ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

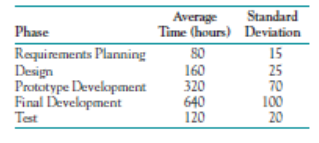

Transcribed Image Text:Phase

Requirements Planning

Design

Prototype Development

Final Development

Test

Average

Time (hours)

80

160

320

640

120

Standard

Deviation

15

25

70

100

20

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A privately owned summer camp for youngsters has the following data for a 12-week session.(a) Develop the mathematical relationships for total cost and total revenue. (b) What is the total number of campers that will allow the camp to just break even? (c) What is the profit or loss for the 12-week session if the camp operates at 80% capacity? (d) What are marginal and average costs per camper at 80% capacity? (e) Would it be ethical to charge campers different rates depending on their family’s socioeconomic status? Identify and describe two points pro and two points con for such a policy.arrow_forwardIf the details of the quantity to be produced for a period are as follows, how many units are produced? The opening inventory is 160 units; units sold are estimated to be 200 units; the desired closing stock is 100 units. a. 200 units b. 260 units c. 460 units d. 140 unitsarrow_forwardConsider the accompanying breakeven graph for an investment, and answer the following questions.(a) Give the equation for total revenue for x units per year. (b) Give the equation for total costs for x units per year. (c) What is the “breakeven” level of x? (d) If you sell 1500 units this year, will you have a profit or loss? How much? (e) At 1500 units, what are your marginal and average costs?arrow_forward

- accounting profit by Weplit costs wn $160,000 and implick costs are $72,000, economic profit isarrow_forward300 250 200 150 100 50 $ TC 30. The minimum Average Variable Cost is (a) $4 (b) $5 (c) $10 (d) $12 TVC TFC 0 Q 0 2 4 6 8 10 12 14 16 18 20 30 25 20 15 10 5 SA $ 0 0 2 4 6 8 10 12 14 16 18 20 MC AC AVC AFC Qarrow_forwardBags/Participants Fixed Cost Variable Cost Total Cost 0 $1,700 $ - $1,700 100 $1,700 $500 $2,200 200 $1,700 $1,200 $2,900 300 $1,700 $2,700 $4,400 400 $1,700 $5,200 $6,900 500 $1,700 $9,000 $10,700 600 $1,700 $15,000 $16,700 700 $1,700 $23,800 $25,500 800 $1,700 $36,800 $38,500 900 $1,700 $55,800 $57,500 1,000 $1,700 $83,000 $84,700 Given the above information on cost, if you charge $15 per entry, what is the breakeven quantity of bags that you should order? At what quantity of bags will profits be maximized? A Use the profit maximizing rule, MR ≥ MC, buy 300 bags. B Use the profit maximizing rule, MR ≥ MC, buy 200 bags. C Use Qb = F/(MR-AVC) where Qb is the breakeven quantity to be determined, the optimal quantity of bags is 300. D Use Qb = F/(MR-AVC) where Qb is the breakeven quantity to be determined, the optimal quantity of bags is 200.arrow_forward

- (1) The revenue for a product is R(x) = -0.004x? + 21x cost is C(x) = 0.02x + 38, for x units produced and sold. (a) Find the marginal profit for 2800 units. (b) Should output be increased or decreased to generate a higher profit? 6200 and thearrow_forwardBackground:New Pumper system equipment is under consideration by a gulf coast chemical processing plant. One crucial pump moves highly corrosive liquids from specially lined tanks on intercoastal barges into storage and preliminary refining facilities dockside. Beacuse of the variable quality of the raw chemical and the igh pressures imposed on the pump chassis and impellers, a close log is maintained on the number of hours per year that the pump operates safety records and pump componenet deterioration are considered critical control points for this system. As currently planned, rebuild and M&O cost estimates are increased accordingly when cummulative operating time reaches the 6000-hour mark. Information:- First cost: $800,000- Rebuild Cost: $150,000 whenever 6000 cumulative hours are logged. Each rework will cost 20% more than the previous one. A maximum of three rebuilds are allowed.- M&O Costs: $25,000 for each year 1 through 4 $40,000 per year starting the year after the…arrow_forward1 17 2 345 5 6 Seed Average Price 3 Marketing Year Index $/short ton 4 127.7 192.4 7 8 B 9 10 11 12 13 14 15 16 17 18 1 2 3 4 5 6 7 8 9 10 11 C 12 13 14 15 Historical Price Data Oil D 242 242 274 242 290 347.2 436 422.8 466 582 508 428 434 Average Price Index $/short ton 317.8 465 662.2 668.2 791.3 732 951 1123 1297.3 1312 1416 1664 1317.4 1182.4 1334.4 E Mash Average Price Index $/short ton 63 87 105 111 124 108 134 153 193 187 193 247 242 197 210arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education