FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

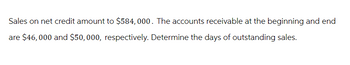

Transcribed Image Text:Sales on net credit amount to $584,000. The accounts receivable at the beginning and end

are $46,000 and $50,000, respectively. Determine the days of outstanding sales.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the Correct Answerarrow_forward. A company with net credit sales of $960,000, beginning net receivables of $70,000, andending net receivables of $90,000 has days’ sales outstanding closest to:a. 37 days.b. 30 days.c. 34 days.d. 41 days.arrow_forwardAccounts Receivable Balance Beginning accounts receivable were $275,500, and ending accounts receivable were $302,300. Cash amounting to $2,965,000 was collected from customers' credit sales. Required: Calculate the amount of sales on account during the period.arrow_forward

- The financial statements of Bolero Manufacturing Inc. report net credit sales of $900,000 and accounts receivable of S80,000 and $40,000 at the beginning of the year and end of the year, respectively. What is the average collection period for accounts receivable in days (rounded)? O 49 days O 16 days 24 days 32 daysarrow_forwardCredit sales during the year were $425,000, the Allowance for Uncollectible Accounts had a beginning of year balance of $2,500 debit, accounts written off during the year were $2,200. It is estimated that 2% of all credit sales are eventually uncollectible. What is the ending balance in the Allowance for Uncollectible Accounts? $8,500 $8,800 $3,800 $8,200arrow_forwardAction Signs recorded credit sales of $10,000 on the gross method. Terms are 2/20, n/30. How would the entry to this sale be recorded? cash decreases by $3,000 sales discounts increase by $200 sales increases by $9,800 accounts receivable increases by $10,000arrow_forward

- The financial statements of the Sunland Company report net sales of $384000 and accounts receivable of $50400 and $33600 at the beginning of the year and the end of the year, respectively. What is the average collection period for accounts receivable in days?arrow_forwardLogan Sales provides the following information: Net credit sales: $770,000 Beginning net accounts receivable: $45,000.00 Ending net accounts receivable: $22,000 Calculate the accounts receivable turnover ratio. (Round your answer to the nearest whole number.) A. 23 times B. 35 times C. 33 times D. 17 timesarrow_forwardcompany reported credit sale of 6252900 and cost of goods sold of 3300000 for the year. the acconunt receivable balance at the beginning and end of the year were 516000 and 581000. receivables turnover ratio is 1. 10.8 2. 6.0 3. 11.4 4. 5.7arrow_forward

- A company has net income of $196,000, a profit margin of 10.00 percent, and an accounts receivable balance of $106,420. Assuming 79 percent of sales are on credit, what is the company's days' sales in receivables?arrow_forwardThe balance in Accounts Receivable at the beginning of the year was $520,000. The balance in Accounts Receivable at the end of the year was $780,000. Customer accounts of $420,000 were written off. The company collected $4,060,000 from credit customers and $1,010,000 from cash customers. What are credit sales for the year? A) $4,740,000 B) $4,480,000 C) $4,060,000 D) $4,220,000arrow_forwardA company has net income of $182,000, a profit margin of 9.90 percent, and an accounts receivable balance of $106,014. Assuming 69 percent of sales are on credit, what is the company's days' sales in receivables? Multiple Choice 21.05 days 40.40 days 30.50 daysarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education