FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

ch 12 #5

The management of Kunkel Company Is considering the purchase of a $26,000 machine that would reduce operating costs by $6500 per year. At the end of the machines five-year useful life, it will have zero salvage value. The companies required rate of return is 16%.

1) determine the net present value of the investment on the machine. 2) what is the difference between the total, undiscounted cash inflows and cash out flows over the entire life of the machine?

Can you show me how to do this? Also, i don’t know which chart I’m supposed to use.

Transcribed Image Text:History

Bookmarks

Profiles

Tab

Window

Help

ACKMAN: X

O Question 5 - Chapter 12 Home X

O exhibit_12B_1.jpg (1317x951)

mheducation.com/Media/Connect_Production/bne/accounting/brewer_8e/exhibit_12B_1.jpg

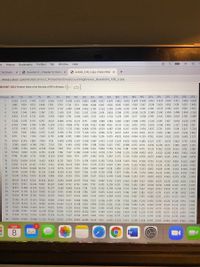

EXHIBIT 12B-1 Present Value of $1;

(1+ r)"

15%

16%

17%

18%

19% 20% 21% 22% 23% 24% 25%

Periods 4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

0.962 0,952 0943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800

0.706 0.694 0.683 0.672 0,661 0.650 0,640

1

2.

0925 0907 0890 0.873 0.857 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718

0889 0864 0.840 0.816 0.794 0.772 0,751 0.731 0,712 0,693 0.675 0658 0641 0.624 0,609 0.593 0,579 0,564 0,551 0.537 0,524 0,512

0.499 0.482 0.467 0.451 0.437 0.423 0.410

3

4

0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516

0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328

0,790 0746 0,705 0,666 0.630 0,596 0564 0,535 0,507 0.480 0456 0432 0410 0,390 0.370 0.352 0.335 0.319 0.303 0289 0275 0262

0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314

0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168

6.

0.296 0.279 0.263 0.249 0.235 0.222 0.210

8.

0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134

0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191

9

10

0.176

0.162 0.149

0137 0.126 0.116 0.107

11

0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0195 0178 0.162

0.148 0135 0123 0112 0103 0094 0.086

0.124 0112 0.102 0.092 0083 0.076 0.069

0.104 0.093 0.084 0.075 0.068 0.061 0 055

12

0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0187

0168 0152 0137

13

0601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0 204 0182 0163 0.145 0130 0.116

14

0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.181

0.160 0141

0.125 0.111

0.099 0.088 0.078 0.069 0.062 0055 0.049 0.044

15

0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035

16

0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141

0.123 0.107 0.093 0.081 0.071

0.062 0.054 0.047. 0.042 0.036 0.032 0.028

0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023

0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018

17

18

0.494 0.416 0.350. 0.296 0.250 0.212 0180 0.153 0.130 011

19

0475 0.396 0.331 0.277 0.232 0194 0164 0138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014

20

0.456 0.377 0.312 0.258 0.215 0178

0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.012

21

0.439 0.359 0.294 0.242 0199 0.164 0.135 0.112

0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009

22

0.422 0.342 0.278 0.226 0184 0.150 0123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007

0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.006

0.390 0.310 0.247 0197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005

23

0.406 0.326 0.262 0.211 0170 0138 0112

24

25

0.375 0.295 0.233 0184 0146 0116

0.092 0.074 0.059 0.047 0.0038 0.030 0.024 0.020 0016

0.013 0.010 0.009 0.007 0.006 0.005 0.004

26

0361 0.281 0.220 0.172

0.135 0106 0084 0066 0.053 0.042 0.033 0.026 0.021 0,017 0.014

0.009 0.007 0.006 0.005 0.004 0.003

27

0.347 0.268 0.207 0.161

0125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0011

0.009 0.007 0.006 0.005 0.004 0.003 0.002

0.333 0.255 0196 0150 016 0,090 0.069 0.054 0.042 0.033 0.026 0.020 0016 0012 0010 0.008 0.006 0.005 0004 0.003 0.002 0.002

28

29

0.321 0.243 0.185 0141

0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002

30

0.099 0.075 0057 0.044 0.033 0026 0.020 0.015 0.012 0009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001

0308 0231 0174

0.131

40

0.208 0142 0.097 0.067 0046 0032 0 022 0015 0.011 0.008 0.005 0.004 0003 0.002 0001

0.001 0.001 0.000 0.000 0.000 0000 0.000

AUG

2

W

80

F3

888

F4

FS

F6

F7

F10

%23

&

3

4.

7.

8

6.

R.

T.

Y

00

Transcribed Image Text:w History

Profiles

の

全 0

Bookmarks

Tab

Window

Help

E TACKMAN: x

6 Question 5 - Chapter 12 Home x

O exhibit_12B_2.jpg (1344x954) x

+

a.mheducation.com/Media/Connect_Production/bne/accounting/brewer_8e/exhibit_12B_2.jpg

EXHIBIT 12B-2 Present Value of an Annuity of $1 in Arrears;

(1+r

20% 21% 22% 23% 24%

25%

7%

0.962 0.952 0.943 0.935 0.926 0.917

Periods 4%

5%

6%

8%

9%

10%

11%

12%

13%

14% 15%

16% 17%

18% 19%

1

0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800

1.886

1.859

1.833

1.808

1.783

1759 1736

1.713

1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440

3

2.775

2.723 2.673

2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952

4

3.630 3.546 3.465 3.387

3.312

3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362

4.452

4.329 4.212

4.100

3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689

5.242 5.076 4.917

4.767

4.623

4.486 4.355 4.231 4.111

3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951

6.002 5.786

5.582 5.389 5.206

5.033 4.868 4.712

4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161

8

6.733

6.463

6.210

5.971

5.747

5.535 5.335 5146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329

9.

7435

7108

6.802 6.515

6.247

5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463

10

8.111

7.722

7.360

7.024

6.710

6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3,571

11

8.760 8.306

7.887. 7.499

7139

6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4836 4.656 4486 4.327 4.177

4.035 3.902 3.776 3.656

12

9.385 8.863 8.384

7.943

7.536

7161

6.814 6.492 6194 5.918 5.660 5.421 5.197 4988 4.793 4.611

4.439 4.278 4.127 3.985 3.851 3.725

13

9.986 9.394 8.853

8.358 7.904

7.487 7103

6.750 6.424 6.122 5.842 5.583 5.342 5118

4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780

14

10.563 9.899 9.295 8745

8.244

7.786 7367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4,611

4.432 4.265 4.108 3.962 3.824

6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859

15

11.118

10.380 9.712

9.108

8.559

8.061 7.606 7191

16

11.652 10.838 10.106

9.447

8.851

8.313 7824 7379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4189 4.033 3.887

17

12.166 11.274 10.477

9.763

6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910

8.756 8.201 7702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928

9 604 8 950 8.365 7839 7366 6.938 6.550 6.198 5877 5.584 5.316 5.070 4843 4.635 4442 4.263 4.097 3.942

9.122

8.544 8.022 7.549 7120

18

12.659 11.690 10.828 10.059 9.372

19

13.134 12.085 11.158

10.336 9.604

20

13.590 12.462 11.470 10.594 9.818

9.129

8514 7963 7469 7.025 6.623 6.259 5.929 5.628 5.353 5.101

4.870. 4.657 4.460 4.279 4.110 3.954

21

14.029 12.821 11.764

10.836 10.017

9.292 8.649 8.075 7562 7102 6.687 6.312 5.973 5.665 5.384 5127 4891 4675 4.476 4.292 4.121

