FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

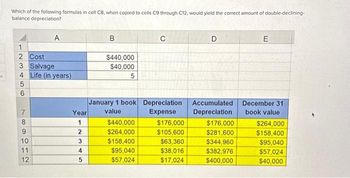

Transcribed Image Text:Which of the following formulas in cell C8, when copied to cells C9 through C12, would yield the correct amount of double-declining-

balance depreciation?

A

1

2 Cost

3 Salvage

4 Life (in years)

5

6

7

8

9

10

11

12

Year

1

2

3

4

5

B

$440,000

$40,000

5

C

January 1 book Depreciation

value

Expense

$440,000

$264,000

$158,400

$95,040

$57,024

$176,000

$105,600

$63,360

$38,016

$17,024

D

Accumulated

Depreciation

$176,000

$281,600

$344,960

$382,976

$400,000

E

December 31

book value

$264,000

$158,400

$95,040

$57,024

$40,000

Transcribed Image Text:Multiple Choice

O

O

=DB($B$2,$B$3,$B$4,48)

-DDB($B$2,$B$3,$B$4,A8)

DDB($B$2,$B$3,$B$4,$A$8)

-DDB($B$2,$B$3,$B$4,A$8)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using the following information create a Double declining, depreciation schedule. Computer Equipment: $3,000 Residual Value: $150 Useful Life: 5 years Example: Straight line depreciation Scheadule. year (beginning of year value) depreciation (end of year value) 1 $3,000 $570 $2,430 2 $2,430 $570 $1,860 3 $1,860 $570 $1,290 4 $1,290 $570 $720 5 $720 $570 $150arrow_forwardWhat is the depreciation deduction, using 200% DB method, after year 4 for an asset that costs #52811 and has an estimated salvage value of $7,000 at the end of its 5-year useful life? Round your answer to 2 decimal places. Add your answerarrow_forwardEquipment costing $80000 with a salvage value of $11000 and an estimated life of 8 years has been depreciated using the straight-line method for 2 years. Assuming a revised estimated total life of 5 years and no change in the salvage value, the depreciation expense for year 3 would be O $20917. O $17250. O $10350. O $14450.arrow_forward

- Peavey Enterprises purchased a depreciable asset for $25,000 on April 1, Year 1. The asset will be depreciated using the straight-line method over its four-year useful life. Assuming the asset's salvage value is $2,600, what will be the amount of accumulated depreciation on this asset on December 31 Year 3? Multiple Choice О $5,600 $22,400 $18,667 $15,400 О $4,667arrow_forwardAssume that a machine costing $120,000 and having a useful life of 10 years (with 10 salvage value). a. Compute the depreciation expense in year 5 by using straight-line col to ensrla 15 b. Compute the depreciation expense in year 7 by using sum-of-the-years' digits c. Compute the depreciation expense in year 3 by using double-declining method Questionarrow_forwardsanjuarrow_forward

- d. The depreciation deduction for year 11 of an asset with a 20-year useful life is $3,600. If the salvage value of the asset was estimated to be zero and straight line depreciation was used to calculate the depreciation deduction for year 11, the initial cost of this asset is most closely equal to which of the following values? (a) $42,000 (b) $67,750 $72,500 (d) $80,000 e. Consider the following data extracted from an After Tax Cash Flow calculation. Before Tax Cash Flow = $22,500 Loan Principal Payment = $7,434 Loan Interest Payment = $892 MACRS Depreciation Deduction = $7,405 Taxes Due = $5,397 Which of the following is closest to the After Tax Cash Flow? (a) $1,372 $8,777 (c) $8,806 (d) $16,211arrow_forwardWhat is the amount of double declining balance depreciation for year 4 if the cost of an asset is $75,000 the useful life is 5 years and the salvage vague is $4000arrow_forwardCost of equipment $64,000, salvage value $10,000, current year deprciation $5000, Total accumulatated depreciation at the end of the year is $31,000. What is the remainder of useful life? a) 7.8 b) 12.8 c) 4.6 or d) 10.8 not sure if I rewrote the question and infor correctly..arrow_forward

- An asset purchased 1 January 20x4, costing $10,000, with a 10-year useful life and no salvage value, was depreciated using the straight-line method during its first three years. During 20x7, the total useful life was re-estimated to be 17 years. What is the amount of depreciation expense in 20x8? Multiple Choice $500 $412arrow_forwardH1.arrow_forwardN6 A new machine tool is being purchased for $260,000 and is expected to have a $36,000 salvage value at the end of its 5-year useful life. Assume any remaining depreciation is claimed in the last year. Compute the depreciation schedules for this capital asset, using the following methods: (a) Straight-line depreciation (b) MACRS Note: No statement is required for this problem.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education