ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A pizza company runs its business in a franchisee mode and has decided to conduct a $1

promotion for its double cheese supreme pizza. However, the Franchisee Association is unhappy

and has filed a lawsuit alleging that the $1 promotion forces the franchisees to sell the pizza with

at least a 10-cent loss. The association says that the $1 pizza typically costs at least $1.10 which

includes about 55 cents for the cost of the meat, pizza base, cheese and toppings. The rest

typically covers expenses such as rent, royalties, and worker wages.

The pizza company, however, justified the promotion by saying that the $1 double cheese supreme

pizza will increase restaurant visits by as much as 20 per cent. But industry analysts say that as

much as half of the gain recorded from increased traffic could be lost because customers are

spending less when they ordered food.

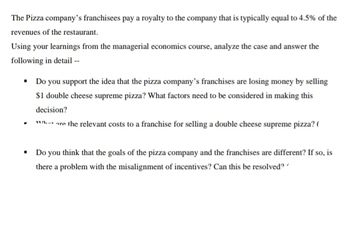

Transcribed Image Text:The Pizza company's franchisees pay a royalty to the company that is typically equal to 4.5% of the

revenues of the restaurant.

Using your learnings from the managerial economics course, analyze the case and answer the

following in detail --

• Do you support the idea that the pizza company's franchises are losing money by selling

$1 double cheese supreme pizza? What factors need to be considered in making this

decision?

*** are the relevant costs to a franchise for selling a double cheese supreme pizza? (

.

• Do you think that the goals of the pizza company and the franchises are different? If so, is

there a problem with the misalignment of incentives? Can this be resolved?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 8. A commodity has price demand function p(x)= 11800 - .01x and each unit costs 1000 and the overhead is 5000. a) what is the revenue function, cost function and profit function ? b) what price should be charged to maximize profits? c) what is the marginal profit for x=400 ? Explain what this marginal profit number means.arrow_forwardEconomicsarrow_forwardAssume that the marginal revenue equals rising marginal cost at 100 units of output. At this output level, a profit-maximizing firm's total fixed cost is $700 and its average variable costs are $5. If the price of the product is $4 per unit and the firm produces the profit-maximizing level of output, How much profit firm will earn ?arrow_forward

- Respond to the question with a concise and accurate answer, along with a clear explanation and step-by-step solution, or risk receiving a downvote.arrow_forwardThe following graph plots the marginal cost (MC) curve, average total cost (ATC) curve, and average variable cost (AVC) curve for a firm operating in the competitive market for jumpsuits. COSTS (Dollars) 80 72 64 56 24 16 8 0 0 8 0 MC ATC AVC Price (Dollars per jumpsuit) 4 8 12 36 48 60 ■ 16 24 32 40 48 56 QUANTITY (Thousands of jumpsuits) ☐ Quantity (Jumpsuits) 64 For every price level given in the following table, use the graph to determine the profit-maximizing quantity of jumpsuits for the firm. Further, select whether the firm will choose to produce, shut down, or be indifferent between the two in the short run. (Assume that when price exactly equals average variable cost, the firm is indifferent between producing zero jumpsuits and the profit-maximizing quantity of jumpsuits.) Lastly, determine whether the firm will earn a profit, incur a loss, or break even at each price. 72 80 Produce or Shut Down? Profit or Loss?arrow_forwardpshotic 166& 5. Profit maximization and shutting down in the short run Suppose that the market for microwave ovens is a competitive market. The following graph shows the daily cost curves of a firm operating in this market. 100 90 80 ATC 70 60 40 30 AVC 20 10 MC 5 10 15 20 25 30 35 40 45 50 QUANTITY (Thousands of ovens) Σ 50 PRICE (Dollars per oven)arrow_forward

- Complete the table below to answer questions 46. and 47.: Price Quantity Cost $18 16 14 12 10 8 642 012345678 Total Revenue Marginal Revenue Marginal $0 X $2.00 $16 $16 2.50 28 12 3.00 3.50 4.00 4.50 5.00 5.50 6.00 What is the profit-maximizing number of units to produce? What is the profit-maximizing price? 46 46. a. 2 b. 4 c. 6 d. 8 47. a. $14 b. $10 c. $6 d. $4arrow_forwardBYOB is a monopolist in beer production and distribution in the imaginary economy of Hopsville. Suppose that BYOB cannot price discriminate; that is, it sells its beer at the same price per can to all customers. The following graph shows the marginal cost (MC), marginal revenue (MR), average total cost (ATC), and demand (D) for beer in this market. Place the black point (plus symbol) on the graph to indicate the profit-maximizing price and quantity for BYOB. If BYOB is making a profit, use the green rectangle (triangle symbols) to shade in the area representing its profit. On the other hand, if BYOB is suffering a loss, use the purple rectangle (diamond symbols) to shade in the area representing its loss. 4.00 3.50 Monopoly Outcome 3.00 2.50 Profit ATC 2.00 Loss 1.50 1.00 MC 0.50 MR 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 QUANTITY (Thousands of cans of beer) Suppose that BYOB charges $2.50 per can. Your friend Dmitri says that since BYOB is a monopoly with market power, it should charge a…arrow_forwardThe marginal costs (MC), average variable costs (AVC), and average total costs (ATC) for a firm are shown in the figure below. The market price is $26. Instructions: Use the tool provided (Pt. A) to identify the profit-maximizing output. Then use the tool "Profit" to draw the area of profit (or loss) that occurs at this level of output. Position this rectangle by dragging on the vertices. Price/Cost ($) 50 r Tools MC 40 Pt. A Profit ATC 30 AVC 20 10 10 20 30 40 50 Quantity Instructions: Round your answer to the nearest whole number. Use a negative sign if necessary. At the profit-maximizing level of output, average total cost is $ and profit is $arrow_forward

- Problem Set #2 (Note: On this problem, use EXCEL to generate numbers. Please replace the below table with your answers ON THIS SHEET. Similarly, in the rest of the assignment use EXCEL and insert figures and tables from EXCEL onto this sheet. 1. Consider the total profit function π = TR (31-Q)Q = TC (20+Q+2Q²) Create a table that shows Total Revenue, Total Cost and Total Profit, (in your table, let quantity run from 0 to 10 in increments of 1.) Indicate in where total profits are maximized your tablearrow_forward(Please attempt thus question if you will provide Solution for both questions below...thanks) 1) If a firm wanted to reduce the annual EOQ cost as a percentage of the annual purchase cost by 50 percent, how would the demand rate have to change? A) Decrease by 50 percent. B) Remain unchanged. C) Increase by 50 percent. D) Double. E) Quadruple. Select correct option and explain answer with Calculation. 2) A firm evaluates its EOQ quantity to equal 180 cases, but it chooses an order quantity of 200 cases. Relative to the order quantity of 180 cases, the order quantity of 200 cases has A) higher ordering cost and higher holding cost. B) higher ordering cost and lower holding cost. C) lower ordering cost and higher holding cost D) lower ordering cost and lower holding cost.arrow_forwardTwo months ago, on July 1, 2019, the State of Illinois raised gasoline taxes by $.19 (19 cents) per gallon of gas Question 3: For this question, please model the short-run impact of this tax on a typical Illinois gas station. The horizontal axis will be qgas (the output of this particular producer) and the vertical axis will measure price in dollars, $. This firm is subject to the Law of Diminishing Marginal Product. Begin by graphically depicting the “Family of Short Run Cost Curves” (AFC, AVC, ATC, MC) for this producer in late June, prior to the implementation of the new gasoline tax (you must submit a graph).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education