3.963

22

14.451 13.163 12.042 11.061 10.201

9.442 8.772 8.176 7.645 7170

6.743 6.359 6.011 5.696 5.410 5.149 4909 4.690 4.488 4.302 4.130 3.970

23

14.857 13.489 12.303 11.272

10.371

9.580 8.883 8.266 7718

7.230 6.792 6.399 6.044 5.723 5.432 5.167

4.925 4.703 4.499 4.311

4.137

3.976

24

15.247 13.799 12.550 11.469 10.529 9.707

8.985 8.348 7784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713

4.507 4.318 4.143 3.981

25

15.622 14.094 12.783 11.654 10.675

9.823 9.077 8.422 7843 7.330 6873 6.464 6.0975766 5.467 5195 4948 4.721 4.514

4.323 4.147 3.985

26

15.983 14.375 13.003 11.826 10.810

9.929 9.161

8.488 7.896 7372 6.906, 6.491 6.118

5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988

11.987 10.935 10.027 9.237 8 548 7.943 7.409 6.935 6.514 6.136 5,798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990

27

16.330 14.643 13.211

28

16.663 14.898 13.406 12.137 11.051

10.116

9.307 8.602 7984 7.441

6.961 6,534 6152 5.810 5502 5.223 4970 4.739 4,528 4.335 4.157 3.992

29

16.984 15.141

13.591 12.278 1158

10.198

9.370 8.650 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994

17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4160 3.995

30

40

19.793 17159

15.046 13.332 11.925 10.757 9779 8.951 8.244 7634 7105

6.642 6.233 5871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999

AUG

2

8

w

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Following is information on an investment in a manufacturing machine. The machine has zero salvage value. The company requires a 3% return from its investments. Initial investment Net cash flows: $ (220,000) Year 1 160,000 128,000 125,000 Year 2 Year 3 QS 11-19 (Algo) Net present value with unequal cash flows LO P3 Compute this machine's net present value. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places. Round present value amounts to the nearest dollar.) Net Cash Flow Present Value Present Value of Net Factor Cash Flows Year 1 Year 2 Year 3 Totals Initial investment Net present valuearrow_forwardRoberts Company is considering an investment in equipment that is capable of producing moreefficiently than the current technology. The outlay required is $2,293,200. The equipment isexpected to last five years and will have no salvage value. The expected cash flows associatedwith the project are as follows: Year Cash Revenues Cash Expenses 1 $2,981,160 $2,293,200 2 2,981,160 2,293,200 3 2,981,160 2,293,200 4 2,981,160 2,293,200 5 2,981,160 2,293,200 Required:1. Compute the project’s payback period.2. Compute the project’s accounting rate of return.3. Compute the project’s net present value, assuming a required rate of return of 10 percent.4. Compute the project’s internal rate of return.arrow_forward5.1.3 Calculate the Net Present Value of each project (with amounts rounded off to the nearest Rand). INFORMATION Zeda Enterprises has the option to invest in machinery in projects A and B but finance is only available to invest in one of them. You are given the following projected data: Initial cost Scrap value Depreciation per year Net profit Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows Year 1 Year 2 Year 3 Year 4 Year 5 Project A R300 000 R40 000 R52 000 R20 000 R30 000 R50 000 R60 000 R10 000 Project B R300 000 0 R60 000 R90 000 R90 000 R90 000 R90 000 R90 000arrow_forward

- 11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forwardD1.arrow_forwardNonearrow_forward

- What is Question Four a. Assume that Green Housing Company is considering an investment of $200,000 in a new at the end of its useful life. The annual cash inflows are £250,000, and the annual cash outflows equipment. The new equipment is expected to last 12 years. It will have a zero salvage value are 150,000. Assume that the annual cash flows are uniform over the asset's useful life. Management has a required rate of return of 18%. i. Calculate the present value of net cash flows ii. Calculate the net present value for this investment iii. Calculate the Discounted Payback Period iv. Advice management of Green Housing Company base on your resultsarrow_forwardQuestion #2 please.arrow_forward* 00 The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $67000. The machine would replace an old piece of equipment that costs $18,000 per year to operate. The new machine would cost $8.000 per year to operate. The old machine currently in use could be sold now for a salvage value of $29,000. The new machine would have a useful life of 10 years with no salvage value. 1 What is the annual depreciation expense associated with the new bottling machine? 2 What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your enswer to 1 declmal place L.e. 0.123 should be considered as 12.3%.) Depreciation expense 2. Incremental net operating income Initial investment, 4. Simple rate of return < Prev 2 of 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education