Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please provide correct answer general Accounting

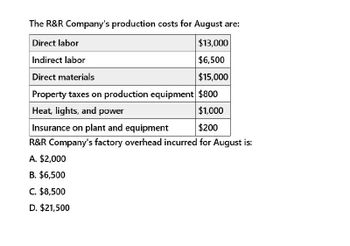

Transcribed Image Text:The R&R Company's production costs for August are:

Direct labor

Indirect labor

Direct materials

$13,000

$6,500

$15,000

Property taxes on production equipment $800

Heat, lights, and power

Insurance on plant and equipment

$1,000

$200

R&R Company's factory overhead incurred for August is:

A. $2,000

B. $6,500

C. $8,500

D. $21,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company estimates its manufacturing overhead will be $750,000 for the next year. What is the predetermined overhead rate given the following independent allocation bases? Budgeted direct labor hours: 60,000 Budgeted direct labor expense: $1,500,000 Estimated machine hours: 100,000arrow_forwardYork Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forwardGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forward

- Patterson Corporation expects to incur 70,000 of factory overhead and 60,000 of general and administrative costs next year. Direct labor costs at 5 per hour are expected to total 50,000. If factory overhead is to be applied per direct labor hour, how much overhead will be applied to a job incurring 20 hours of direct labor? a. 120 b. 260 c. 28 d. 140arrow_forwardRulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours. The cost to make Job 416 is $95 in neon, 15 hours of labor at $13 per hour, and five machine hours. During the month, it incurs $95 in indirect material cost, $130 in administrative labor, $320 in utilities, and $350 in depreciation expense. What is the predetermined overhead rate if machine hours are considered the cost driver? What is the cost of Job 416? What is the overhead incurred during the month?arrow_forwardNeed help with this questionarrow_forward

- A company estimated the manufacturing overhead costs for the coming year at $420,00 The total estimated direct labor hours are 15,000 hours, and the estimated machine hou to be worked are 6,000 hours. The company allocates its manufacturing overhead cos based on the direct labor hours. What is the pre-determined overhead allocation rate? a. $20 per direct labor hour b. $70 per machine hour c. $28 per machine hour d. $28 per direct labor hour Answer O A O B ODarrow_forwardK Rios Corporation reports costs for the year as follows: Direct Materials Used Wages to Line Workers Office Rent Indirect Materials Used How much is the total product costs for the year? A. $605,000 OB. $1,155,000 OC. $550,000 OD. $1,199,500 $430,000 120,000 44,500 605,000arrow_forwardJackson Furniture Company provided the following manufacturing costs for the months of June Direct labor costs $120,000 62,000 Direct materials costs Equipment depreciation (straight-line) Factory insurance Factory manager's salary Janitor's salary Packaging costs Property taxes on the factory From the above information, calculate Jackson's total fixed costs. OA. $279,700 OB. $64,100 OC. $78,900 OD. $68,400 27,000 10,500 10,000 14,800 18,800 16,600arrow_forward

- Johansen company has the following estimated..accounting questionsarrow_forwardcompany's total overhead cost at various levels of activity is presented below: Month March April May June Machine Hours 5,000 4,000 6,000 8,000 Total Overhead Cost $ 38,750 $ 31,000 $ 46,500 $ 55,000 Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 4,000 machine-hour level of activity is as follows: Utilities (considered variable) $8,000 Supervisory salaries (considered fixed) $5,000 Maintenance (considered mixed) $18,000 Total overhead cost $31,000 Suppose the company uses the high-low method to estimate a cost formula for mixed costs. What is the total maintenance cost the company expects to incur at an activity level of 6,900 machine hours? ○ $29,600 $29,200 O $30,400 $29,900arrow_forwardNova Company's total overhead cost at various levels of activity are presented below: Total Overhead Cost $ 210,600 $ 184,200 $ 237,000 $ 263,400 Month April May June July Machine-Hours 50,000 40,000 60,000 70,000 Assume the total overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 40,000 machine-hour level of activity is: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) Total overhead cost $ 56,000 60,000 68,200 $ 184,200 Nova Company's management wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $263,400 of overhead cost in July was maintenance cost. (Hint: To do this, it may be helpful to first determine how much of the $263,400 consisted of utilities and supervisory salaries. Think about the behavior of variable and fixed costs.) 2. Using the high-low method, estimate a cost formula for maintenance in the form Y = a + bx. 3.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning