Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

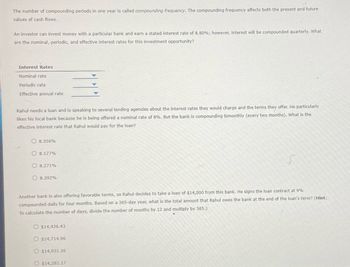

Transcribed Image Text:The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future

values of cash flows.

An investor can invest money with a particular bank and earn a stated interest rate of 8.80%; however, interest will be compounded quarterly. What

are the nominal, periodic, and effective interest rates for this investment opportunity?

Interest Rates

Nominal rate

Periodic rate

Effective annual rate

Rahul needs a loan and is speaking to several lending agencies about the interest rates they would charge and the terms they offer. He particularly

likes his local bank because he is being offered a nominal rate of 8%. But the bank is compounding bimonthly (every two months). What is the

effective interest rate that Rahul would pay for the loan?

8.356%

O8.177%

8.271%

8.392%

Another bank is also offering favorable terms, so Rahul decides to take a loan of $14,000 from this bank. He signs the loan contract at 9%

compounded daily for four months. Based on a 365-day year, what is the total amount that Rahul owes the bank at the end of the loan's term? (Hint:

To calculate the number of days, divide the number of months by 12 and multiply by 365.)

O $14,426.43

O $14,714.96

O $14,931.36

O $14,282.17

Expert Solution

arrow_forward

Step 1

Nominal rate

The interest rate before accounting for inflation is referred to as the nominal interest rate. The term "nominal" can also apply to the advertised or quoted interest rate on a loan, which excludes any fees or interest compounding.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A local bank is advertising that you can double your money in eleven years if you invest with them. What simple interest rate is the bank offering?arrow_forwardYou want to invest $24,000 and are looking for safe investment options. Your bank is offering you a certificate of deposit that pays a nominal rate of 6% that is compounded quarterly. What is the effective rate of return that you will earn from this investment?arrow_forwardFind the required value for each problem. Show the formula used and the counts for each problem. 6. How much more would you earn in three years if you invest $ 10,000 at a compound annual interest rate of 5.75%, instead of at a simple interest rate of 5.75%? 7. What would be the compound annual interest rate you would need to double your investment of $ 1,000 in three years? 8. If your bank pays you 5% annual interest, compounded monthly, how much would you have in ten years if you invest $ 1,000 today? 9. How much would you have to deposit today in a bank account that pays 9.25% annual interest, compounded quarterly, if you expect to have $20,000 at the end of five years? 10. Suppose you invested $ 2,500 in the business that a friend opened and in three years this friend returned $ 3,700 to you. How much was the return on your investment in your friend's business?arrow_forward

- After examining the various personal loanrates available toy, you find the can borrow funds from an investment company at 12%Compounded monthly or from a bank at 13% compounded annually. Which alternative is the most attractive?arrow_forward4. Non annual compounding period The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An investor can invest money with a particular bank and earn a stated interest rate of 11.00%; however, interest will be compounded quarterly. Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. Interest Rates Nominal rate : Periodic rate Effective annual rate Clancy needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes his local bank because he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective interest rate of on his loan. Another bank is also offering favorable terms, so Clancy decides to take a loan of $15,000 from this bank. He signs the loan…arrow_forwardYou are considering a safe investment opportunity that requires a $1,410 investment today, and will p $780 two years from now and another $830 five years from now. a. What is the IRR of this investment? b. If you are choosing between this investment and putting your money in a safe bank account that pa an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR wit the IRR of the investment? Explain. a. What is the IRR of this investment? The IRR of this investment is %. (Round to two decimal places.)arrow_forward

- 不 a. Use the appropriate formula to determine the periodic deposit. b. How much of the financial goal comes from deposits and how much comes from interest? Periodic Deposit Rate Time Financial Goal $? at the end of each year 3% compounded annually 15 years $130,000 Click the icon to view some finance formulas. a. The periodic deposit is $ (Do not round until the final answer. Then round up to the nearest dollar as needed.) this View an example Get more help 4 Clear all Checarrow_forwardA financial instrument just paid the investor $127 last year. The cash flow is expected to last forever and increase at a rate of 1.6 percent annually. If you use a 5.2 percent discount rate for investments like this, what should be the price you are willing to pay for this financial instrument? (Round to the nearest dollar.)arrow_forwardPLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULAS3.- Andres Rosas wants to know how much he must deposit today, so that in 5 years he will have the amount (FV) of 88,180.00, which he needs to pay for a trip, a) if the account pays 6.125% interest compoundable semiannually; b) if the account pays 7.65% compoundable monthly. The formula must be cleared to find the initial value (PV). Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially when you use excel. TO CONSIDER THE YEAR AS 360 DAYS (WHICH IS COMMERCIAL) (only if required)arrow_forward

- You are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $20,100 at the end of this year and subsequent payments that will grow at a rate of 3.4 percent annually. If you use a 9 percent discount rate for investments like this, what is the present value of this growing perpetuity? (Round answer to 2 decimal places, e.g. 15.25.)arrow_forwardYou plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would increase the calculated value of the investment? Group of answer choices The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for 10 years rather than 5 years, hence that each payment is for $10,000 rather than for $20,000. The discount rate decreases. The riskiness of the investment's cash flows increases. The total amount of cash flows remains the same, but more of the cash flows are received in the later years and less are received in the earlier years. The discount rate increases.arrow_forwardYou want to invest $18,000 and are looking for safe investment options. Your bank is offering you a certificate of deposit that pays a nominal rate of 6% that is compounded semiannually. What is the effective rate of return that you will earn from this investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education