Concept explainers

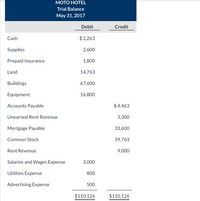

The Moto Hotel opened for business on May 1, 2017. Here is its

Other data:

| 1. | Insurance expires at the rate of $300 per month. | |

| 2. | A count of supplies shows $1,070 of unused supplies on May 31. | |

| 3. | (a) Annual |

|

| (b) Annual depreciation is $2,280 on equipment. | ||

| 4. | The mortgage interest rate is 5%. (The mortgage was taken out on May 1.) | |

| 5. | Unearned rent of $2,690 has been earned. | |

| 6. | Salaries of $690 are accrued and unpaid at May 31. |

Prepare a ledger using T-accounts. Enter the trial balance amounts and post the

Cash, Supplies, Prepaid Insurance, Land, Building,

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- Kevin Smith, financial officer of Benson Inc., showed the following unadjusted account balances at January 31, 2023, its year end. Other information: There was one reconciling item on the bank reconciliation: an NSF cheque for $800. A review of the Prepaid Rent account showed that the balance represents rent for two months beginning January 1, 2023. Annual depreciation on the boats is $3,780. Annual depreciation on the furniture is $3,560. Use this information to prepare the January 31, 2023 classified balance sheet. xxx F 团 + (select one) Balance Sheet (select one) Account Balance Accounts payable 24,800 Accounts receivable 5,600 Accumulated depreciation, boats, 41,820 Accumulated depreciation, furniture, 30,360 Boats 49,220 Bonds payable (due August, 2031). 24,800 Cash 12,400 Commissions earned 19,400 Consulting revenue earned 6,700 Copyright 14,300 Dividends 6,600 Furniture 46,360 Insurance expense 3,800 Land 13,300 Long-term notes payable, 25,000 Long-term investment in shares…arrow_forwardBenwick Company borrowed $56,000 cash on October 1, 2022, and signed a nine-month, 9% interest-bearing note payable with interest payable at maturity. Assuming that adjusting entries have not been made during the year, the amount of accrued interest payable to be reported on the December 31, 2022 balance sheet is which of the following? Group of answer choices $630. $756. $1,260. $1,890.arrow_forwardOn September 15, 2024, Oliver's Mortuary received a $6,000 note from the estate of Jay Hendrix in exchange for services rendered. Terms of the note call for the payment of principal, and interest at 10% in nine months. Oliver's has a December 31 year-end. What adjusting entry will the company record on December 31, 2024? Multiple Choice Account Title Interest receivable Interest revenue Account Title Interest receivable Interest revenue Cash Debit Credit 230 Debit 600 230 Credit 175 425arrow_forward

- McNamara Industries completed the following transactions during 2024: (Click the icon to view the transactions.) Journalize the transactions. Explanations are not required. Round to the nearest dollar. (Record debits first, then credits. Exclude explanations from journal entries.) Nov. 1: Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Date Accounts Debit Credit Nov. 1 More info Nov. 1 Nov. 20 Dec. 31 Dec. 31 ← Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Paid $500 to satisfy warranty claims. Estimated vacation benefits expense to be $3,500. McNamara expected to pay its employees a 4% bonus on net income after deducting the bonus. Net income for the year is $25,000. Prin Done Xarrow_forwardMarin Ltd. started the year with a balance owing from Stratford Inc. of $31,200. After several phone calls, on Feb. 1, 2025, Stratford offered to sign a 5% note for the balance owing. The note is due May 1, 2025. Marin has a calendar year end and adjusts its accounts monthly. On May 5, Marin Ltd. was notified that Stratford Inc. went bankrupt and would not be paying off its debts.Required: Prepare all journal entries and month-end adjusting entries from Feb. 1, 2025 to May 5, 2025 for Marin Ltd.arrow_forwardThe following are the trial balance and the other information related to Bruce Marigold, who operates a construction hauling business.MARIGOLDTRIAL BALANCEDECEMBER 31, 2020 DebitCreditCash$39,000Accounts Receivable48, 400Allowance for Doubtful Accounts$3,400 Supplies3, 040Prepaid Insurance1, 200Equipment30, 000Accumulated Depreciation Equipment5, 750Notes Payable 7, 200Owners Capital45, 640Service Revenue 97,790 Rent Expense 7, 800Salaries and Wages Expense28, 400Utilities Expenses1, 040Office Expense900 $159, 780$159, 7801. Fees received in advance from clients $5, 100, which were recorded as revenue.2. Services performed for clients that were not recorded by December 31, $5,000.3. Equipment is being depreciated at 8% per year.4. Bad debt expense for the year is $1,470.5. Insurance expired during the year $520.6. Marigold gave the bank a 90-arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education