EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Raghu Bhai

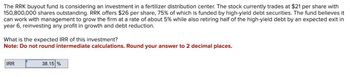

Transcribed Image Text:The RRK buyout fund is considering an investment in a fertilizer distribution center. The stock currently trades at $21 per share with

150,800,000 shares outstanding. RRK offers $26 per share, 75% of which is funded by high-yield debt securities. The fund believes it

can work with management to grow the firm at a rate of about 5% while also retiring half of the high-yield debt by an expected exit in

year 6, reinvesting any profit in growth and debt reduction.

What is the expected IRR of this investment?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

IRR

38.15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sincere Stationary Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with an annual coupon rate 10.0 percent with interest paid semiannually and a 10-year maturity. Investors require a return of 9.0 percent. A. Compute the market value of the bonds B. How many bonds will the firm have to issue to receive the needed funds C. What is the firms after-tax cost of debt if the firms tax rate is 34 percentarrow_forwardMary, Inc. is considering a project for next year, which will cost $5 million. Mary plans to use the following combination of debt and equity to finance the investment. Issue $1.5 million of 10-year bonds at a price of 101, with a coupon/contract rate of 4%, and flotation costs of 2% of par. Use $3.5 million of funds generated from retained earnings. The equity market is expected to earn 8%. U.S. Treasury bonds are currently yielding 3%. The beta coefficient for Mary, Inc. is estimated to be .70. Mary is subject to an effective corporate income tax rate of 30 percent. Compute Mary's expected rate of return using the Capital Asset Pricing Model (CAPM). Please show calculations.arrow_forwardAxon Industries needs to raise $22.41M for a new investment project. If the firm issues one-year debt, it may haveto pay an interest rate of 9.44 %, although Axon's managers believe that 5.51 % would be a fair rate given the level of risk. If the firm issues equity, they believe the equity may be underpriced by 11.26 %. What is the cost to current shareholders of financing the project out of Equity? NOTE: Provide your answers in Millions. E.G. for 100M you must enter 100.0000, for 20M you must enter 20.0000, etc.arrow_forward

- Sincere Stationary Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with a 12 percent annual coupon rate and a 10 year maturity. If floatation costs are 10.5 percent of the market price, how many bonds will the firm have to issue to receive the needed funds?arrow_forwardKohwe Corporation plans to issue equity to raise $50.7 million to finance a new investment. After making the investment, Kohwe expects to earn free cash flows of $10.4 million each year. Kohwe's only asset is this investment opportunity. Suppose the appropriate discount rate for Kohwe's future free cash flows is 7.7%, and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Kohwe's investment? b. What is the value of Kohwe if it finances the investment with equity? a. What is the NPV of Kohwe's investment? The NPV of Kohwe's investment is $ million. (Round to two decimal places.) b. What is the value of Kohwe if it finances the investment with equity? The Kohwe finances stment with equity $ million. (Round decimal places.)arrow_forwardThe Hartley Hotel Corporation is planning a major expansion. Hartley is financed 100 percent with equity and intends to maintain this capital structure after the expansion. Hartley’s beta is 0.8. The expected market return is 15 percent, and the risk-free rate is 8 percent. If the expansion is expected to produce an internal rate of return of 14 percent, should Hartley make the investment? Round your answer to one decimal places. Based on the cost of capital of ________ %, Hartley should invest ____ or not invest ______arrow_forward

- Alpha Industries is considering a project with an initial cost of $8.4 million. The project will profuce cash inflows of $1.64 million per year for 8 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.73 percent and a cost of equity of 11.35 percent. The debt-equity ratio is .64 and the tax rate is 39 percent. What is the net present value of the project?arrow_forwardThe Hartley Hotel Corporation is planning a major expansion. Hartley is financed 100 percent with equity and intends to maintain this capital structure after the expansion. Hartley’s beta is 1.3. The expected market return is 14 percent, and the risk-free rate is 9 percent. If the expansion is expected to produce an internal rate of return of 13 percent, should Hartley make the investment? Round your answer to one decimal places. Based on the cost of capital of %, Hartley invest.arrow_forwardSetrakian Industries needs to raise $71.8 million to fund a new project. The company will sell bonds that have a coupon rate of 5.78 percent paid semiannually and that mature in 25 years. The bonds will be sold at an initial YTM of 6.46 percent and have a par value of $2,000. How many bonds must be sold to raise the necessary funds?arrow_forward

- The Norris Company is looking to fund a new project with capital from both bondholders and shareholders. The company will collect 5,000 from bondholders demanding a 7.5% interest rate, with the other 50% of financing coming from shareholders. The company predicts there is a 55% chance the project will be a failure. The value of the project to the firm if the project is a success is $15,000, while the overall expected value of the project to the firm is $9,280. What are the expected returns for each investor?arrow_forwardTurner Video will invest $64,500 in a project. The firm's cost of capital is 6 percent. The investment will provide the following inflows. Use Appendix A for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 Inflow $ 18,000 20,000 24,000 28,000 32,000 The internal rate of return is 10 percent. a. If the reinvestment assumption of the net present value method is used, what will be the total value of the inflows after five years? (Assume the inflows come at the end of each year.) Note: Do not round intermediate calculations and round your answer to 2 decimal places. Total value of inflows b. If the reinvestment assumption of the internal rate of return method is used, what will be the total value of the inflows after five years? Note: Use the given internal rate of return. Do not round intermediate calculations and round your answer to 2 decimal places. Total value of inflowsarrow_forwardOrion Corporation is discussing a new capital expenditure project that requires an investment of €100 million. In line with the target capital structure of Orion, the management of the company has prepared the following funding plan:- A 5-year zero-coupon bond with face value of €32 million, priced at 80% of its face value.- A 5-year coupon bond, with 4% annual coupons, face value of €26 million, priced at 95% of its face value. -Preferred shares with a total €18 million face value. The issue price is at €40 with a preferred coupon of 12%. The flotation expenses are 2% on the issue price.-The remaining financing needs will be covered from retained earnings. Currently, the stock of the company trades at €50, the last dividend payment was €2.5 per share, and the expected growth rate for dividends is 8 percent. In addition, the beta of the stock is 1.4, the risk-free rate is 4 percent, and the expected market risk premium is 8 percent. Questions:1. Estimate the WACC of Orion…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT