Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

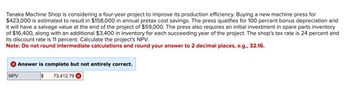

Transcribed Image Text:Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for

$423,000 is estimated to result in $158,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and

it will have a salvage value at the end of the project of $59,000. The press also requires an initial investment in spare parts inventory

of $16,400, along with an additional $3,400 in inventory for each succeeding year of the project. The shop's tax rate is 24 percent and

its discount rate is 11 percent. Calculate the project's NPV.

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

× Answer is complete but not entirely correct.

NPV

$ 73,412.79 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Masters Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $892,800 is estimated to result in $297,600 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS Table), and it will have a salvage value at the end of the project of $130,200. The press also requires an initial investment in spare parts inventory of $37,200, along with an additional $5,580 in inventory for each succeeding year of the project. If the shop's tax rate is 22 percent and its discount rate is 19 percent, what is the NPV for this project?arrow_forwardKolby’s Korndogs is looking at a new sausage system with an installed cost of $680,000. The asset qualifies for 100 percent bonus depreciation and can be scrapped for $90,000 at the end of the project’s 5-year life. The sausage system will save the firm $193,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $45,000. If the tax rate is 25 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardAlliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method. Complete the following table to compute the net present value (NPV) of the investment. (Hint: Remember that, in Year 10, Alliances also receives the salvage value of the machine.) Year Cash Flow PV Interest Factor at 14%…arrow_forward

- Riverview Company is evaluating the proposed acquisition of a new production machine. The machine's base price is $200,000, and installation costs would amount to $28,000. Also, $10,000 in net working capital would be required at installation. The machine will be depreciated for 3 years using simplified straight line depreciation. The machine would save the firm $110,000 per year in operating costs. The firm is planning to keep the machine in place for 2 years. At the end of the second year, the machine will be sold for $100,000. Riverview has a cost of capital of 12% and a marginal tax rate of 34%. What is the NPV of the project? $9,555 $19,016 - $9,783 $3,875 $12,155arrow_forwardEggz, Incorporated, is considering the purchase of new equipment that will allow the company to collect loose hen feathers for sale. The equipment will cost $490,000 and will be eligible for 100 percent bonus depreciation. The equipment can be sold for $84,000 at the end of the project in 5 years. Sales would be $327,000 per year, with annual fixed costs of $60,000 and variable costs equal to 35 percent of sales. The project would require an investment of $51,000 in NWC that would be returned at the end of the project. The tax rate is 23 percent and the required return is 8 percent. Calculate the NPV of this project. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPV 348437.32arrow_forwardA Funiture Factory is considering buying a new automated planing machine for a cost of $80,250. This price includes a complete guarantee of the maintenance costs for the first two years, and it covers a good proportion of the maintenance costs for years 3 and 4. The company’s portion of the maintenance cost is estimated to be $1,000 in year 3 and $3,000 in year 4. Depreciation on the capital cost would be 7% per year. Determine the Economic Life and EAC* of the new machine assuming the MARR is 6.5% and that there will be an installation cost of $2,800. PLEASE PLEASE SHOW FULL DETAILED STEPSarrow_forward

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $397,000 is estimated to result in $145,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and it will have a salvage value at the end of the project of $46,000. The press also requires an initial investment in spare parts inventory of $15,100, along with an additional $2,100 in inventory for each succeeding year of the project. The shop's tax rate is 21 percent and its discount rate is 8 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPVarrow_forwardConsider the following project for Hand Clapper, Inc. The company is considering a 4-year project to manufacture clap-command garage door openers. This project requires an initial investment of $16.7 million that will be depreciated straight-line to zero over the project’s life. An initial investment in net working capital of $1,070,000 is required tosupport spare parts inventory; this cost is fully recoverable whenever the project ends. The company believes it can generate $14.3 million in revenues with $5.8 million in operating costs. The tax rate is 22 percent and the discount rate is 14 percent. Themarket value of the equipment over the life of the project is as follows:d. Compute the project NPV assuming the project is abandoned after only threeyears.Year: Market Value ($ millions)1: $ 14.702: $11.703: $9.204: $1.95arrow_forwardA new production system for a factory is to be purchased and installed for $135331. This system will save approximately 300,000 kWh of electric power each year for a 6-year period. Assume the cost of electricity is $0.10 per kWh, and factory MARR is 15% per year, and the salvage value of the system will be $8662 at year 6. Using the PW method to analyzes if this investment is economically justified A- calculate the PW of the above investment and insert the result below.arrow_forward

- Massey Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $530,000 is estimated to result in $220,000 in annual pretax cost savings. The press falls in the MACRS five-year class, and it will have a salvage value at the end of the project of $89,000. The press also requires an initial investment in spare parts inventory of $26,000, along with an additional $3,100 in inventory for each succeeding year of the project. The shop’s tax rate is 35 percent and its discount rate is 9 percent. Refer to the MACRS schedule. Calculate the NPV of this project.arrow_forwardCullumber Lumber, Inc; is considering purchasing a new wood saw that costs $65000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $4500 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Cullumber’s tax rate is 26 percent, and it’s opportunity cost of capital is 13.10 percent. What is the project’s NPV?arrow_forwardAlliance Manufacturing Company is considering the purchase of a new automated drill press to replace an older one. The machine now in operation has a book value of zero and a salvage value of zero. However, it is in good working condition with an expected life of 10 additional years. The new drill press is more efficient than the existing one and, if installed, will provide an estimated cost savings (in labor, materials, and maintenance) of $6,000 per year. The new machine costs $25,000 delivered and installed. It has an estimated useful life of 10 years and a salvage value of $1,000 at the end of this period. The firm’s cost of capital is 14 percent, and its marginal income tax rate is 40 percent. The firm uses the straight-line depreciation method.a. What is the net cash flow in year 0 (i.e., initial outlay)?b. What are the net cash flows after taxes in each of the next 10 years?c. What is the NPV of the investment?d. Should Alliance replace its existing drill press?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education