FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

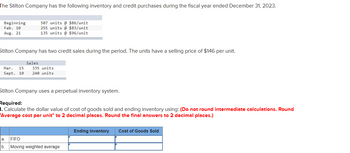

Transcribed Image Text:The Stilton Company has the following inventory and credit purchases during the fiscal year ended December 31, 2023.

Beginning

Feb. 10

Aug. 21

507 units @ $86/unit

255 units @ $83/unit

135 units@ $96/unit

Stilton Company has two credit sales during the period. The units have a selling price of $146 per unit.

Sales

Mar. 15 335 units

Sept. 10 240 units

Stilton Company uses a perpetual inventory system.

Required:

1. Calculate the dollar value of cost of goods sold and ending inventory using: (Do not round intermediate calculations. Round

'Average cost per unit" to 2 decimal places. Round the final answers to 2 decimal places.)

a. FIFO

b. Moving weighted average

Ending Inventory Cost of Goods Sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sanjuarrow_forwardSteven Company uses a perpetual inventory system. It sells its product to customers for $60 per unit. Below is information regarding inventory transactions for April. The company uses the FIFO method. Apr.1 Beginning Inventory 60 units @ $22 = $1,320 Apr. 12 Purchase 1 30 units @ $23 = $690 Apr. 18 Sale 1 15 units Apr. 20 Purchase 2 15 units @ $25 = $375 Apr. 29 Sale 2 50 units Calculate the amount of revenue earned during December. Show your calculations Blank 1. Fill in the blank, read surrounding text. Total Revenue for December Blank 2. Fill in the blank, read surrounding text.arrow_forwardCalculator Addison, Inc. uses a perpetual inventory system. The following is information about one inventory item for the month of September: Sept. 1 Inventory 20 units at $20 4 Sale 10 units 10 Purchase 30 units at $25 17 Sale 20 units 30 Purchase 10 units at $30 If Addison uses FIFO, the cost of the ending merchandise inventory on September 30 is Oa. $700 Ob. $650 Oc. $800 Od. $750 Previousarrow_forward

- During 2021, a company sells 25 units of inventory. The company has the following inventory purchase transactions for 2021: Unit Total Number of Units 20 Date Transaction Cost Cost Jan. 1 Beginning inventory Sep. 8 Purchase $50 68 $1,000 680 10 30 $1,680 Calculate ending inventory and cost of goods sold for 2021 assuming the company uses the weighted-average cost method. (Rour weighted-average unit cost to 4 decimal places. Round your final answers to the nearest dollar amount.) Ending inventory Cost of goods soldarrow_forwardMontoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions. Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 580 units @ $40 per unit February 10 Purchase 420 units @ $38 per unit March 13 Purchase 180 units @ $25 per unit March 15 Sales 755 units @ $70 per unit August 21 Purchase 190 units @ $45 per unit September 5 Purchase 560 units @ $41 per unit September 10 Sales 750 units @ $70 per unit Totals 1,930 units 1,505 units Required: Compute cost of goods available for sale and the number of units available for sale. Cost: I got 75170 Units:1930 Compute the number of units in ending inventory. I got 425 Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (For specific identification, units sold consist of 580 units from…arrow_forwardHemming Company reported the following current-year purchases and sales for its only product. Activities Beginning inventory Sales Units Acquired at Cost @$12.20 = Purchase @$17.20 = Sales Purchase @ $22.20 = Sales Purchase Totals Date January 1 January 10 March 14 March 15 July 30 October 5 October 26 Required: Hemming uses a perpetual inventory system. 255 units 410 units 455 units 155 units 1,275 units @ $27.20 $ 3,111 7,052 10,101 4,216 $ 24,480 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Units Sold at Retail 210 units 350 units 430 units 990 units @ $42.20 @ $42.20 @ $42.20arrow_forward

- Required information [The following information applies to the questions displayed below.] Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities March 1 March 5 Beginning inventory Purchase Units Acquired at Cost 100 units @ $51.00 per unit 225 units @ $56.00 per unit Units Sold at Retail March 9 Sales 260 units @ $86.00 per unit March 18 Purchase March 25 Purchase March 29 Sales Totals 85 units @ $61.00 per unit 150 units @ $63.00 per unit 560 units 130 units @ $96.00 per unit 390 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Beginning inventory Purchases: March 5 March 18 March 25 Total Cost of Goods Available for Sale # of units Cost per Unit Cost of Goods Available for Sale S Next >arrow_forwardAssume Ava Co. has the following purchases of inventory during the first month of operations Number of Units Cost per unit 115 3.0 110 4.6 First Purchase Second Purchase Close Assuming Ava Co sells 155 units at $12 each, what is the ending balance in the inventory account if they use LIFO?arrow_forwardyas.5arrow_forward

- The following units of a particular item were availlable for sale during the calendar year: Jan. 1 Inventory 4,100 units at $39 Apr. 19 Sale 2,300 units June 30 Purchase 4,500 units at $43 Sept. 2 Sale 5,200 units Nav. 15 Purchase 2,100 units at $46 The firm maintains a perpetual inventory system. Determine the cost of goods ssold for each sale and the inventory balance after each sale, assuming the last-in, first-out method. Present the illustrated in Exhibit 4. Under LIFO, if units are in inventory at two or more different costs, enter the units with the LOWER unit cost first in the Inventory Unit Cost column. Schedule of Cost of Goods Sold LIFO Method Cost of Goods Sold Inventory Purchases Quantity Total Cos Quantity Unit Cost Total Cost Unit Cost Unit Cost Total Cost Quantity Date Jan. 1 Apr. 19 June 30 Sept. 2 Nov. 15 Dec. 31 Balancesarrow_forwardThe inventory data for an item for November are: Nov. 1 Inventory 18 units at $23 4 Sale 10 units 10 Purchase 35 units at $25 17 Sale 16 units 30 Purchase 22 units at $27 Using a perpetual system, what is the cost of merchandise sold for November if the company uses LIFO? Oa. $1.269 Ob. $614 Oc. $630 Od. $814arrow_forwardMontoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Activities Units Sold at Retail Unita Acquired at Cost 600 unita $35 per unit 300 unite @ $32 per unit 150 units @ $20 per unit Date. Jan. 1 Beginning inventory Feb. 10 Purchase. Mar. 13 Purchase Mar. 15 Sales Aug. 21 Purchase. Sept. 5 Purchase. Sept. 10 Sales Totaln 190 units @ $40 per unit 540 units $37 per unit Cost of goods available for sale Number of units available for sale 1,780 units 725 units @ $80 per unit Required: 1. Compute cost of goods available for sale and the number of units available for sale. units 730 unite $80 per unit 1,455 unitearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education