FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

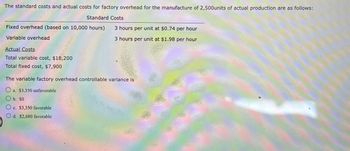

Transcribed Image Text:The standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows:

Standard Costs

Fixed overhead (based on 10,000 hours)

Variable overhead

Actual Costs

Total variable cost, $18,200

Total fixed cost, $7,900

3 hours per unit at $0.74 per hour

3 hours per unit at $1.98 per hour

The variable factory overhead controllable variance is

O a. $3,350 unfavorable

O b. So

Oc. $3,350 favorable

O d. $2,680 favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- answer in text form please (without image)arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,700 units of actual production are as follows: Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $17,800 Total fixed cost, $8,200 The total factory overhead cost variance is Oa. $1,600 unfavorable Ob. $2,930 favorable Oc. $2,930 unfavorable Od. $4,260 favorable Standard Costs 3 hours per unit at $0.70 per hour 3 hours per unit at $2.00 per hourarrow_forwardOwearrow_forward

- The standard costs and actual costs for factory overhead for the manufacture of 2,800 units of actual production are as follows: Standard Costs Fixed overhead (based on 10,000 hours) 3 hours per unit @ $0.78 per hour Variable overhead 3 hours per unit @ $1.91 per hour Actual Costs Total variable cost, $17,800 Total fixed cost, $8,100 The variable factory overhead controllable variance is a.$1,756 favorable b.$1,756 unfavorable c.$1,405 favorable d.$0arrow_forwardData on Gantry Company's direct labor costs are given below: Standard direct labor-hours Actual direct labor-hours Direct labor efficiency variance-favorable Direct labor rate variance-favorable Total direct labor payroll What was Gantry's actual direct labor rate? 35,000 34,000 $ 4,100 $ 6,800 $ 132,600 Multiple Choice $4.10 $3.70 $3.90 $6.80arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs 3 hours per unit at $0.71 per hour 3 hours per unit at $1.90 per hour Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $17,800 Total fixed cost, $7,900 The fixed factory overhead volume variance is Oa. So Ob. $1,420 unfavorable Oc. $1,775 unfavorable Od. $1,420 favorablearrow_forward

- The following information relating to a company's overhead costs is available. Budgeted fixed overhead rate per machine hour Actual variable overhead Budgeted variable overhead rate per machine hour Actual fixed overhead Budgeted hours allowed for actual output achieved Based on this information, the total overhead variance is: Multiple Choice O O $69,000 favorable. $112,000 favorable. $43,000 unfavorable. $112,000 unfavorable. $43,000 favorable. $ 1.50 $ 99,000 $ 4.00 $ 20,000 42,000arrow_forwardAGL Inc. provided the following data related to the direct labor costs for the current period: Data Related to Direct Labor Costs Data Rate Hours Standard $17.50 12,000 Actual $15.50 14,000 Determine the direct labor cost variance. Group of answer choices -$7,000 favorable -$28,000 favorable $7,000 unfavorable $28,000 unfavorablearrow_forwardUsing a traditional cost system and applies overhead to production based on machine hours. Estimated overhead cost $150,000 Actual overhead cost $140,000 Estimated machine hours 20,000 hrs Actual machine hours 25,000 Determine the overhead variance for the period? Is it $10,000 overlapped?arrow_forward

- Need help with fixed factory overhead volume variance amount and total factory overhead cost variance, please! Factory Overhead Variance Corrections The data related to Shunda Enterprises Inc.’s factory overhead cost for the production of 60,000 units of product are as follows: Actual: Variable factory overhead $261,300 Fixed factory overhead 188,400 Standard: 91,000 hrs. at $5 ($2.90 for variable factory overhead) 455,000 Productive capacity at 100% of normal was 90,000 hours, and the factory overhead cost budgeted at the level of 91,000 standard hours was $452,300. Based on these data, the chief cost accountant prepared the following variance analysis: Variable factory overhead controllable variance: Actual variable factory overhead cost incurred $261,300 Budgeted variable factory overhead for 91,000 hours (263,900) Variance—favorable $(2,600) Fixed factory overhead volume variance: Normal productive capacity at 100% 90,000 hrs.…arrow_forwardThe following data relate to factory overhead cost for the production of 4,000 computers: Actual: Variable factory overhead $139,700 Fixed factory overhead 36,000 Standard: 4,000 hrs. at $42 168,000 If productive capacity of 100% was 6,000 hours and the total factory overhead cost budgeted at the level of 4,000 standard hours was $180,000, determine the variable factory overhead Controllable Variance, fixed factory overhead volume variance, and total factory overhead cost variance. The fixed factory overhead rate was $6 per hour. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. Variance Amount Favorable/Unfavorable Controllable variance $ Volume variance $ Total factory overhead cost variance $arrow_forwardXYZ Company makes one product and has calculated the following amounts for direct labor: AH x AR = $84,000; AH x SR = $83,000; SH x SR = $85,000. Compute the direct labor cost variance. Multiple choice question. $1,000 U $1,000 F $2,000 F $2,000 Uarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education