FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

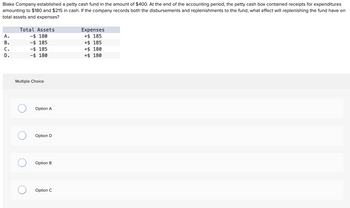

Transcribed Image Text:Blake Company established a petty cash fund in the amount of $400. At the end of the accounting period, the petty cash box contained receipts for expenditures

amounting to $180 and $215 in cash. If the company records both the disbursements and replenishments to the fund, what effect will replenishing the fund have on

total assets and expenses?

A.

B.

C.

D.

Total Assets

-$ 180

-$ 185

-$ 185

-$ 180

Multiple Choice

O

Option A

Option D

Option B

Option C

Expenses

+$ 185

+$ 185

+$ 180

+$ 180

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Describe an entry needed to establish a $50 petty cash fund and an entry to reimburse the fundarrow_forwardAccountingarrow_forward1. Brooks Agency set up a petty cash fund for $140. At the end of the current period, the fund contained $37 and had the following receipts: entertainment, $48, postage, $28; and printing, $27. Prepare journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. 2. Identify the two events from the following that cause a Petty Cash account to be credited in a journal entry. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. View transaction list Journal entry worksheet < 1 2 Record the establishment of the petty cash fund. Note: Enter debits before credits. Transaction 1a General Journal Debit Credit Record entry Clear entry View general journalarrow_forward

- On April 2, Granger Sales decides to establish a $280 petty cash fund to relieve the burden on Accounting. a. Journalize the establishment of the fund. Apг. 2arrow_forwardJournalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): a. On July 1, check No. 12-375 issued to establish a petty cash fund of $1,080. b. The amount of cash in the petty cash fund which is now $125. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $589; miscellaneous selling expense, $190; miscellaneous administrative expense, $150. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $1,080, record the discrepancy in the cash short and over account.)arrow_forwardCheck No. 12-375 is issued to establish a petty cash fund of $600. The amount of cash in the petty cash fund is now $216. Check No. 12-476 is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $223; miscellaneous selling expense, $92; miscellaneous administrative expense, $58. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $500, record the discrepancy in the cash short and over account.) Question Content Area a. Journalize the entry to establish the petty cash fund. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blank Question Content Area b. Journalize the entry to replenish the petty cash fund. For a compound transaction, if an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forward

- where the question marks are. 3 questionsarrow_forwardJone Company established a petty cash fund. 1. Established a petty cash fund of $10000 on August 2. 2. Petty cash expenses August 2-31 are Postage Supplies Transportation $1200 Misc, expense $2500 $4500 $800 3. The fund is replenished on September 1 and increased by $5000. Prepare journal entries to record Jone Company transactions under the 2 petty cash fund systems which are fluctuating fund system and imprest fund system.arrow_forwardABC company paid cash to replenish the petty cash fund: $145; $72 for supplies; $40 for advertising expense; $33 for micellaneous expense. The account credited for this transaction is:arrow_forward

- Answer for Problem 1-6arrow_forwardPalmona Company establishes a $180 petty cash fund on January 1. On January 8, the fund shows $85 in cash along with receipts for the following expenditures: postage, $41; transportation - in, $11; delivery expenses, $13; and miscellaneous expenses, $30. Palmona uses the perpetual system in accounting for merchandise inventory. Prepare the entry to establish the fund on January 1. Prepare the entry to reimburse the fund on January 8 under two separate situations: To reimburse the fund. To reimburse the fund and increase it to $230. Hint: Make two entriesarrow_forwardOn September 1, French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries using this information for the following transactions for questions 1-5. On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. What is the correct journal entry?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education