ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

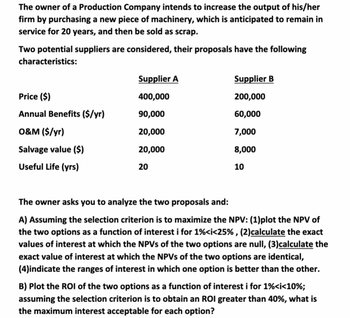

Transcribed Image Text:The owner of a Production Company intends to increase the output of his/her

firm by purchasing a new piece of machinery, which is anticipated to remain in

service for 20 years, and then be sold as scrap.

Two potential suppliers are considered, their proposals have the following

characteristics:

Price ($)

Annual Benefits ($/yr)

O&M ($/yr)

Salvage value ($)

Useful Life (yrs)

Supplier A

400,000

90,000

20,000

20,000

20

Supplier B

200,000

60,000

7,000

8,000

10

The owner asks you to analyze the two proposals and:

A) Assuming the selection criterion is to maximize the NPV: (1)plot the NPV of

the two options as a function of interest i for 1%<i<25%, (2) calculate the exact

values of interest at which the NPVs of the two options are null, (3)calculate the

exact value of interest at which the NPVs of the two options are identical,

(4)indicate the ranges of interest in which one option is better than the other.

B) Plot the ROI of the two options as a function of interest i for 1% <i<10%;

assuming the selection criterion is to obtain an ROI greater than 40%, what is

the maximum interest acceptable for each option?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A city is planning to renovate their current facility with hi-tech computerized systems. Four plans are proposed by the engineers. Each plan will save $950,000 annually but their cost is different. The benefits will last for 30 years. Based on a benefit-cost analysis what should the agency do, if i = 10%? Initial Cost Annual O & M A $7,250,000 $90,000 B D E F C $6,000,000 $6,500,000 $7,500,000 $8,000,000 $5,500,000 $110,000 $140,000 $80,000 $150,000 $60,000 FOCUSarrow_forwardwork on part Carrow_forwardA seasonal bus tour firm has 5 buses with a capacity of 60 people each. Each customer pays $25 for a one-day tour. Records show $360,000 in fixed costs per season, incremental costs of $5 per customer, and an average daily occupancy of 80%. The number of days of operation necessary each season to break even is closest to which value? (a) 50 days (b) 75 days (c) 100 days (d) 120 days?arrow_forward

- What is the intervention process for a distressed project? (a) Requirements gathering and work breakdown structure construction(b) Conduct the earned value analysis (c) Conduct the earned value analysis and root cause analysis (d) None of the abovearrow_forwarda b C $40; $40 $40; zero $150,000; $150,000 zero; $40arrow_forwardK L Q MPL APL (Q/L) VML (MPL*P) FC VC (L*150) TC 5 0 0 0 0 5 1 50 50 50 50 25 150 175 5 2 125 75 62.5 150 25 300 325 5 3 225 100 75 200 25 450 475 5 4 375 150 93.7 300 25 600 625 5 5 450 75 90 150 25 750 775 5 6 450 0 75 0 25 900 925 5 7 400 -50 57.14 -100 25 1050 1075 5 8 425 -75 53.12 -150 25 1200 1225 5 9 450 -25 50 -50 25 1350 1375 5 10 500 -50 50 -100 25 1500 1525 5 11 525 25 47.7 50 25 1650 1675 Define firm’s fixed costs. Next, what is Firm’s FC in the Table above. Why?arrow_forward

- K An analysis of accidents in a rural state indicates that widening a highway from 30 ft to 40 ft will decrease the annual accident rate from 1,270 to 660 per million vehicle-miles Calculate the average daily number of vehicles that should use the highway to justify widening on the basis of the following estimates: (1) the average loss per accident is $1,000, (ii) the cost of widening is $107,000 per mile (iii) the useful life of the widened road is 25 years; (iv) annual maintenance costs are 3% of the capital investment and (v) MARR is 12% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Choose the correct answer below OA. The average daily number of vehicles is about 36 vehicles per day OB. The average daily number of vehicles is about 61 vehicles per day OC. The average daily number of vehicles is about 70 vehicles per day OD. The average daily number of vehicles is about 43 vehicles per day OE. The average daily…arrow_forwardPlease handwriten solutionarrow_forwardEvery city and county in California is required to have a long-term general plan that establishes (A) O arbitrary limitations that discourage development. (B) O goals that encourage development. (C) O limitations on population growth and building. (D) O protection for old buildings that should be torn down.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education