Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Other options are: 4.48% 4.58% or 4.38%

Please explain steps to take to find correct answer

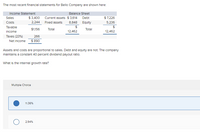

Transcribed Image Text:The most recent financial statements for Bello Company are shown here:

Income Statement

Balance Sheet

Sales

$ 3,400 Current assets $ 3,614 Debt

$7,226

Costs

2,244

Fixed assets

8,848 Equity

5,236

Таxable

$

$

$1,156

Total

Total

Income

12,462

12,462

Taxes (23%)

266

Net Income

$ 890

Assets and costs are proportional to sales. Debt and equity are not. The company

malntalns a constant 40 percent dividend payout ratio.

What is the Internal growth rate?

Multiple Cholce

11.36%

2.94%

Expert Solution

arrow_forward

Step 1

Internal growth rate (IGR) means maximum level of growth which a company can achieve without any external financing. It is equal to the product of retention ratio and return on assets (ROA).

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- what are the solutions for questions 4 & 5?arrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardA risky $420,000 investment is expected to generate the following cash flows: Year 1 2 3 4$ 102,700 $ 163,030 $ 160,824 $ 135,200 If the firm’s cost of capital is 12 percent, should the investment be made?. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar.NPV: $ Should The investment be made? An alternative use for the $420,000 is a four-year U.S. Treasury bond that pays $25,200 annually and repays the $420,000 at maturity. Management believes that the cash inflows from the risky investment are equivalent to only 70 percent of the certain investment, which pays 6 percent. Should the investment be made? Use Appendix B to answer the question. Do not round other intermediate calculations. NPV: $ Should The investment be made?arrow_forward

- can you explain why the answer for the third part is option number 2 from the selection of answersarrow_forwardI need all four question to be solved....if you can't give all four part....don't attempt this question .... (A) multiple choice: 7.80% 7.88% 7.69% 7.50% 7.62% (B) Multiple choice: 7.49% 6.84% 7.20% 7.33% 7.56% (C) multiple choice: 1.39% 2.04% 2.06% 1.86% 1.96% (D) multiple choice: 11.14% 16.38% 16.54% 14.97% 15.85%arrow_forwardHh1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education