FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

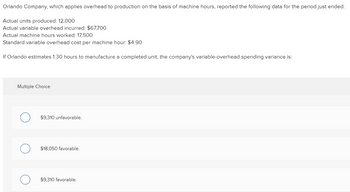

Transcribed Image Text:Orlando Company, which applies overhead to production on the basis of machine hours, reported the following data for the period just ended:

Actual units produced: 12,000

Actual variable overhead incurred: $67,700

Actual machine hours worked: 17,500

Standard variable overhead cost per machine hour: $4.90

If Orlando estimates 1.30 hours to manufacture a completed unit, the company's variable-overhead spending variance is:

Multiple Choice

$9,310 unfavorable.

$18,050 favorable.

$9,310 favorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- SouthHaven Corporation applies overhead based on direct labor hours. According to standard cost card, the variable overhead standard is 11.5 hours at $20.5 per hour. During July, SouthHaven produced 4,600 units using 52,380 labor hours and spent $1,091,700 for variable overhead. What is the variable overhead efficiency variance? Multiple Choice $17,910 unfavorable $979,490 favorable $17,910 favorable $10,660 favorablearrow_forwardZillow Inc. has the following data related to direct materials costs for the current month: actual cost for 7,000 pounds of material at $2.50 per pound and standard cost for 6,700 pounds of material at $3.20 per pound. What is the direct materials quantity or efficiency variance? Group of answer choices -$4,900 favorable $4,900 unfavorable $960 unfavorable -$960 favorablearrow_forwardProvide solution for this questionarrow_forward

- Perez Company established a predetermined fixed overhead cost rate of $37 per unit of product. The company planned to make 6,100 units of product but actually produced only 5,300 units. Actual fixed overhead costs were $233,200. Required a. Determine the fixed cost spending variance and indicate whether it is favorable (F) or unfavorable (U). b. Determine the fixed cost volume variance and indicate whether it is favorable (F) or unfavorable (U). Note: For all requirements, Select "None" if there is no effect (i.e., zero variance). a. Total spending variance b. Total volume variancearrow_forwardA manufacturing company that has only one product has established the following standards for its variable manufacturing overhead. The company bases its variable manufacturing overhead standards on direct labor-hours. Standard hours per unit of output Standard variable overhead rate 3.60 DLHS $10.95 per DLH The following data pertain to operations for the last month: Actual direct labor-hours Actual total variable manufacturing overhead cost Actual output What is the variable overhead efficiency variance for the month? Multiple Choice $6,789 U $7,213 F $3,592 U $7,213 U 8,900 DLHS $ 95,820 2,300 unitsarrow_forwardThe records of Heritage Home Supplies show the following for July: Standard direct labor-hours allowed per unit of output 4 Standard variable overhead rate per standard direct labor-hour $ 44 Good units produced 3,800 Actual direct labor-hours worked 14,675 Actual total direct labor cost $ 537,200 Direct labor efficiency variance $ 19,530 F Actual variable overhead $ 645,700 Required: Compute the direct labor and variable overhead price and efficiency variances. Note: Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Direct labor: Price variance Efficiency variance Variable overhead: Price variance Efficiency variance need helparrow_forward

- You Did It! (YDI) has the following standards for direct labor: o Estimated quantity 8,900 direct labor hours o Estimated unit variable $48 per hour o Estimated fixed costs $18,000 YDI actually used 8,300 direct labor hours during production at an average hourly wage rate of $49.20, and actually incurred total fixed costs of $17,600. Using this information, answer the following questions. Please circle to identify the variance as favorable or unfavorable. What is the direct labor volume variance? Favorable or unfavorable?arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,800 units of actual production are as follows: Line Item DescriptionValueFixed overhead (based on 10,000 hours)3 hours per unit at $0.71 per hourVariable overhead3 hours per unit at $1.98 per hour Actual Costs Total variable cost, $18,200 Total fixed cost, $8,200 The fixed factory overhead volume variance is Group of answer choices $1,136 unfavorable $909 unfavorable $909 favorable $0arrow_forwardThe standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs 3 hours per unit at $0.71 per hour 3 hours per unit at $1.92 per hour Fixed overhead (based on 10,000 hours) Variable overhead Actual Costs Total variable cost, $18,200 Total fixed cost, $8,100 The variable factory overhead controllable variance is Oa. $3,800 unfavorable Ob. $3,800 favorable Oc. $3,040 favorable Od. Soarrow_forward

- Beverly Company has determined a standard variable overhead rate of $4.00 per direct labor hour and expects to incur 0.50 labor hour per unit produced. Last month, Beverly incurred 1,700 actual direct labor hours in the production of 3,500 units. The company has also determined that its actual variable overhead rate is $2.40 per direct labor hour. Calculate the variable overhead rate and efficiency variances as well as the total amount of over- or underapplied variable overhead. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Variable Overhead Rate Variance $2,720 F Variable Overhead Efficiency Variance $200 F Over or under applied Variable Overhead??- how do I figure this out??arrow_forwardFeagin Company’s actual variable overhead was $73,000. Actual direct labor hours were 25,000 to make 20,000 finished products. The per-unit standard for direct labor hour is 1.5 hours, and the pre-determined variable overhead rate is $3 per direct labor hour. What were (1) the variable overhead spending variance (2) the variable overhead efficiency variance?arrow_forwardThis Company uses standard costing. Variable overhead is applied at $8 per direct labor hour. Data for the month of September follows: Actual overhead variable costs $78,000 Standard hours allowed for actual production 10,000 Actual labor hours worked 9,800 How much is the controllable overhead spending variance? a. $2,000 favorable b. $400 favorable c. $400 unfavorable d. $2,000 unfavorablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education