FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Educational Content on Capital Investment Decision

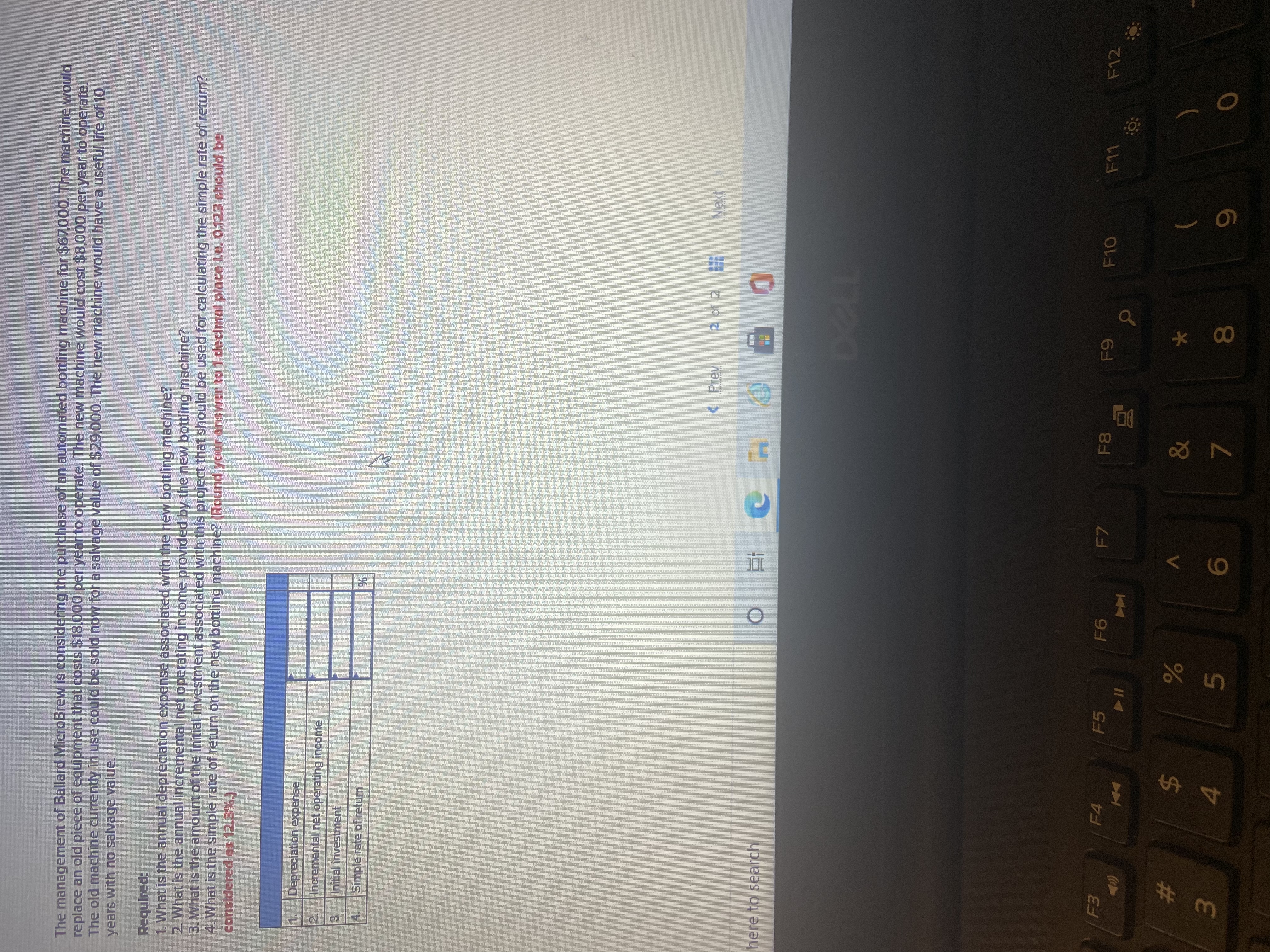

**Scenario:**

The management of Ballard MicroBrew is considering purchasing an automated bottling machine for $67,000. This machine would replace an older piece of equipment that costs $18,000 per year to operate. In contrast, the new machine would cost only $8,000 per year to operate. The old machine could be sold now for a salvage value of $29,000. The new machine would have a useful life of 10 years with no salvage value.

**Required Calculations:**

1. **What is the annual depreciation expense associated with the new bottling machine?**

2. **What is the annual incremental net operating income provided by the new bottling machine?**

3. **What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return?**

4. **What is the simple rate of return on the new bottling machine?** *(Round your answer to 1 decimal place, i.e., 0.123 should be considered as 12.3%.)*

**Analysis (Table Format):**

| 1. | **Depreciation expense** | |

|----|----------------------------------------------|------------|

| 2. | **Incremental net operating income** | |

| 3. | **Initial investment** | |

| 4. | **Simple rate of return** | **%** |

This exercise helps learners to understand how to calculate and assess various financial metrics involved in capital budgeting and decision-making processes. These calculations contribute to making informed decisions on whether or not to invest in new technology, considering aspects like depreciation, operating income, and return on investment.

Expert Solution

arrow_forward

Step 1

Method of Charging depreciation expense is as follows:

- Straight-Line Depreciation

- Units of Production Depreciation

- Sum-of-the-Years' Digits Depreciation

- Declining Balance Depreciation

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Need help with this please explain step by step how u get the solutionarrow_forwardListen You want to buy a new equipment to replace an existing one. The new equipment will be depreciated down to zero using straight-line depreciation over its 10-year life. The project is a 10-year project. The market value of the new equipment at the end of year 10 is expected to be 0. The new equipment will replace an existing old equipment that has 10 years left of depreciation at a $3,000 a year. The estimated before tax proceeds from selling this existing equipment is $15,000 today. The market value in 10 years for this old equipment would be 0. The new equipment will generate annual cost savings of $12,000 before taxes. The tax rate is 20% and the discounting rate is 10%. What is the maximum price you are willing to pay today for the new equipment? For your answer, do not enter the dollar sign ($), DO NOT use commas, and you can round to zato decimals (the nearest dollar). Your Answer: Answerarrow_forward6arrow_forward

- Coparrow_forwardQUESTION 3 You are considering starting a new factory producing small electric heaters. Each unit will sell at a price of $55. The production cost of each heater is $35. You are expecting to sell 9000 units per year. This project has an economic life of 6 years. The project requires an investment of $700000 in plants and equipment. This equipment will be depreciated to zero salvage value based on 5-year MACRS schedule. The depreciation rates from year 1 to 6 are 20 % ,32 %, 19.2 %, 11.52 %, 11.52 %, and 5.76 percent, respectively. The company will sell its old equipment for $100,000. The old machine is fully depreciated. The required rate of return for the project is 12 percent, the working capital requirement is 10 percent of the next year's sales revenue. The marginal corporate tax rate is 20 percent. At the termination of the project, the plant and equipment will be sold for an estimated value of $50000. Based on these assumptions, estimate the cash flow for capital expenditures.…arrow_forwardQuestion 07: Virat Kohli Welders is planning to replace an old machine with a new one to improve efficiency in its production process. The machine will increase the efficiency as it is more modern and will result in an incremental savings of $80,000 per year. The old machine was bought 3 years ago at a cost of $270,000. The new machine will cost $420,000. Both machines have useful lives of 6 years. The machines are depreciated to zero for tax purpose over the six-year life using a straight-line depreciation method. The tax rate is 34% and the required rate of return is 11%. The old machine has no salvage value at the end of its life but can be sold now at a cost of $100,000. The new machine will have a salvage value of $80,000 at the end of its life. Should the new machine be purchased?arrow_forward

- give me the right answer only ASAP Suppose we are thinking about replacing an old computer with a new one. The old one cost us $1.4 million; the new one will cost $1.7 million. The new machine will be depreciated straight-line to zero over its five-year life. It will probably be worth about $325,000 after five years. The old computer is being depreciated at a rate of $281,000 per year. It will be completely written off in three years. If we don’t replace it now, we will have to replace it in two years. We can sell it now for $450,000; in two years, it will probably be worth $130,000. The new machine will save us $315,000 per year in operating costs. The tax rate is 22 percent, and the discount rate is 12 percent. a-1. Calculate the EAC for the old and the new computer. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a-2. What is the NPV of the decision to…arrow_forward39arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education