Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

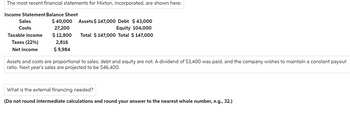

Transcribed Image Text:The most recent financial statements for Mixton, Incorporated, are shown here:

Income Statement Balance Sheet

$ 40,000

27,200

$ 12,800

2,816

$ 9,984

Sales

Costs

Taxable income

Taxes (22%)

Net income

Assets $ 147,000 Debt $43,000

Equity 104,000

Total $ 147,000 Total $147,000

Assets and costs are proportional to sales; debt and equity are not. A dividend of $3,400 was paid, and the company wishes to maintain a constant payout

ratio. Next year's sales are projected to be $46,400.

What is the external financing needed?

(Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The most recent financial statements for Bello Co. are shown here: Income Statement Sales Costs Taxable income $20,400 14,000 $ 6,400 Taxes (22%) Net income $ 4,992 1,408 Balance Sheet Current assets $ 12,000 Debt Fixed assets 32,850 Equity Total $ 16,600 28,250 $44,850 Total $44,850 Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 35 percent dividend payout ratio. What is the internal growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded 2 decimal places, e.g., 32.16.)arrow_forwardNet Income Interest (Loss) $ 185, 000 179, 600 157, 250 188, 100 Expense $ 59, 200 Income Taxes $ 46, 250 64,656 66, 045 90, 288 a. b. 80, 820 44,030 11, 286 c. d. Compute times interest earned. Which company indicates the strongest ability to pay interest expense as it comes due? Complete this question by entering your answers In the tabs below. Times Interest Interest Earned Ratio Coverage Which company indicates the strongest ability to pay interest expense as it comes due? Which company indicates the strongest ability to pay interest expense as it comes due? < Times Interest Earned Ratioarrow_forwardThe Haines Corporation shows the following financial data for 20X1 and 20X2: 20X2 $ 3,000,000 2,060,000 $ 940,000 300,000 $ 640,000 54,400 $ 585,600 204,960 $ 380,640 Sales Cost of goods sold Gross profit Selling & administrative expense Operating profit Interest expense Income before taxes Taxes (35%) Income after taxes 20X1 $ 3,400,000 1,880,000 $ 1,520,000 302,000 $ 1,218,000 48,000 $ 1,170,000 409,500 $ 760,500 For each year, compute the following ratios and indicate how the change in each ratio will affect profitability in 20x2. Note: Input your answers as a percent rounded to 2 decimal places. a. Cost of goods sold to sales b. Selling and administrative expense to sales c. Interest expense to sales 20X1 % % % 20X2 Profitability % Decrease % Increase % Decreasearrow_forward

- Given the following information for the Green Company: Net sales (all on account) $5,200,000Interest expense 240,000Income tax expense 280,000Net income 420,000Income tax rate 40%Total assets: January 1, 2010 $1,800,000 December 31, 2010 2,400,000Stockholders' equity: January 1, 2010 1,500,000 December 31, 2010 1,600,000Current assets, December 31, 2010 700,000Quick assets, December 31, 2010 400,000Current liabilities, December 31, 2010 300,000Net accounts receivable: January 1, 2010 200,000 December 31, 2010 180,000 Green's return on total assets during 2010 was: Question 15 options: a) 20.0% b) 26.9%…arrow_forwardQUESTION: JESTER CORPORATIONS'S MOST RECENT INCOME STATEMENT APPEARS BELOW: SALES (ALL ON ACCOUNT) $610,000 COST OF GOODS SOLD $340,000 GROSS MARGIN $270,000 SELLING AND ADMINISTRATIVE $160,000 EXPENSE NET OPERATING INCOME $110,000 INTEREST EXPENSE $20,000 NET INCOME BEFORE TAXES $90,000 INCOME TAXES (30%) $27,000 NET INCOME $63,000 THE BEGINNING BALANCE OF TOTAL ASSETS WAS $360,000 AND THE ENDING BALANCE WAS $320,000. WHAT IS THE PERCENTAGE OF RETURN ON TOTAL ASSETS?arrow_forwardThe most recent financial statements for Camryn, Incorporated, are shown here (assuming no income taxes): Income Statement Sales Costs Balance Sheet $6,500 Assets $23,500 Debt $ 9,500 4,610 Equity 14,000 Net income $1,890 Total $ 23,500 Total $ 23,500 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,150. What is the external financing needed? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) External financing neededarrow_forward

- The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement. Net income Assets: Total EFN $6,800 -4,080 $2,720 Balance Sheet. $20,400 Debt $20,400 Equity Total $10,600 9,800 $20,400 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $7,752. What is the external financing needed? (A negative value should be indicated by a minus si Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardces The most recent financial statements for Bradley, Inc., are shown here (assuming no income taxes): Sales Costs Income Statement Net income Assets Total EFN $9,200 -5,520 $3,680 Balance Sheet Debt Equity $26,680 $26,680 Total $10,800 15,880 $26,680 Check my Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $10,212. What is the external financing needed? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardThe most recent financial statements for Kerch, Inc., are shown here (assuming no income taxes): Income Statement Balance Sheet Sales Costs $9,300 7,330 Assets $20,000 Debt Equity $ 8,000 12,000 Net income $ 1,970 Total $20,000 Total $20,000 Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid. Next year's sales are projected to be $10,788. What is the external financing needed? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) External financing neededarrow_forward

- Nonearrow_forwardancial Statements Nataro, Incorporated, has sales of $676,000, costs of $338,000, depreciation expense of $82,000, interest expense of $51,000, and a tax rate of 24 percent. What is the net income for this firm? (Do not round intermediate calculations.) Net incomearrow_forwardThe most recent financial statements for Mixton, Incorporated, are shown here: INCOME STATEMENT Sales Costs Taxable income Taxes (22%) Net income $ 52,000 Assets 42,400 $ 9,600 2,112 $ 7,488 Total BALANCE SHEET Debt Equity Total Answer is complete but not entirely correct. External financing needed s 11,990 X $ 115,700 $ 115,700 $ 34,500 81,200 $ 115,700 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,900 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $61,360. What is the external financing needed? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education