ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

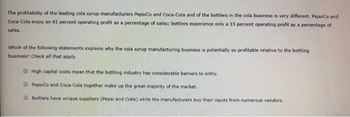

Transcribed Image Text:The profitability of the leading cola syrup manufacturers PepsiCo and Coca-Cola and of the bottlers in the cola business is very different. PepsiCo and

Coca-Cola enjoy an 81 percent operating profit as a percentage of sales; bottlers experience only a 15 percent operating profit as a percentage of

sales.

Which of the following statements explains why the cola syrup manufacturing business is potentially so profitable relative to the bottling

business? Check all that apply.

High capital costs mean that the bottling industry has considerable barriers to entry.

PepsiCo and Coca-Cola together make up the great majority of the market.

Bottlers have unique suppliers (Pepsi and Coke) while the manufacturers buy their inputs from numerous vendors.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If most firms in an industry are earning a 7 percent rate of return on their assets, but your business is earning 9 percent, your rate of economic profit is minus 2 percent. 2 percent. 9 percent. 16 percent.arrow_forwardLast year Bill Bailey quit his $20,000 per year job and invested $200,000 to open the Bargain Bonanzas. This year he sold for $600,000 merchandise he bought for $400,000. He paid his sales clerks $50,000. Bill could have earned 10 percent interest on other investments. This year, Bill’s: accounting and economic profit were both $150,000 economic loss was $70,000 economic profit was $110,000 economic profit was $220,000 less than his accounting profitarrow_forwardThe following data describe the firm's monthly demand and monthly costs for a manufacturer of electronic components. 1. Complete the following cost and revenue schedules for this company. Total Average Marginal Marginal Cost per Variable Variable Average Price per Cost per Total Cost Revenue per Cost for Quantity of boxes of per box of box of 1000 units Total box of 1000 box of units Fixed Total box of Revenue units 1000 units 1000 units produced Cost Cost 1000 units 1000 units $0 $800 $800 $1,700 $1,575 $1,450 $1,325 1 $1,028 $1,074 $1,117 $1,184 $1,303 2 3 4 5 $1,200 6. $1,075 $950 $1,498 7 $1,753 8 $825 $2,103 (a) What is the profit maximizing (or loss minimizing) quantity of boxesthat this company should supply? Why? (b) What price will the company charge? How is this price determined? Will this result in economic profits? (c) If the company charged a higher price than what you found in (b) above, what would happen? (d) What market structure do you think this company participates…arrow_forward

- Complete the table (fill up the FC, compute for TC, MC, AC, AFC and AVC):arrow_forwardDistinguish between a plant, a firm, and industry. Contrast a vertically integrated firm, a horizontally intergrated firm, and a conglomerate. Cite and example of a horizontally intergrated firm from which you have recently made purchase.arrow_forwardRespond to the question with a concise and accurate answer, along with a clear explanation and step-by-step solution, or risk receiving a downvote.arrow_forward

- Charging $17.99 a month for an unlimited number of movie rentals (three at one time), Netflix revolutionized the movie rental business with a one-day mailing service for DVDs and acquired 12 million subscribers and $1.5 billion in revenue. However, Blockbuster, the video rental giant from the earlier $5.5 billion bricks-and-mortar movie rental business, decided to enter the mail-in delivery and online-DVD rental businesses. Blockbuster (now a division of Dish Network) drove prices down to $14.99, attracting 2 million subscribers. Netflix responded with a cut-rate service of one movie at a time for $9.99 per month, which drove the net profit right out of the business. Movie studios like Viacom and Time Warner also entered the market with direct- to-the-customer video on demand delivered over the web. Following two months of theatre-only releases, the studios asked $20 to $25 per showing. This fee is five times what it costs to rent a second-run or classic movie from the cable companies…arrow_forwardBen Hunt operated a farm under the name of S.B.H. Farms. Hunt went to Mollary Bank and Trust and requested a loan to build hog houses, buy livestock, and expand farming operations. The bank agreed to loan S.B.H. Farms $175,000, for which short-term promissory notes were signed by Hunt. At the same time, oral discussions were held with the loan officer regarding long-term financing for the farm operations. No dollar amount, interest rate, or repayment terms were discussed. When Hunt defaulted on the short-term notes, the bank foreclosed on the farm. Hunt counterclaimed for $750,000 damages, alleging that the bank had breached a contract for long-term financing. Was there a valid offer for long-term financing offered by the bank?arrow_forwardThe Hokey Pokey, a children's day care center is thinking about changing the nature of its business. It is considering shutting down the day care center, and re-opening their business as an adult night club called the Hanky Panky. The Hokey Pokey currently makes $500 in profits. However, re-opening as the Hanky Panky will increase their profits from $500 to $1500. Friendly's Ice Cream which is currently located next to the Hokey Pokey is concerned because this move would reduce its profits by $1200. This would occur because they lose many of the families who currently come to the restaurant (some of which have their kids in the day care center.) but very few adult night club patrons are looking for ice cream. If no significant bargaining costs exists, does economic theory predict that the efficient outcome will still occur? A) Yes, the Hokey Pokey will change to the Hanky Panky because this gives them the highest profit.…arrow_forward

- How HEB behaves toward Walmart is a major determinant of whether it will face entry by new competitors. Explain. (HEB is a chain store in texas)arrow_forward3. Definition of economic costs Jacques lives in San Francisco and runs a business that sells guitars. In an average year, he receives $711,000 from selling guitars. Of this sales revenue, he must pay the manufacturer a wholesale cost of $411,000; he also pays wages and utility bills totaling $279,000. He owns his showroom; if he chooses to rent it out, he will receive $1,000 in rent per year. Assume that the value of this showroom does not depreciate over the year. Also, if Jacques does not operate this guitar business, he can work as a financial advisor and receive an annual salary of $31,000 with no additional monetary costs. No other costs are incurred in running this guitar business. Identify each of Jacques's costs in the following table as either an implicit cost or an explicit cost of selling guitars. Implicit Cost Explicit Cost The wholesale cost for the guitars that Jacques pays the manufacturer The wages and utility bills that Jacques pays The rental income Jacques could…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education