ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:I

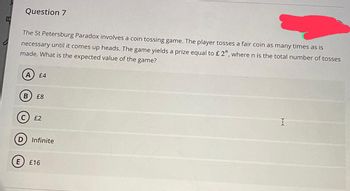

Question 7

The St Petersburg Paradox involves a coin tossing game. The player tosses a fair coin as many times as is

necessary until it comes up heads. The game yields a prize equal to £ 2", where n is the total number of tosses

made. What is the expected value of the game?

B

£4

£8

£2

D Infinite

E £16

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Clancy has difficulty finding parking in his neighborhood and, thus, is considering the gamble of illegally parking on the sidewalk because of the opportunity cost of the time he spends searching for parking. On any given day, Clancy knows he may or may not get a ticket, but he also expects that if he were to do it every day, the average amount he would pay for parking tickets should converge to the expected value. If the expected value is positive, then in the long run, it will be optimal for him to park on the sidewalk and occasionally pay the tickets in exchange for the benefits of not searching for parking. Suppose that Clancy knows that the fine for parking this way is $100, and his opportunity cost (OC) of searching for parking is $20 per day. That is, if he parks on the sidewalk and does not get a ticket, he gets a positive payoff worth $20; if he does get a ticket, he ends up with a payoff ofarrow_forwardConsider the lottery that assigns a probability T of obtaining a level of consumption CH and a probability 1-T an individual facing such a lottery with utility function u(c) that has the properties that more is better (that is, a strictly positive marginal utility of consumption at all levels of c) and diminishing marginal utility of consumption, u"(c) CL. Consider du(c) for the first derivative of the utility function with respect to dc du(c) du' (c) consumption and u"(c) (which is also the derivative of the first derivative of the utility function). to be the second derivative of the utility function dc dc2 1. Provide a definition for the certainty equivalent level of consumption for the simple lottery described above.arrow_forwardA total of 10 players are each choosing a number from {0,1,2,3,4,5,6,7,8}. If a player's number equals exactly half of the average of the numbers submitted by the other nine players, then she is paid $100; otherwise, she is paid 0. Solve for the strategies that survive the IDSDS.arrow_forward

- Reactors `R’ Us operates a nuclear power plant in Potsdam.In the event of reactor failure, there would be major damages to the North Country. The company can reduce the probability of failure through proper maintenance of the facility. The marginal cost of maintenance is increasing in the amount of maintenance done (and thus decreasing in the probability of an accident). We can write this marginal cost curve as MAC=2-10p (where 0<p<1, and represents the probability of a failure over a 50 year period). The marginal expected damages are an increasing function of the probability of an accident so that MD=2.2+10p. Provide a graph or graphs to illustrate your analysis/answers to the following questions. A. What is the efficient probability of reactor failure? B. If “Reactors ‘R’ Us” thinks that, in the event of reactor failure, they will NOT be found liable for damages, what probability of failure will they choose? C. If “Reactors ‘R’ Us” thinks that, in the…arrow_forwardProblem 4: Consider an infinitely repeated game, where the base game is the following 2-person 2x2 game: A A 0,0 10, 10 S1: choose A always S2: choose B always B 10, 10 0,0 Assume both players discount the future at the same rate of r, 0 < r < 1. Limiting each player's strategies to the following six possibilities, S3: Choose A then mimic the other player's previous choice S4: Choose B, then mimic the other player's previous choice S5: Choose A, then choose the opposite of the other player's previous choice S6: Choose B, then choose the opposite of the other player's previous choice a. present the strategic form of this game, b. identify all pure-strategy Nash equilibria c. does repetition with these strategies "solve" the coordination dilemma that confronts the players in the single play of the above game.arrow_forwardClancy has difficulty finding parking in his neighborhood and, thus, is considering the gamble of illegally parking on the sidewalk because of the opportunity cost of the time he spends searching for parking. On any given day, Clancy knows he may or may not get a ticket, but he also expects that if he were to do it every day, the average amount he would pay for parking tickets should converge to the expected value. If the expected value is positive, then in the long run, it will be optimal for him to park on the sidewalk and occasionally pay the tickets in exchange for the benefits of not searching for parking. Suppose that Clancy knows that the fine for parking this way is $100, and his opportunity cost (OC) of searching for parking is $20 per day. That is, if he parks on the sidewalk and does not get a ticket, he gets a positive payoff worth $20; if he does get a ticket, he ends up with a payoff ofarrow_forward

-  Time remaining: 01 :53 :32 Economics A dealer decides to sell an antique automobile by means of an English auction with a reservation price of $900. There are two bidders. The dealer believes that there are only three possible values, $7,200, $3,600, and $900, that each bidder’s willingness to pay might take. Each bidder has a probability of 1/3 of having each of these willingnesses to pay, and the probabilities for each of the two bidders are independent of the other’s valuation. Assuming that the two bidders bid rationally and do not collude, the dealer’s expected revenue from selling the car is approximately Group of answer choices $3,600. $2,500. $3,900. $5,400. $7,200.arrow_forwardRachel's objective is to maximize the expected profit, subject to that Emma works for Rachel and Emma puts effort. However, effort level is not observable. Hence, Rachel needs to write a contract based on the observables. Let's say, Rachel pays Emma based on the outcome: when the profit is $0, 2 when the profit is $2000, and zu when the profit is $3,000. Then Emma has three options: (i) Not to work for Rachel (ii) Work for Rachel without effort (iii) Work for Rachel with effort Find Emma's expected utility on each option.arrow_forward1 Q1. Jerry has wealth of $60 and derives utility from this according to the utility function U(w) = 1 - Where w is his wealth. Jerry now finds a lottery ticket (the drawing takes place the next day) that offers a 50% chance of winning $5. W a) What is the expected value of Jerry if he takes the lottery ticket? (pay attention, it's not jerry's wealth) b) What is the minimum amount for which Jerry would be willing-to-sell the ticket? (Hint: sets a price of p, and at the minimum amount, the expected utility of selling and not selling should be the same) c) Which is bigger, your answer to (a) or (b), and suggest whether Jerry is a risk averse person based on the previous conclusion? d) If he does not sell the ticket, what is Jerry's cost of risk? (The cost of risk is the difference between the expected wealth and the certainty equivalence)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education