ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

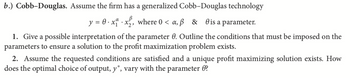

b.) Cobb–Douglas. Assume the firm has a generalized Cobb–Douglas technology y=θ∙x1α∙x2β,where0<α,β & θisaparameter.

1. Give a possible interpretation of the parameter θ. Outline the conditions that must be imposed on the parameters to ensure a solution to the profit maximization problem exists.

2. Assume the requested conditions are satisfied and a unique profit maximizing solution exists. How does the optimal choice of output, y∗, vary with the parameter θ?

Transcribed Image Text:b.) Cobb-Douglas. Assume the firm has a generalized Cobb-Douglas technology

y = 0·x.x₂, where 0 <a, ß & is a parameter.

1. Give a possible interpretation of the parameter 0. Outline the conditions that must be imposed on the

parameters to ensure a solution to the profit maximization problem exists.

2. Assume the requested conditions are satisfied and a unique profit maximizing solution exists. How

does the optimal choice of output, y*, vary with the parameter ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Please help with g.arrow_forwardLooking at the Table, Profit, Cost and Revenue Functions, Quant is the quantity of output, C(Q) is the Total Cost of production for corresponding quantities of output, R(Q) is the corresponding Total Revenue at each level of output Q, if all output is sold and PRF(Q) is the Total Profit for each corresponding output level. PRF(Q) is calculated as R(Q)-C(Q). Using this information, does the company make its highest profit where R(Q) is highest? a. No, because the highest possible revenue may be at an output level where the cost of output may exceed the revenue generated at that output level. In this problem, the highest profit is at output level 15 Ob. Yes, because there is no way that cost can exceed revenue when revenue is maximized. Cc. No, because the highest possible revenue may be at an output level where the cost of output may exceed the revenue generated at that output level. In this problem, the highest profit is at output level 10 or 12 or in between. Od. Yes, because the…arrow_forwardSuppose that the finance department of our favorite company, TVZ R US, determines that the total = 500+ 2x. The marketing department's cost of producing a amount of televisions is C (x) estimate of the demand function for televisions has not changed and remains p = 10 -0.01x. A) Write an equation for the profit of this company. B) Use the first derivative to find the marginal profit of the function you wrote in part A. C) Compute the second derivative and determine if the value you found in Part B is an absolute maximum or absolute minimum. D) Find the maximum profit of the company. E) At what price are profits maximized?arrow_forward

- Q. The Ali Baba Co. is the only supplier of a particular type of Oriental carpet. The estimated demand for its carpets is Q = 112,000 – 500P + 5M Where Q = number of carpets, P = price of carpets (dollars per unit), and M = consumers’ income per capita. The estimated average variable cost function for Ali Baba’s carpets is AVC = 200 – 0.012Q + 0.000002Q2 Consumer’s income per capita is expected to be $20,000 and total fixed cost is $100,0000. a. How many carpets should the firm produce to maximize profit? b. What is the profit-maximizing price of carpets? c. What is the maximum amount of profit that the firm can earn selling carpets? d. Answer parts a through c if consumers’ income per capita is expected to be $30,000 instead.arrow_forwardOnly typed answer and please don't use chat gpt and don't use tablearrow_forwardNeed urgent answer and correct. Will upvotearrow_forward

- Could you fully explain the part (C)? And please dont miss any details.arrow_forwardIn the following problem, find the profit maximizing quantity and graph the marginal revenue and marginal cost. Interpret your first-order condition in terms of marginal benefit and marginal cost. max π = (12 - Q)Q-20² 9arrow_forwardadvanced microeconomics, uncertaintyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education