FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:M

ΟΣ

Mu

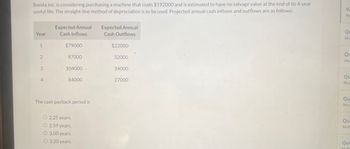

Bonita Inc. is considering purchasing a machine that costs $192000 and is estimated to have no salvage value at the end of its 4-year

useful life. The straight-line method of depreciation is to be used. Projected annual cash inflows and outflows are as follows:

Vi

Expected Annual

Expected Annual

Year

Cash Inflows

Cash Outflows

1

$79000

$22000

2

97000

32000

3

104000.

34000

4

84000

27000

The cash payback period is

O 2.25 years.

O2.59 years.

O 3.00 years.

O 3.20 years.

Mu

zo

Qu

Mult

좋은

Qu

Mul

좋은

좋은

Qu

Mul

Que

Multi

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Foster Company wants to buy a special automated machine to replace an existing manual system. The initial outlay (cost) is $3,500,000. The new machine will last 5 years with no expected salvage value. The expected annual cash flows are as follows: Year Cash Inflow Cash Outflow 0 $ - $ 3,500,000.00 1 $ 3,900,000.00 $ 3,000,000.00 2 $ 3,900,000.00 $ 3,000,000.00 3 $ 3,900,000.00 $ 3,000,000.00 4 $ 3,900,000.00 $ 3,000,000.00 5 $ 3,900,000.00 $ 3,000,000.00 Foster has a cost of capital equal to 10%. 1. Calculate the payback period. Payback period: yearsarrow_forwardThe following present value factors are provided for use in this problem. Periods 1 2 3 4 Present Value of $1 at 8% 0.9259 0.8573 0.7938 0.7350 Xavier Co. wants to purchase a machine for $37,800 with a four year life and a $1,200 salvage value. Xavier requires an 8% return on investment. The expected year-end net cash flows are $12,800 in each of the four years. What is the machine's net present value? Multiple Choice O O $4,595. $(5,477). $(4,595). Present Value of an Annuity of $1 at 8% 0.9259 1.7833 2.5771 3.3121 $43,277.arrow_forward1666arrow_forward

- i need the answer quicklyarrow_forwardHello, just need help with the annual net cash flow portion. I haven't computed it in this methodarrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $360,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Equipment Selling, general, and administrative expenses Income (a) Compute the annual net cash flow. (b) Compute the payback period. (c) Compute the accounting rate of return for this equipment. Complete this question by entering your answers in the tabs below. Required A Compute the annual net cash flow. Required B Required C Annual Results from Investment Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Equipment Selling, general, and administrative expenses. Income Net cash flow Income $ 225,000 $ 120,000 30,000 22,500 52,500 $ 225,000 120,000 30,000 22,500 $ 52,500 Cash Flow Flowarrow_forward

- Terminal cash flow: Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $207,000 and will require $29,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages). A $26,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,000 before taxes; the new machine at the end of 4 years will be worth $73,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 21% tax rate. The terminal cash flow for the replacement decision is shown below: (Round to the nearest…arrow_forwardAccounting Sheridan is contemplating a capital investment of $19100. The cash flows over the project's five year life are projected as follows: Expected Annual Cash Inflows Expected Annual Cash Outflows Year 1 $6300 $1100 2 8100 2100 3 10200 2500 4 11700 3100 15600 2600 The asset will be depreciated using the straight-line method with no expected salvage value. The cash payback period is 2.46 years. 2.45 years. 2.36 years. 3.02 years.arrow_forwardRoberts Company is considering an investment in equipment that is capable of producing moreefficiently than the current technology. The outlay required is $2,293,200. The equipment isexpected to last five years and will have no salvage value. The expected cash flows associatedwith the project are as follows: Year Cash Revenues Cash Expenses 1 $2,981,160 $2,293,200 2 2,981,160 2,293,200 3 2,981,160 2,293,200 4 2,981,160 2,293,200 5 2,981,160 2,293,200 Required:1. Compute the project’s payback period.2. Compute the project’s accounting rate of return.3. Compute the project’s net present value, assuming a required rate of return of 10 percent.4. Compute the project’s internal rate of return.arrow_forward

- Vandezande Inc. is considering the acquisition of a new machine that costs $370,000 and has a useful life of 5 years with no salvage value. The cash flows that would be produced by the machine are (Ignore income taxes): Net Cash Flows Year 1 $ 128,000 Year 2 $ 105,000 Year 3 $ 126,000 Year 4 $ 123,000 Year 5 $ 122,000 Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to:arrow_forwardNonearrow_forwardD1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education