FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

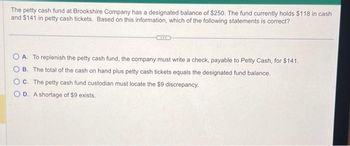

Transcribed Image Text:The petty cash fund at Brookshire Company has a designated balance of $250. The fund currently holds $118 in cash

and $141 in petty cash tickets. Based on this information, which of the following statements is correct?

A. To replenish the petty cash fund, the company must write a check, payable to Petty Cash, for $141.

B. The total of the cash on hand plus petty cash tickets equals the designated fund balance.

OC. The petty cash fund custodian must locate the $9 discrepancy.

OD. A shortage of $9 exists.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Swifty Company established a petty cash fund on May 1, cashing a check for $125.00. The company reimbursed the fund on June 1 and July 1 with the following results. June 1: Cash in fund $5.55. Receipts: delivery expense $30.80, postage expense $37.75, and miscellaneous expense $50.90. July 1: Cash in fund $3.00. Receipts: delivery expense $19.95, entertainment expense $47.05, and miscellaneous expense $55.00. On July 10, Swifty increased the fund from $125.00 to $155.Prepare journal entries for Swifty Company for May 1, June 1, July 1, and July 10. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.75. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction date May 1June 1July 1July 10 enter an account title enter a debit amount…arrow_forwardWillard Company established a $400 petty cash fund on September 9, 2020. On September 30, the fund had $159.40 in cash along with receipts for these expenditures: transportation-in, $32.45; office supplies, $113.55; and repalrs expense, $87.60. Willard uses the perpetual method to account for merchandise Inventory. The petty cashier could not account for the $7.00 shortage In the fund. a. Prepare the September 9 entry to establish the fund. View transaction list Journal entry worksheet 1 Record the entry to establish the fund. Note: Enter debits before credits. Date General Journal Debit Credit Sep 09, 2020 Record entry Clear entry View general jourmalarrow_forwardOn September 1, French company has decided to initiate a petty cash fund in the amount of $850. A. On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $120, Postage Expense $260, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $111. B. On September 14, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $19, Supplies $170, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $230. C. On September 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $90, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $251. The cash on hand at this time was $20. D. On September 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On September 30, the petty…arrow_forward

- Petty Cash Fund Entries Journalize the entries to record the following: a. Check No. 12-375 is issued to establish a petty cash fund of $800. b. The amount of cash in the petty cash fund is now $288. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $4297; miscellaneous selling expense, $123; miscellaneous administrative expense, $77. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $500, record the discrepancy in the cash short and over account.) a. Journalize the entry to establish the petty cash fund. If an amount box does not require an entry, leave it blank. 88 b. Journalize the entry to replenish the petty cash fund. For a compound transaction, if an amount box does not require an entry, leave it blank.arrow_forwardKk.435.arrow_forwardD5.arrow_forward

- 2., On November 30, XYZ, Inc.'s petty cash fund of $150 is replenished. The fund contains cash of $30, and receipts for supplies of $75 and postage of $45. Prepare the journal entry to record the replenishment of the petty cash fund.arrow_forwardA petty cash fund was established with a $500 balance. It currently has cash of $35 and petty cash tickets as shown below: Travel expense $105 Office supplies expense 315 Equipment rental expense 45 Which of the following would be the journal entry to replenish the Petty Cash account? A. debit Cash $35; credit various expenses $35 B. debit various expenses $465; credit Petty Cash $465 C. debit various expenses $465; credit Cash $465 D. credit Petty Cash $465; debit Cash $465arrow_forwardSubmit it in excel formarrow_forward

- A $126 petty cash fund contains $116 in petty cash receipts, and $7 in currency and coins. Which of the following would be part of the journal entry to replenish the account? Select the correct answer. credit to Cash Short and Over for $3 debit to Cash Short and Over for $3 credit to Cash for $116 credit to Petty Cash for $126arrow_forwardOn June 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,300. A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $372, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $132. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $180. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $252, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $192. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed…arrow_forwardHw.108.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education