Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

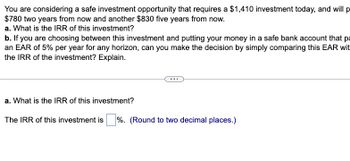

Transcribed Image Text:You are considering a safe investment opportunity that requires a $1,410 investment today, and will p

$780 two years from now and another $830 five years from now.

a. What is the IRR of this investment?

b. If you are choosing between this investment and putting your money in a safe bank account that pa

an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR wit

the IRR of the investment? Explain.

a. What is the IRR of this investment?

The IRR of this investment is %. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering investing in a security that will pay you $5,000 in 29 years. If the appropriate discount rate is 12 percent, what is the present value of this investment? b. Assume these investments sell for $2,423 in return for which you receive $5,000 in 29years. What is the rate of return investors earn on this investment if they buy it for $2,423? If the appropriate discount rate is 12 percent, the present value of this investment isarrow_forward(Use Calculator or Formula Approach) Suppose you need $15,000 in 3 years . If you can earn 6% annually, how much do you need to invest today? If you could invest the money at 8%, would you have to invest more or less than at 6%? How much?arrow_forwardYou’re trying to choose between two different investments, both of which will cost $65,000 today. Investment A will give you $125,000 in 6 years and Investment B will give you $205,000 in 10 years. Which of the two investments should you choose? Why? How will your answer change, if any, if interest rates are expected to increase over the next 10 years. (Explain using the appropriate equations and show all work)arrow_forward

- You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $500 today and expect to receive $50,000 in 40 years. Your cost of capital for this (very risky) opportunity is 19%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree? The IRR of this investment opportunity is %. (Round to two decimal places.) Carrow_forwardanswer the question now its econ answer it now!!!arrow_forwardYou are evaluating five different investments, all of which involve an upfront outlay of cash. Each investment will provide a single cash payment back to you in the future. Details of each investment appears here: Calculate the IRR of each investment. State your answer to the nearest basis point (i.e., the nearest 1/100th of 1%, such as 3.76%). The yield for investment A is The yield for investment B is The yield for investment C is The yield for investment D is The yield for investment E is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) C Data table Investment A B с D E Initial Investment $1,600 $10,000 $600 $3,400 $5,200 Future Value Print $3,120 $15,775 $2,923 $4,526 $8,789 End of Year 10 11 16 Done 3 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 12 D Xarrow_forward

- You are considering an investment manufacturing cocoa powder. This investment needs $185,000 today and expects to repay you $200,000 in a year from now. What is the IRR of this investment opportunity? Given the riskiness of the investment opportunity, your discount rate is 11%. What does the IRR rule say about whether you should invest? a. The IRR is 7.5%. The IRR rule says that you should not invest. b. The IRR is 8.11%. The IRR rule says that you should not invest. c. The IRR is 1.2%. The IRR rule says that you should not invest. d. The IRR is 16.8%. The IRR rule says that you should invest.arrow_forwardWhat is the excel function and formula for this question? Off-The-Books Investment Firm, LLC, has offered you an investment it says will return to you $20,000 in 2 years. To get in, you'll need to make a $10,000 deposit to their receivables account and promise not to tell anyone about it. What is the annual return on this investment?arrow_forwardYou are considering an investment that will pay you $3,000 a year for 33 years, starting today. What is the present value of this investment if the appropriate discount rate is 8%? Use TMV calculator in explanation.arrow_forward

- You are considering a safe investment opportunity that requires a $1,450 investment today, and will pay $950 two years from now and another $710 five years from now. a. What is the IRR of this investment? b. If you are choosing between this investment and putting your money in a safe bank account that pays an EAR of 5% per year for any horizon, can you make the decision by simply comparing this EAR with the IRR of the investment? Explain. a. What is the IRR of this investment? The IRR of this investment is %. (Round to two decimal places.)arrow_forwardPlease answer the question. The details of the question are attached in the image below.arrow_forwardEconomics Your friend is inviting you to this exciting investment opportunity. To get in it costs 10,000 today but you will get 10,500 at the end of the year. a) What is the Internal Rate or Return of the investment opportunity? b) Suppose that the risk-free government bond rate is 5 percent. Should you still invest with your friend?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education