you to pay $90 for the phone and monthly charges of $68 for 12 months. Assume you will keep replacing the phone after your contract expires. Your cost of capital is 4.4% APR, compounded monthly. Based on cost alone, which carrier should you choose? The EAA for plan A is $ (Round to the nearest cent.)arrow_forward

- When purchasing a $100,000 house, a borrower is comparing two loan alternatives. The first loan is an 80% loan at 4% with monthly payments of $591.75 for 15 years. The second loan is 90% loan at 5% with monthly payments of $526.13 over 25 years. What is the incremental cost of borrowing the extra money assuming the loan will be held for the full term? O 6.50% O 13.21% O 7.20% O 13.70%arrow_forwardDecreasing the number of years of a loan decreases the amount of interest repaid over the term of the loan. Suppose a dental hygienist has the option of a 30-year loan or a 25-year loan of $365,000 at an annual interest rate of 3.75%. (a) Calculate the monthly payment (in dollars) for each loan. (Round your answers to the nearest cent.) 30-year loan $? 25-year loan $? (b) Calculate the savings in interest (in dollars) by using the 25-year loan. (Round your answer to the nearest cent.) $ ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education