Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the required interest rate of this financial accounting question?

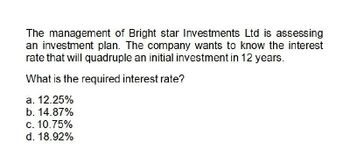

Transcribed Image Text:The management of Bright star Investments Ltd is assessing

an investment plan. The company wants to know the interest

rate that will quadruple an initial investment in 12 years.

What is the required interest rate?

a. 12.25%

b. 14.87%

c. 10.75%

d. 18.92%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- According to the Rule of 72, what must the return on an investment be to double an initial investment of $1,000 in 7 years? Multiple Choice 10.41% 2% 8.63% 10.29% 7.2% Show all steps of calculation and formulas if necessaryarrow_forwardFenton, Inc., has established a new strategic plan that calls for new capital investment. The company has a 9.8% required rate of return and an 8.3% cost of capital. Fenton currently has a return of 10% on its other investments. The proposed new investments have equal annual cash inflows expected. Management used a screening procedure of calculating a payback period for potential investments and annual cash flows, and the IRR for the 7 possible investments are displayed in image. Each investment has a 6-year expected useful life and no salvage value. A. Identify which project(s) is/are unacceptable and briefly state the conceptual justification as to why each of your choices is unacceptable. B. Assume Fenton has $330,000 available to spend. Which remaining projects should Fenton invest in and in what order? C. If Fenton was not limited to a spending amount, should they invest in all of the projects given the company is evaluated using return on investment?arrow_forwardYour investment will pay you the following cash flow stream: YEAR | CASH FLOW 1 |200 2 10 3 100 4 100 If your required rate of return is 12%, what is the value (i. e., present value ) of this investment at time 0? What is the future value at the end of year 7? Please explain in steps to input on BA II Plus calculatorarrow_forward

- i need the answer quicklyarrow_forwardWhat is the internal rate of return (IRR) of an investment that requires an initial investmen of $11,000 today and pays $15,400 in one year's time?arrow_forwardQuilts R Us (QRU) is considering an investment in a new patterning attachment with the cash flow profile shown in the table below. QRU’s MARR is 13.5%/year. Solve, a. What is the annual worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on annual worth? c. Should QRU invest?arrow_forward

- Please only answer PART F d) Suppose the Internal Rate of Return (IRR) of this investment opportunity is 15%. Based on this information alone, should Limitless Ltd. make the investment? Why?Would this decision be consistent with that from B? Explain your reasoning.e) Suppose that, instead of paying the initial £500,000 now, Limitless Ltd. decides to pay it in equal instalments over the next 10 years. How much would the companyneed to pay each year to make all these payments equivalent to £500,000 today? f) Now assume that an alternative project would generate immediate (time zero) net profits of £500,000 upfront, but after that, it would result in annual losses of£120,000 over the next five years, and then the annual losses of £60,000 over the following five years. The cost of capital is 12% and the IRR is 15%. Should you start this project? Explain your reasoning. Would you make the same decision based on NPV and IRR? Why?arrow_forwardCalculate the duration for the following cash flows of an investment. Given the market interest rates are 10%. Year 1 2 3 4 7 8 Cash flow 140 150 160 170 180 190 200 250arrow_forward(a)An investment is offered whereby £1000 is invested immediately, £2000 is invested in exactly threeyears’ time followed by a further investment of £3000 after a further threeyears. The investment is due to return £10000 in ten years’ from now. (i)Write down the equation of valuefor the investment (ii) Estimatethe yield on the investment. (b) (i)Calculate the present value, at a rate of interest of 6.5% per annum effective, of anannuity where £5000 is paidat the end of the first year, £4,800 is paid at the end ofthe second year, £4,600 is paid at the end of the third year and so on, with paymentsdecreasing by £200 per annum until the payment stream ends afterof 10 years. (ii)What would the payments be for an investment with the same present value, with equal payments every month?arrow_forward

- How I resolve this problems please give me the detail A firm has the following investment alternatives: Year A B C 1 $400 $--- $---- 2 400 400 ---- 3 400 800 ---- 4 400 800 1,800 Each investment cost of capital is 10 percent a. What is each investment's internal rate of return? b. Should the firm make any of theses investment? C. What is each investemtn's net present value? d. Should the firm make any of these investmentarrow_forwardCan you please answer these follow up questions from the above question: d) Suppose the Internal Rate of Return (IRR) of this investment opportunity is 15%. Based on this information alone, should Limitless Ltd. make the investment? Why?Would this decision be consistent with that from B? Explain your reasoning.e) Suppose that, instead of paying the initial £500,000 now, Limitless Ltd. decides to pay it in equal instalments over the next 10 years. How much would the companyneed to pay each year to make all these payments equivalent to £500,000 today?arrow_forwardThe HUT is evaluating a 5 year investment projected to yield the following relevant cash flows over its 5 year life: Given that the firm employs a 12% discount rate, what is the value of each of the three criteria: NPV? Profitability Index? Payback Period? Varrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College