FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

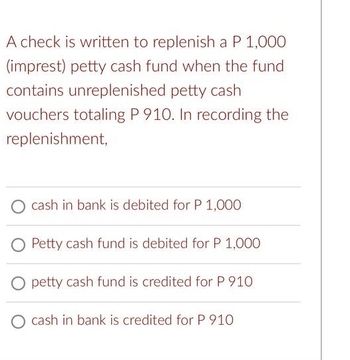

Transcribed Image Text:A check is written to replenish a P 1,000

(imprest) petty cash fund when the fund

contains unreplenished petty cash

vouchers totaling P 910. In recording the

replenishment,

O cash in bank is debited for P 1,000

Petty cash fund is debited for P 1,000

O petty cash fund is credited for P 910

O cash in bank is credited for P 910

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Aarrow_forwardThe bank reconciliation for Widgets Inc. included the following items: $30 bank service charge; NSF check of $275; bank error of $30; EFT collection from a customer for $2,335. Based on the information, Widgets Inc. will adjust cash by what amount? O $1,480 O $2,030 O $2,000 O $2,060arrow_forwardOn March 20, Novak's petty cash fund of $118 is replenished when the fund contains $20 in cash and receipts for postage $47, supplies $19, and travel expense $32. Prepare the journal entry to record the replenishment of the petty cash fund. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Mar. 20 Debit Creditarrow_forward

- Transfers between the Petty Cash Book and the Bank Account are called Contra- entries. Such cash transactions usually mirror the Bank statement entries. Mr Mohammed withdraws £50 business money from the Business bank account for office use. Which of the ledger accounts should be debited and credited, respectively?arrow_forwardLittlestown Corporation reports the following information: Balance in National Bank checking account Certificates of deposit Petty cash Cash on hand Employees' IOUS Balance in Society Bank checking account Customer's postdated check Balance in Peoples Savings and Loan savings account $15,155 5,600 425 4,325 225 (300) 175 9,500 Required: Compute the correct amount of cash that will appear as a current asset on Littlestown Corporation's balance sheet.arrow_forwardmultiple choice question When the petty cash imprest system is established: the bank account is debited. the petty cash account is credited. the bank account is debited and the petty cash account is credited. 4.the bank account is credited and the petty cash account is debitedarrow_forward

- A. Started a petty cash fund in the amount of $250.B. Replenished petty cash fund using the following expenses: Auto Expense $17, Office Expense $15, Postage Expense $86, Miscellaneous Expense $74. Cash on hand is $35.C. Increased petty cash by $150. Record these transactions. If an amount box does not require an entry, leave it blank.arrow_forwardA $84 petty cash fund has cash of $17 and receipts of $72. The journal entry to replenish the account would include a Oa. credit to Cash Short and Over for $5 Ob. debit to Cash for $17 Oc. credit to Cash for $84 Od. credit to Petty Cash for $72arrow_forward19 When the petty cash fund is replenished: Multiple Choice Cash is debited. Petty Cash is credited. Petty Cash is debited. Appropriate expense and/or asset accounts are debited.arrow_forward

- A. Started a petty cash fund in the amount of $250.B. Replenished petty cash fund using the following expenses: Auto Expense $72, Office Expense $82, Postage Expense $90, Miscellaneous Expense $6. Cash on hand is $10.C. Increased petty cash by $100. Record these transactions. If an amount box does not require an entry, leave it blank. A. Petty Cash Petty Cash Cash Cash B. Auto Expense Auto Expense Office Expense Office Expense Postage Expense Postage Expense Miscellaneous Expense Miscellaneous Expense Cash Over and Short Cash Over and Short Cash Cash C. Petty Cash Petty Cash Cash Casharrow_forwardA $220 petty cash fund has cash of $10 and receipts of $206. The journal entry to replenish the account would include a credit to a.Cash Short and Over for $4. b.Petty Cash for $216. c.Cash for $210. d.Cash for $10.arrow_forwardPrepare the following adjusting entries at August 31 for Nokia (FIN). Interest on notes payable of € 327 is accrued. a. b. Unbilled fees for services performed total € 1,449. Salaries and wages earned by employees of € 657 have not been recorded. d. Bad debt expense for year is € 923. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, Salaries and Wages Payable, Allowance for Doubtful Accounts, and Bad Debt Expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit a. b. C. d.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education