FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

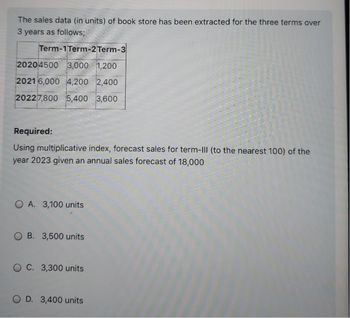

Transcribed Image Text:The sales data (in units) of book store has been extracted for the three terms over

3 years as follows;

Term-1Term-2 Term-3

20204500 3,000 1,200

2021 6,000 4,200 2,400

20227,800 5,400 3,600

Required:

Using multiplicative index, forecast sales for term-III (to the nearest 100) of the

year 2023 given an annual sales forecast of 18,000

OA. 3,100 units

B. 3,500 units

OC. 3,300 units

OD. 3,400 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- On average, a firm sells $2,000,000 in merchandise a month. It keeps inventory equal to one-half of its monthly sales on hand at all times. If the firm analyzes its accounts using a 365-day year, what is the firm’s inventory conversion period (ICP)? (Hint: ICP = 365/(sales/inventory)arrow_forwardLewellen Products has projected the following sales for the coming year: 01 02 03 04 Sales $940 $1,020 $980 $1,080 Sales in the year following this one are projected to be 20 percent greater in each quarter a. Calculate payments to suppliers assuming that the company places orders during each quarter equal to 30 percent of projected sales for the next quarter. Assume that the company pays immediately. What is the payables period in this case? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate payments to suppliers assuming a 90-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. Calculate payments to suppliers assuming a 60-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. b. Payment of accounts Payment of accounts Payment of accounts 01 02 Q3 Q4arrow_forward= $ 15, Assume that D = 5,000, k = $ 186, c = and five setups (orders) are required per year. What is the percentage per unit per year of the implicit cost of holding inventory? (result in percentage)arrow_forward

- Don Williams received a memo requesting that he complete a trend analysis of the following numbers using 2021 as the base year. Sales Gross profit Net income 2024 $ 390,000 210,000 41,100 Could you help Don with the request? 2024 Sales Gross profit Net income % % % 2023 $ 462,000 285,000 53,100 2023 % % % 2022 2022 $ 486,000 410,000 23,100 % % % 2021 2021 $ 600,000 500,000 30,000 100 % 100 % 100 %arrow_forwardDiscuss briefly the role unions and government agencies play in the design of procedures for the HR management process.arrow_forwardSelected comparative financial statements of Haroun Company follow. HAROUN COMPANY Comparative Income Statements For Years Ended December 31, 2021-2015 ($ thousands) Sales 2021 Cost of goods sold $ 1,769 1,271 2020 $ 1,549 2019 2018 2017 2016 2015 $ 1,410 $ 1,292 $ 1,206 $ 1,121 $ 919 1,034 889 778 723 676 539 Gross profit 498 515 521 514 483 445 380 Operating expenses Net income 377 295 271 200 173 171 142 $ 121 $ 220 $ 250 $ 314 $ 310 $ 274 $ 238 HAROUN COMPANY Comparative Year-End Balance Sheets December 31, 2021-2015 ($ thousands) Assets Cash Accounts receivable, net Merchandise inventory Other current assets Long-term investments Plant assets, net Total assets Liabilities and Equity 2021 2020 2019 2018 2017 2016 2015 $ 108 773 $ 142 812 $ 148 735 2,797 2,036 1,779 $ 151 564 1,499 $ 157 496 $ 155 $ 160 470 332 1,346 1,144 829 72 65 40 71 60 61 32 e B 220 220 220 220 3,422 3,409 2,982 1,683 $ 7,172 $ 6,464 $ 5,684 $ 4,188 $ 4,019 1,740 1,546 $ 3,596 $ 2,900 1,327 Current liabilities…arrow_forward

- Suppose a firm has had the historical sales figures shown as follows. What would be the forecast for next year's sales using the average approach? Year 2017 2018 Sales $ 750,000 500,000 Multiple Choice O $695,000 $700,000 $750,000 $775.000 2019 $ 700,000 2020 $ 750,000 2021 $ 775,000arrow_forwardCalculate LTM (last twelve months) 9/30/2012 sales given the information below Sales data in millions YTD 9/30/2012 sales YTD 9/30/2011 sales YTD 9/30/2010 sales 2011 sales 2010 sales $1,900.7 $2,000.5 $2,100.0 Ⓒ$2,400.0 $1,600.0 1,450.0 1,375.0 2,250.0 2,000.0arrow_forwardA retailer ordered merchandise totaling $128,115.23 with terms 3.5%/10 net 40. What is the effective rate of return? Assume there are 365 days in a year.arrow_forward

- Suppose a firm has had the following historic sales figures. What would be the forecast for next year's sales using the average approach? You must use the built-in Excel function to answer this question. Input area: Year Sales 2016 2017 2018 es es e $ 1,500,000 $ 1,750,000 $ 1,400,000 2019 $ 2,000,000 2020 $ 1,600,000 Output area: Next year's salesarrow_forwardCompute trend percents for the following accounts using 2020 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favourable or unfavourable. 2024 2023 Sales Cost of goods sold Accounts receivable $ 553,119 290,122 26,882 $ 363,894 190,775 21,215 2022 $ 292,284 155,088 20,021 2021 $ 210,276 110,844 12,322 2020 $ 159,300 82,836 10,928 2024: 2023: 2022: 2021: 2020: Numerator: Trend Percent for Net Sales: 1 Is the trend percent for Net Sales favourable or unfavourable? 2024: 2023: 2022: 2021: 2020: Denominator: = Trend percent 0 % 0% 0% 0% 0 % Trend Percent for Cost of Goods Sold: Numerator: Denominator: Is the trend percent for Cost of Goods Sold favourable or unfavourable? = Trend percent 0% 0% 0% 0% 0%arrow_forwardSuppose a firm has had the following historic sales figures. Year: 2016 Sales $1,420,000 2017 $1,720,000 Next year's sales 2018 2019 2020 $1,600,000 $2,010,000 $1,770,000 What would be the forecast for next year's sales using FORECAST.ETS to estimate a trend? Note: Round your answer to the nearest whole dollar. 27arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education