MHA Medical Center is starting a new lab test center on its third floor. The expected patient volume demands will generate $500,000 per year in revenues for the next five years. The new center will incur operating expenses, excluding

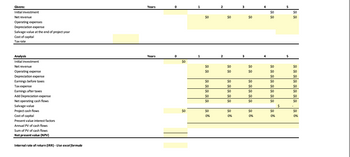

Use the following tables. * LOOK at Image

| Givens: | Years | 0 | 1 | 2 | 3 | 4 | 5 | ||||||||

| Initial investment | $0 | $0 | |||||||||||||

| Net revenue | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Operating expenses | |||||||||||||||

| Depreciation expense | |||||||||||||||

| Salvage value at the end of project year | |||||||||||||||

| Cost of capital | |||||||||||||||

| Tax rate | |||||||||||||||

| Analysis | Years | 0 | 1 | 2 | 3 | 4 | 5 | ||||||||

| Initial investment | $0 | ||||||||||||||

| Net revenue | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Operating expense | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Depreciation expense | $0 | $0 | |||||||||||||

| Earnings before taxes | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Tax expense | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Earnings after taxes | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Add Depreciation expense | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Net operating cash flows | $0 | $0 | $0 | $0 | $0 | ||||||||||

| Salvage value | $ - | ||||||||||||||

| Project cash flows | $0 | $0 | $0 | $0 | $0 | $0 | |||||||||

| Cost of capital | 0% | 0% | 0% | 0% | 0% | ||||||||||

| Annual PV of cash flows | |||||||||||||||

| Sum of PV of cash flows | |||||||||||||||

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- A Funiture Factory is considering buying a new automated planing machine for a cost of $80,250. This price includes a complete guarantee of the maintenance costs for the first two years, and it covers a good proportion of the maintenance costs for years 3 and 4. The company’s portion of the maintenance cost is estimated to be $1,000 in year 3 and $3,000 in year 4. Depreciation on the capital cost would be 7% per year. Determine the Economic Life and EAC* of the new machine assuming the MARR is 6.5% and that there will be an installation cost of $2,800. PLEASE PLEASE SHOW FULL DETAILED STEPSarrow_forwardA company is intending to invest in a capital budgeting project to manufacture a medical testing device and has projected the following sales: Year 1 Year 2 Year 3 Year 4 Year 5 50,000 66,400 81,200 68,500 54,500 The installed cost of the new assets will be $18,500,000 which will be depreciated using the 7-year MACRS schedule. The assets will have a salvage value of $3,700,000. Initial NWC requirements are $1,500,000 and additional working capital needs are estimated to be 15% of the projected sales increases for the following year. Total fixed costs are $2,000,000 per year. The medical device has a selling price of $300 per unit and variable production costs are $175. The firm has a marginal tax rate of 35% and a required rate of return of 18%. Analyze this project and give your recommendation as to whether they should invest in it or…arrow_forwardCaspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.30 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.20 million per year and cost $1.77 million per year over the 10-year life of the project. Marketing estimates 12.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 24.00%. The WACC is 12.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

- Purple Haze Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $526,528 is estimated to result in some amount of annual pretax cost savings. The press will have an aftertax salvage value at the end of the project of $86,879. The OCFS of the project during the 4 years are $170,654, $199,481, $175,232 and $169,873, respectively. The press also requires an initial investment in spare parts inventory of $23, 482, along with an additional $1,631 in inventory for each succeeding year of the project. The shop's discount rate is 6 percent. What is the NPV for this project?arrow_forwardCaspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.29 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.46 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 22.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forwardSheridan's Hair Salon is considering opening a new location in French Lick, California. The cost of building a new salon is $261,000. A new salon will normally generate annual revenues of $63,650, with annual expenses (including depreciation) of $40,200. At the end of 15 years, the salon will have a salvage value of $74,000. Calculate the annual rate of return on the project. Annual rate of return eTextbook and Media Save for Later % Attempts: 0 of 7 used Submit Answerarrow_forward

- Atlantic Manufacturing is considering a new investment project that will last for four years. The delivered and installed cost of the machine needed for the project is $23,957 and it will be depreciated according to the three-year MACRS schedule. The project also requires an initial increase in net working capital of $300. Financial projections for sales and costs are in the table below. In addition, since sales are expected to fluctuate, NWC requirements will also fluctuate. The end-of- year NWC requirements are included below (hint: these NWC capital requirements DO NOT represent the change in NWC for the period). The $0 requirement for NWC at the end of year 4 means that all NWC is recovered by the end of the project. The corporate tax rate is 35% and the required return on the project is 12%. Year 1 2 3 4 Sales $11,653 $12,746 $13,973 $10,638 Costs 2,322 2,536 3,456 1,434 NWC 324 352 231 0 Requirements What is the project's NPV? (Round answer to O decimal places. Do not round…arrow_forwardA new solid waste treatment plant is to be constructed in Washington County. The initial installation will cost $35 million (M). After 10 years, minor repair and renovation (R&R) will occur at a cost of $14M will be required; after 20 years, a major R&R costing $20M will be required. The investment pattern will repeat every 20 years. Each year during the 20-year period, operating and maintenance (O&M) costs will occur. The first year, O&M costs will total $2M. Thereafter, O&M costs will increase at a compound rate of 4% per year. Based on a 4% MARR, what is the capitalized cost for the solid waste treatment plant?arrow_forwardFirm Z has invested $4 million in marketing campaign to assess the demand for the product Minish. This product will be in the market next year and will last five years. Revenues are projected to be $50 million per year along with expenses of $20 million. The firm spends $15 million immediately on equipment that will be depreciated using MACRS depreciation to zero. Additionally, it will use some fully depreciated existing equipment that has a market value of $4 million. Finally, Minish will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). But, receivables are expected to account for 15% of annual sales. Payables are expected to be 15% of the annual cost of goods sold (COGS) between year 1 and year 4. All accounts payables and receivables will be settled at the end of year 5. Based on this information and WACC in the first part of the question, find the NPV of the project. Identify the IRR of the…arrow_forward

- RealTurf is considering purchasing an automatic sprinkler system for its sod farm by borrowing the entire $30,000 purchase price. The loan would be repaid with four equal annual payments at an interest rate of 12%/year. It is anticipated that the sprinkler system would be used for 9 years and then sold for a salvage value of $2,000. Annual operating and maintenance expenses for the system over the 9-year life are estimated to be $9,000 per year. If the new system is purchased, cost savings of $15,000 per year will be realized over the present manual watering system. RealTurf uses a MARR of 15%/year for economic decision making. Based on a present worth analysis, is the purchase of the new sprinkler system economically attractive?arrow_forwardCori's Meats is looking at a new sausage system with an installed cost of $435,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $61,000. The sausage system will save the firm $255,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $20,000. If the tax rate is 24 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPVarrow_forwardTemporary Housing Services Incorporated (THSI) is considering a project that involves setting up a temporary housing facility in an area recently damaged by a hurricane. THSI will lease space in this facility to various agencies and groups providing relief services to the area. THSI estimates that this project will initially cost $4 million to set up and will generate $20 million in revenues during its first and only year in operation (paid in one year). Operating expenses are expected to total $8 million during this year and depreciation expense will be another $2 million. THSI will require no working capital for this investment. THSI's tax-rate is 20% Assume that THSI's cost of capital for this project is 15%. The net present value (NPV) of this temporary housing project is closest to:arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education