Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

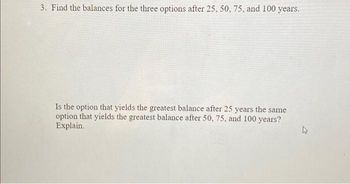

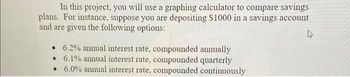

Transcribed Image Text:In this project, you will use a graphing calculator to compare savings

plans. For instance, suppose you are depositing $1000 in a savings account

and are given the following options:

4

• 6.2% annual interest rate, compounded annually

6.1% annual interest rate, compounded quarterly

6.0% annual interest rate, compounded continuously

•

Transcribed Image Text:In this project, you will use a graphing calculator to compare savings

plans. For instance, suppose you are depositing $1000 in a savings account

and are given the following options:

4

• 6.2% annual interest rate, compounded annually

6.1% annual interest rate, compounded quarterly

6.0% annual interest rate, compounded continuously

•

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Use a calculator to evaluate the present value of annuity formula. For the values of the variables m, r, and t (respectively). Assume n=12. (Round your answer to the nearest cent). $50, 5%, 3 years.arrow_forwardPlease solve very soon completelyarrow_forwardOne can solve for payments (PMT), periods (N), and interest rates (1) for annuities. The easiest way to solve for these variables is with a financial calculator or a spreadsheet. Quantitative Problem 1: You plan to deposit $2,100 per year for 4 years into a money market account with an annual return of 3%. You plan to make your first deposit one year from today. a. What amount will be in your account at the end of 4 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. Assume that your deposits will begin today. What amount will be in your account after 4 years? Do not round intermediate calculations. Round your answer to the nearest cent. $ Quantitative Problem 2: You and your wife are making plans for retirement. You plan on living 25 years after you retire and would like to have $95,000 annually on which to live. Your first withdrawal will be made one year after you retire and you anticipate that your retirement account will earn 12% annually. a.…arrow_forward

- Use the formula for computing future value using compound interest to determine the value of an account at the end of 8 years if a principal amount of $13,000 is deposited in an account at an annual interest rate of 5% and the interest is compounded quarterly. The amount after 8 years will be $ (Round to the nearest cent as needed.) Enter your answer in the answer box and then click Check Answer. All narts showing javascript:doExercise(9); Clear All Check Answer sy Po a 99+arrow_forwardUsing an online tool like Calculator Soup https://www.calculatorsoup.com/calculators/financial future-value-annuity-calculator.php Calculate the FV of an annuity that grows. The person will save $200 at the end of the first month. They will increase their savings by 1.0% per month. (2nd month will be S202,00, etc.) Interest will be compounded monthly and cam an average annual rate of 7.00% a) What will be the future value of this person's retirement account in 20 years b)If they followed this plan, what would be their 240th (last) deposit amount? c) What would be the FV if they did not increase the savings per month and their monthly contribution remained at $200/mo?arrow_forwardUse a calculator to evaluate an ordinary annuity formula 1 +4 nt - 1 A = m for m, r, and t (respectively). Assume monthly payments. (Round your answer to the nearest cent.) $50; 5%; 8 yr A = $arrow_forward

- Future Value ComputationAt the beginning of the year you deposit $3,000 in a savings account. How much will accumulate in 3 years if you earn 8% compounded annually?Use Excel or a financial calculator for computation. Round your answer to nearest dollar.arrow_forwardUse a calculator to evaluate an ordinary annuity formula nt 1 +I 1 A = m %3D for m, r, and t (respectively). Assume monthly payments. (Round your answer to the nearest cent.) $100; 6%; 10 yr A = $ Need Help? Read Itarrow_forwardUse the formula for the future value of an ordinary annuity to solve for n when A = $6,000, the monthly payment r = $550 and annual intrest r = 8.5%arrow_forward

- 1. What is the different between an ordinary annuity and an annuity due? Which occursmore in practice? Give a common example of both. 2. Using the example of a savings account, explain the difference between the effectiveannual rate and the annual percentage rate. 3. A mortgage instrument pays $1.5 million at the end of each of the next two years. Aninvestor has an alternative investment with the same amount of risk that will payinterest at 8% compounded semiannually. what the investor should pay for themortgage instrument?arrow_forwardReview the compound interest formulas for n compoundings per year and for continuous compounding we learned this week. Do a quick check of the various interest offering from your favorite bank and then design a saving plan that would give you the most satisfactory savings in at the end of 2030 if you have only 5 extra dollars to be put away every day? interest rate =0.5%arrow_forwardUse future value and present value calculations (an online calculator, app, financial calculator, or spreadsheet software) to determine the following: Use Exhibit 1-A, Exhibit 1-B and Exhibit 1-C. a. The future value of a $710 savings deposit after nine years at an annual interest rate of 8 percent. Note: Round FV factor to 3 decimal places and final answer to nearest whole dollar. b. The future value of saving $3,200 a year for three years at an annual interest rate of 7 percent. Note: Round discount factor to 3 decimal places and final answer to nearest whole dollar. c. The present value of a $3,400 savings account that will earn 4 percent interest for six years. Note: Round PV factor to 3 decimal places and final answer to nearest whole dollar. a. Future value b. Future value c. Present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education