FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

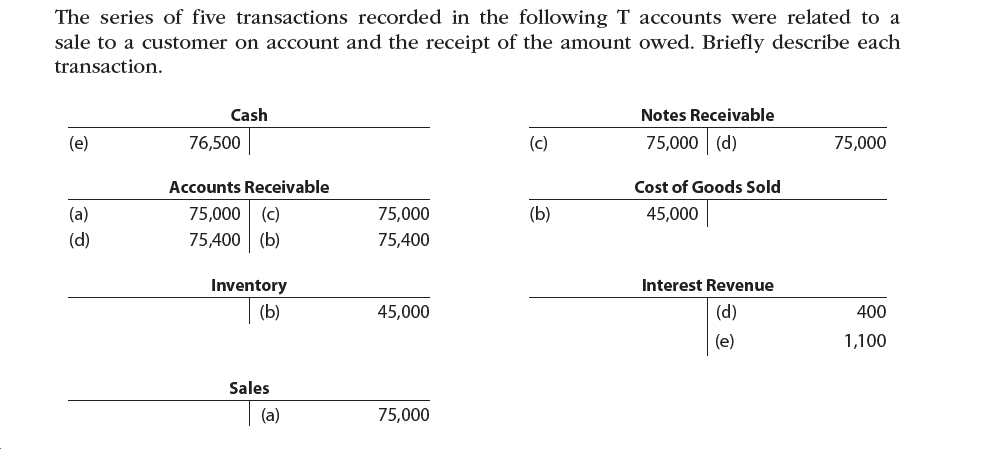

Transcribed Image Text:The series of five transactions recorded in the following T accounts were related to a

sale to a customer on account and the receipt of the amount owed. Briefly describe each

transaction.

Cash

Notes Receivable

75,000 | (d)

75,000

(e)

76,500

(c)

Accounts Receivable

Cost of Goods Sold

75,000 (c)

75,400 (b)

75,000

(b)

(a)

45,000

(d)

75,400

Inventory

Interest Revenue

45,000

(b)

(d)

400

(e)

1,100

Sales

(a)

75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Based on the following data, what is the accounts receivable turnover? Line Item Description Amount Sales on account during year $481,916 Cost of goods sold during year 220,075 Accounts receivable, beginning of year 44,464 Accounts receivable, end of year 52,698 Inventory, beginning of year 82,460 Inventory, end of year 110,155 a. 4.4 b. 9.9 c. 2.2 d. 10.8arrow_forwardBased on the following data, what is the accounts receivable turnover? Sales on account during year $545,555 Cost of goods sold during year 200,188 Accounts receivable, beginning of year 48,147 Accounts receivable, end of year 54,388 Inventory, beginning of year 90,742 Inventory, end of year 119,266arrow_forwardOn December 1, 2022, Blossom Company had the following account balances. Cash Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. 12 2. 17 During December, the company completed the following transactions. 19 22 26 31 Debit Adjustment data: $18,800 Accumulated Depreciation-Equipment 2,400 Accounts Payable Common Stock Retained Earnings 7,000 15,500 1,700 29,000 $74,400 Credit Received $3,600 cash from customers in payment of account (no discount allowed). Purchased merchandise on account from Vance Co. $12,400, terms 1/10, n/30. Sold merchandise on account $16,400, terms 2/10, n/30. The cost of the merchandise sold was $9,600. $2,900 6,200 50,100 15,200 $74,400 Paid salaries $2,100. Paid Vance Co. in full, less discount. Received collections in full, less discounts, from customers billed on December 17. Received $2,800 cash from customers in payment of account (no discount allowed). Depreciation was $200 per month. Insurance of $400 expired in December.arrow_forward

- Accounts Receivable Balance Beginning accounts receivable were $275,500, and ending accounts receivable were $302,300. Cash amounting to $2,965,000 was collected from customers' credit sales. Required: Calculate the amount of sales on account during the period.arrow_forwardJournalize the corrections for the following transactions: 1. A cash sale of $1,000,000 has been recorded for $100,000,000 2. The receipt of $50,000 in accounts receivable has been recorded as a payment of $500,000 in accounts payable. 3. Payment of accounts payable $50,000 has been recorded as a cash sale of $5,000,000 4. Merchandise ending inventory was overstated $10,000arrow_forwardUsing the following data for the current year, determine the accounts receivable turnover. Net sales on account during the year $ 457,065 Cost of merchandise sold during the year 461,280 Accounts receivable, beginning of year 75,290 Accounts receivable, end of year 26,280 Inventory, beginning of year 185,000 Inventory, end of year 169,570 a.7 b.8 c.10 d.9arrow_forward

- The following information is available for Market, Incorporated and Supply, Incorporated at December 31: Accounts Market, Incorporated Supply, Incorporated $ 58,600 $ 79,600 Accounts receivable Allowance for doubtful accounts 3,148 Sales revenue 636,960 2,556 917,100 Required: 1. What is the accounts receivable turnover for each of the companies? 2. What is the average days to collect the receivables? 3. Assuming both companies use the percent of receivables allowance method, what is the estimated percentage of uncollectible accounts for each companyarrow_forwardAccounts Receivable Analysis The following data are taken from the financial statements of Basinger Inc. Terms of all sales are 2/10, n/45. 20Y3 20Y2 20Y1 Accounts receivable, end of year $157,200 $164,000 $171,800 Sales on account 883,300 789,130 a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days' sales in receivables. Round interim calculations to the nearest dollar and final answers to one decimal place. Assume a 365-day year. 20Y3 20Y2 1. Accounts receivable turnover 2. Number of days' sales in receivables days days This can be seen in both the in accounts receivable b. The collection of accounts receivable has turnover and the in the collection period.arrow_forwardplease solve with proper explanation , computation ,formula with steps answer in text thanksarrow_forward

- The trial balance of Pacilio Security Services, Incorporated as of January 1, Year 8, had the following normal balances: $93,708 100 22,540 1,334 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Cash Petty cash Accounts receivable Allowance for doubtful accounts Supplies Prepaid rent Merchandise inventory (18@ $285) 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. Land Salaries payable Common stock Retained earnings During Year 8, Pacilio Security Services experienced the following transactions: 1. Paid the salaries payable from Year 7. 2. Purchased equipment and a van for a lump sum of $36,000 cash on January 2, Year 8. The equipment was appraised for $10,000 and the van was appraised for $30,000. Requirement 3. Paid $9,000 on May 1, Year 8, for one year's office rent in advance. 4. Purchased $300 of supplies on account 5. Purchased 120 alarm systems at a cost of $280 each. Pald cash for the purchase. 6. After numerous attempts to collect from customers, wrote off $2,350 of uncollectible accounts…arrow_forwardEcho Corporation had the following balances immediately prior to writing off a $100 uncollectible account: Current assets $ 30,000 Accounts receivable 3,300 Allowance for credit losses 300 Current liabilities 10,000 Required: Calculate the following amounts or ratios and determine the relationship between the amount or ratio before the write-off (x) with the amount or ratio after the write-off (y): Current ratio x equals y Net accounts receivable balance x equals y Gross accounts receivable balance x greather than Yarrow_forwardThe following information relates to a company’s accounts receivable: gross accounts receivable balance at the beginning of the year, $350,000; allowance for uncollectible accounts at the beginning of the year, $24,000 (credit balance); credit sales during the year, $1,200,000; accounts receivable written off during the year, $15,000; cash collections from customers, $1,100,000. Assuming the company estimates that future bad debts will equal 12% of the year-end balance in accounts receivable.1. Calculate bad debt expense for the year.2. Calculate the year-end balance in the allowance for uncollectible accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education